Instructions for Schedule I Form 1041 2022

What is the Instructions For Schedule I Form 1041

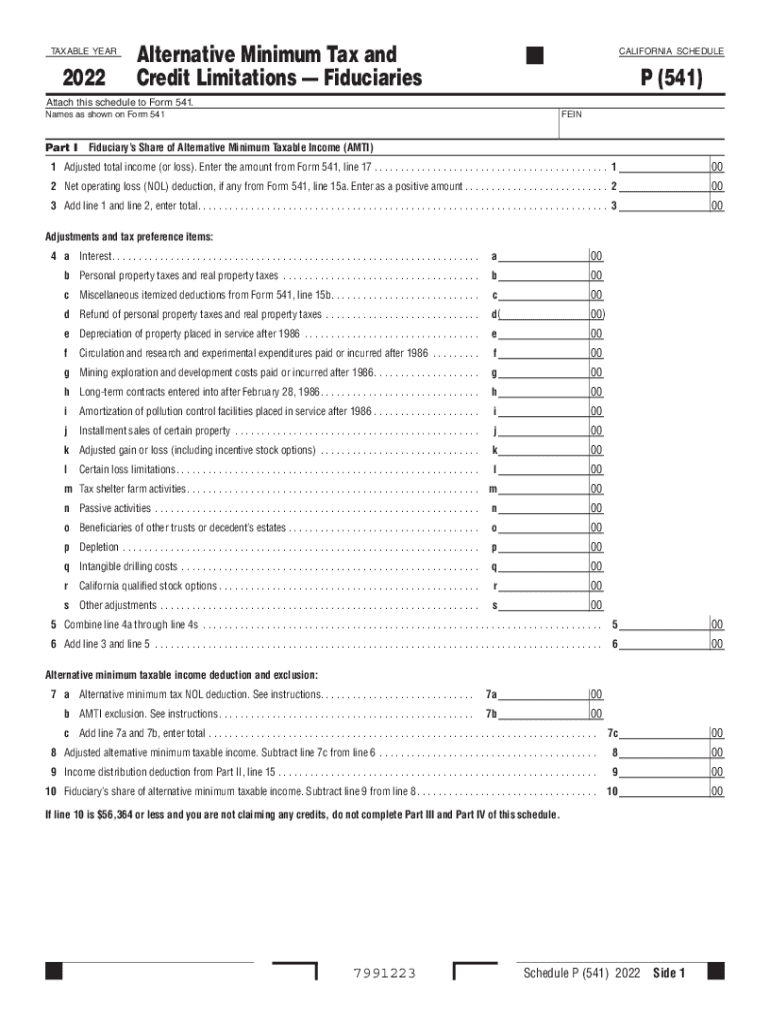

The Instructions For Schedule I Form 1041 provide detailed guidance for fiduciaries managing estates and trusts in the United States. This document outlines how to report income, deductions, and credits associated with the estate or trust. Understanding these instructions is crucial for ensuring compliance with federal tax regulations and accurately completing the form.

Steps to complete the Instructions For Schedule I Form 1041

Completing the Instructions For Schedule I Form 1041 involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Review the specific sections of the Instructions For Schedule I to understand what information is required.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Double-check the calculations and information provided to avoid errors.

- Submit the completed form by the specified deadline to avoid penalties.

How to obtain the Instructions For Schedule I Form 1041

The Instructions For Schedule I Form 1041 can be obtained directly from the IRS website. They are available as downloadable PDF files, which can be printed for convenience. Additionally, tax professionals may provide copies or guidance on how to access these instructions.

Legal use of the Instructions For Schedule I Form 1041

The legal use of the Instructions For Schedule I Form 1041 is essential for fiduciaries to comply with tax laws. These instructions clarify the obligations of the fiduciary in reporting income and deductions, ensuring that the estate or trust meets its tax responsibilities. Misuse or failure to follow these instructions can lead to legal issues, including penalties from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Schedule I Form 1041 are typically aligned with the tax year of the estate or trust. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. It is important to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the Instructions For Schedule I Form 1041, several documents are required:

- Financial statements of the estate or trust.

- Records of income received, including interest, dividends, and capital gains.

- Documentation of deductions, such as administrative expenses and distributions to beneficiaries.

- Any prior year tax returns that may provide context for the current filing.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule i form 1041

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule i form 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Schedule I Form 1041?

The Instructions For Schedule I Form 1041 provide detailed guidance on how to complete this form, which is used for reporting income and deductions for estates and trusts. Understanding these instructions is crucial for accurate tax reporting and compliance. airSlate SignNow can help streamline the process of filling out and eSigning these forms.

-

How can airSlate SignNow assist with the Instructions For Schedule I Form 1041?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the Instructions For Schedule I Form 1041. With features like document templates and eSignature capabilities, users can efficiently manage their tax documents. This ensures that you can focus on compliance without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Schedule I Form 1041?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can help with the Instructions For Schedule I Form 1041, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents like the Instructions For Schedule I Form 1041?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to manage the Instructions For Schedule I Form 1041 and other tax-related documents. The platform is designed to enhance productivity and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for handling the Instructions For Schedule I Form 1041?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when dealing with the Instructions For Schedule I Form 1041. This means you can connect your existing tools and enhance your document management process seamlessly.

-

What are the benefits of using airSlate SignNow for the Instructions For Schedule I Form 1041?

Using airSlate SignNow for the Instructions For Schedule I Form 1041 provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform simplifies the eSigning process, ensuring that your documents are signed quickly and securely. This allows you to focus on other important aspects of your business.

-

How secure is airSlate SignNow when handling the Instructions For Schedule I Form 1041?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Instructions For Schedule I Form 1041. You can trust that your sensitive information is safe while using our platform. We adhere to industry standards to ensure your data remains confidential.

Get more for Instructions For Schedule I Form 1041

- Njpb incident report njconsumeraffairs fill and sign form

- Electronic prescriptions new jersey division of consumer affairs form

- Verification of postgraduate training form

- Full text of ampquotthe sisters of the ihm the story of the form

- Forensic wchucks changesindd form

- Box 45027 form

- Bme medical education verification formindd

- Application for continuing education approval for course sponsors form

Find out other Instructions For Schedule I Form 1041

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online