990 Schedule L Instructions Form

Understanding the IRS Schedule 6 Instructions

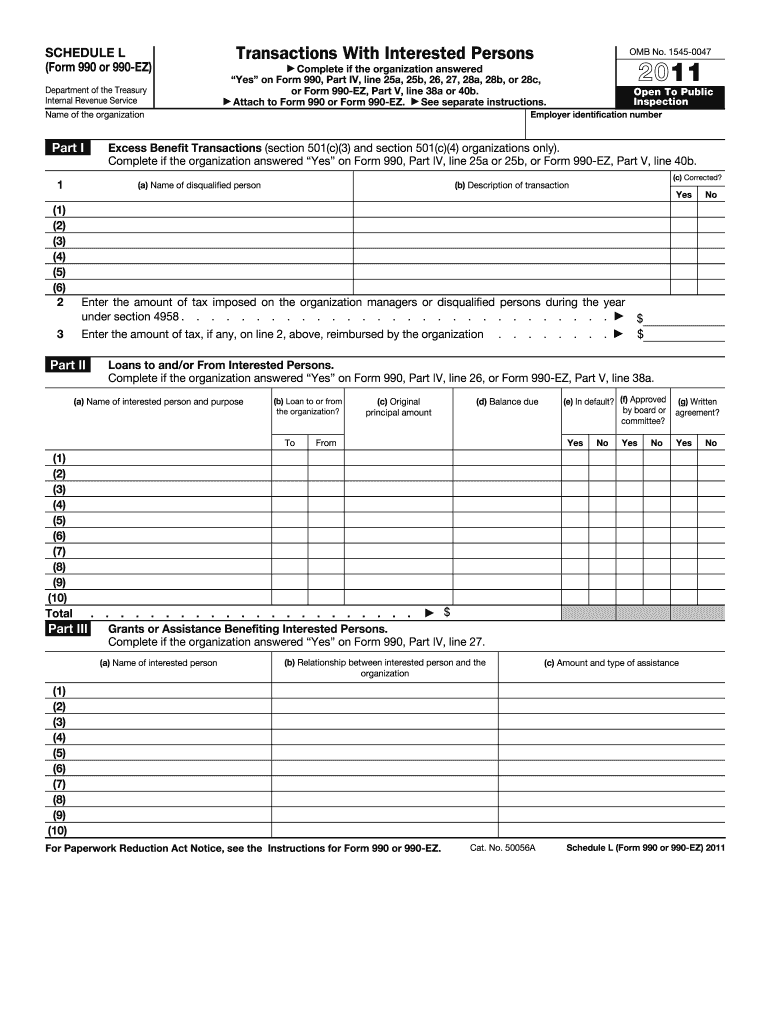

The IRS Schedule 6 is an essential component of Form 990, which nonprofit organizations must file annually. This schedule specifically addresses the reporting of transactions with interested persons, ensuring transparency and compliance with IRS regulations. Understanding the instructions for Schedule 6 is crucial for organizations to accurately disclose these transactions, which can include loans, grants, and other financial dealings. Proper completion helps maintain the integrity of the organization and fosters trust with stakeholders.

Steps to Complete the IRS Schedule 6

Completing the IRS Schedule 6 involves several key steps to ensure accuracy and compliance. Organizations should start by gathering necessary documentation related to transactions with interested persons. This includes identifying all individuals and entities that have a significant financial interest in the organization. Next, organizations should detail each transaction, including the nature, amount, and purpose. It is important to follow the specific line instructions provided in the Schedule 6 to ensure all required information is included. Finally, review the completed schedule for accuracy before submitting it with Form 990.

Legal Use of the IRS Schedule 6 Instructions

The legal use of the IRS Schedule 6 instructions is paramount for compliance with federal regulations. Nonprofit organizations must adhere to the guidelines outlined in the instructions to avoid potential penalties or legal issues. Accurate reporting of transactions with interested persons not only fulfills legal obligations but also promotes transparency and accountability within the organization. Organizations should consult legal or tax professionals if they have questions regarding specific transactions or compliance requirements.

Filing Deadlines for IRS Schedule 6

Filing deadlines for the IRS Schedule 6 align with the overall deadlines for Form 990. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their accounting period. For organizations operating on a calendar year, this typically means a May 15 deadline. It is essential to be aware of any extensions that may apply, as well as the implications of late filing, which can include penalties and increased scrutiny from the IRS.

Key Elements of the IRS Schedule 6

Several key elements define the IRS Schedule 6 and its requirements. Organizations must report the names of interested persons, the nature of their relationship with the organization, and the details of any transactions. The schedule also requires organizations to disclose the amounts involved and the terms of the transactions. Understanding these elements helps organizations ensure they provide complete and accurate information, which is critical for compliance and transparency.

Who Issues the IRS Schedule 6

The IRS Schedule 6 is issued by the Internal Revenue Service as part of the Form 990 series. The IRS provides the necessary forms and instructions for organizations to follow when reporting their financial activities. The schedule is specifically designed to assist nonprofit organizations in disclosing transactions with interested persons, thereby promoting transparency and accountability in the nonprofit sector.

Examples of Using the IRS Schedule 6

Examples of using the IRS Schedule 6 can help clarify how organizations should report transactions. For instance, if a board member receives a loan from the organization, this transaction must be reported on Schedule 6, detailing the amount, interest rate, and repayment terms. Similarly, if an organization provides a grant to a family member of a board member, this must also be disclosed. These examples illustrate the importance of transparency and the need to report any potential conflicts of interest to the IRS.

