Ca 589 Form

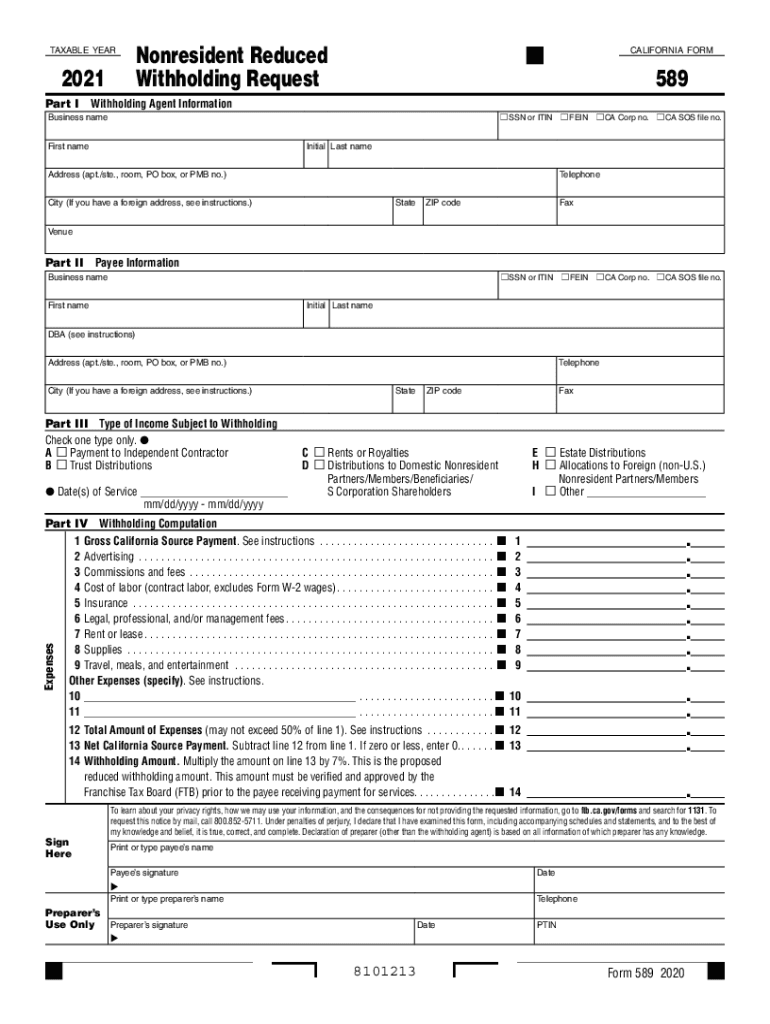

What is the California 589 Form?

The California 589 form, also known as the Withholding Exemption Certificate, is a document used by employees and payees in California to claim exemption from state income tax withholding. This form is essential for individuals who believe they will not owe any California income tax for the year. It allows them to avoid unnecessary withholding from their wages or payments, ensuring they receive their full earnings.

Steps to Complete the California 589 Form

Completing the California 589 form involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Claiming Exemption: Indicate the reason for claiming exemption. You must meet specific criteria, such as having no tax liability in the previous year and expecting none in the current year.

- Signature: Sign and date the form to certify that the information provided is accurate.

Ensure that you review the completed form for accuracy before submission.

How to Obtain the California 589 Form

The California 589 form can be easily obtained through various means:

- Online: Download the form directly from the California Franchise Tax Board (FTB) website.

- In-Person: Visit local tax offices or libraries that provide tax forms.

- By Mail: Request a physical copy from the FTB if you prefer to receive it by post.

Legal Use of the California 589 Form

The California 589 form is legally binding when filled out correctly. It must be submitted to your employer or the entity making payments to you. Misuse of this form, such as falsely claiming exemption, can lead to penalties and back taxes owed to the state.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the California 589 form is crucial for compliance:

- Annual Filing: The form should be submitted at the beginning of the tax year or whenever there is a change in your withholding status.

- Employer Requirements: Employers must retain the form for their records and may need to provide it upon request by the FTB.

Form Submission Methods

The California 589 form can be submitted through various methods:

- Online: Employers may accept electronic submissions through payroll systems.

- By Mail: Send the completed form directly to your employer.

- In-Person: Deliver the form directly to your employer’s payroll department.

Quick guide on how to complete ca 589

Prepare Ca 589 effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delay. Manage Ca 589 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to modify and eSign Ca 589 with ease

- Locate Ca 589 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or save it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Ca 589 while ensuring outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca 589

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a 2021 form request and how can airSlate SignNow assist with it?

A 2021 form request refers to the process of collecting and managing forms from clients or customers in the year 2021. airSlate SignNow simplifies this process by allowing users to create, send, and eSign documents seamlessly. With its intuitive interface, businesses can ensure efficient handling of all their 2021 form requests.

-

What are the pricing options for using airSlate SignNow for 2021 form requests?

airSlate SignNow offers flexible pricing plans tailored to different business needs, allowing you to choose the option that best suits your budget for handling 2021 form requests. Plans typically include features like unlimited document signing and templates at a competitive price, ensuring cost-effectiveness.

-

Are there any features in airSlate SignNow that specifically cater to 2021 form requests?

Yes, airSlate SignNow includes several features designed for managing 2021 form requests, such as custom templates, automated workflows, and real-time tracking. These functionalities streamline the documentation process, making it easier for businesses to oversee all their forms in one place.

-

How does airSlate SignNow ensure the security of my 2021 form requests?

airSlate SignNow prioritizes the security of your 2021 form requests by employing advanced encryption technology and strict compliance with international security standards. This ensures that your documents remain confidential and protected from unauthorized access throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for my 2021 form requests?

Absolutely! airSlate SignNow supports various integrations with popular applications and platforms, making it easier to manage your 2021 form requests. These integrations enhance productivity and allow seamless data transfer between systems to streamline your business operations.

-

What benefits can I expect from using airSlate SignNow for 2021 form requests?

Using airSlate SignNow for your 2021 form requests provides numerous benefits, including faster document turnaround times, reduced paperwork, and improved collaboration. These advantages lead to enhanced efficiency for your business, allowing you to focus on what matters most.

-

Is airSlate SignNow suitable for businesses of all sizes handling 2021 form requests?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large corporation, its scalability and customizable features allow you to efficiently manage your 2021 form requests and adapt to your specific needs.

Get more for Ca 589

Find out other Ca 589

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document