Quick guide on how to complete form schedule l part iv 501 c 6 irs code

Prepare 990 Schedule L Instructions effortlessly on any device

Online document administration has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely preserve it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your papers promptly without hold-ups. Manage 990 Schedule L Instructions on any device with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign 990 Schedule L Instructions with ease

- Obtain 990 Schedule L Instructions and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize pertinent sections of your files or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 990 Schedule L Instructions and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

In C#, when coding to interfaces, how should exceptions be dealt with? In order to be able to truly swap out different implementations of an interface, surely the possible exceptions thrown should form part of the contract?

My $0.02 for what it’s worth:Your question pertains to any object oriented language supporting exceptions and some form of polymorphism, whether via interfaces or via (abstract) base classes, since as you imply, it would seem that the possible exceptions that may be thrown from an interface implementation should arguably form part of the interface contract.The trouble is that the definer of an interface cannot in the very general abstract case (which is what an interface or abstract class specification is about), possibly know all the kinds of unexpected problems (exceptions) every possible type of concrete implementation of a given interface that might be ever be created in the future may encounter and therefore need to raise. This is true both on the consumer and the producer side.That is, it’s in a sense impossible to pre-emptively define all the possible exceptions associated to every potential interface implementation, that is to be handled, ahead of time. (I suppose I could add: … unless you’re prepared to severely limit and constrain the implementors of your interface to only those cases that you’ve imagined and thought of, the trouble being that this is almost inevitably going to vastly reduce the usefulness of your interface as it will overspecify and bind your implementors vastly more strictly than you arguably ought.)At best, the definer of an interface could/should suggest (advisory) categories of exceptions that could or should be raised (and/or possibly handled by a client) in certain general situations for possible given anticipated implementations and or situations that are anticipated to be relevant during some implementations of an interface, again taking case not to make assumptions or impose unwarranted restrictions about unimagined possible uses and implementations not imagined yet.Of course enforcing or checking of this kind of “advisory” specification is not explicitly supported by C# (or really any other language that I can think of right now), while Java’s exception contracts while seemingly a good idea in principle and a step in this direction, is a bit too simplistic and too strict in practice, tending towards being overly burdensome and being somewhat problematic in many cases as also pointed out in Eric Worrall’s answer.

Create this form in 5 minutes!

How to create an eSignature for the form schedule l part iv 501 c 6 irs code

How to generate an eSignature for the Form Schedule L Part Iv 501 C 6 Irs Code in the online mode

How to generate an electronic signature for the Form Schedule L Part Iv 501 C 6 Irs Code in Chrome

How to generate an electronic signature for signing the Form Schedule L Part Iv 501 C 6 Irs Code in Gmail

How to make an electronic signature for the Form Schedule L Part Iv 501 C 6 Irs Code from your mobile device

How to generate an electronic signature for the Form Schedule L Part Iv 501 C 6 Irs Code on iOS

How to make an eSignature for the Form Schedule L Part Iv 501 C 6 Irs Code on Android

People also ask

-

What are the 990 Schedule L Instructions?

The 990 Schedule L Instructions provide detailed guidelines for reporting transactions between a nonprofit organization and its officers, directors, or key employees. These instructions are crucial for ensuring compliance with IRS regulations and maintaining transparency in financial reporting.

-

How can airSlate SignNow assist with 990 Schedule L filing?

airSlate SignNow simplifies the process of managing and eSigning documents related to your 990 Schedule L Instructions. Our platform allows you to prepare and send necessary documents securely, ensuring all transactions are documented correctly for IRS compliance.

-

Is airSlate SignNow cost-effective for nonprofits handling 990 Schedule L?

Yes, airSlate SignNow offers a cost-effective solution tailored for nonprofits, making it an ideal choice for those managing 990 Schedule L Instructions. With flexible pricing plans, you can choose a package that fits your budget while ensuring you have all the tools needed for efficient document management.

-

What features does airSlate SignNow offer for 990 Schedule L compliance?

Our platform includes features such as customizable templates, secure eSigning, and audit trails, all essential for adhering to the 990 Schedule L Instructions. These tools help streamline your documentation process, ensuring accuracy and compliance with IRS regulations.

-

Can airSlate SignNow integrate with accounting software for 990 Schedule L preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow when preparing for the 990 Schedule L Instructions. This integration allows for the automatic transfer of data, reducing errors and saving you time.

-

What benefits does airSlate SignNow provide for managing 990 Schedule L documents?

Using airSlate SignNow for your 990 Schedule L documents provides several benefits, including improved efficiency, enhanced security for sensitive information, and easy access to signed documents. This ensures you can focus on your mission while staying compliant with IRS requirements.

-

How does airSlate SignNow ensure the security of documents related to 990 Schedule L Instructions?

airSlate SignNow prioritizes security with advanced encryption protocols and secure cloud storage for all documents, including those prepared under the 990 Schedule L Instructions. This commitment helps protect your organization’s sensitive information from unauthorized access.

Get more for 990 Schedule L Instructions

- Direct pay flyerpub hudson light and power department form

- M101 form

- Md form 746

- Notice of intent to foreclose mortgage loan default form

- Bcps field trip permission form rule 6800 form i

- Rule 6800 form g overnight field tripforeign study program

- Student service hours record card form

- Salary review request form baltimore city public schools pcab baltimorecityschools

Find out other 990 Schedule L Instructions

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free