Form 8822 Rev February Change of Address

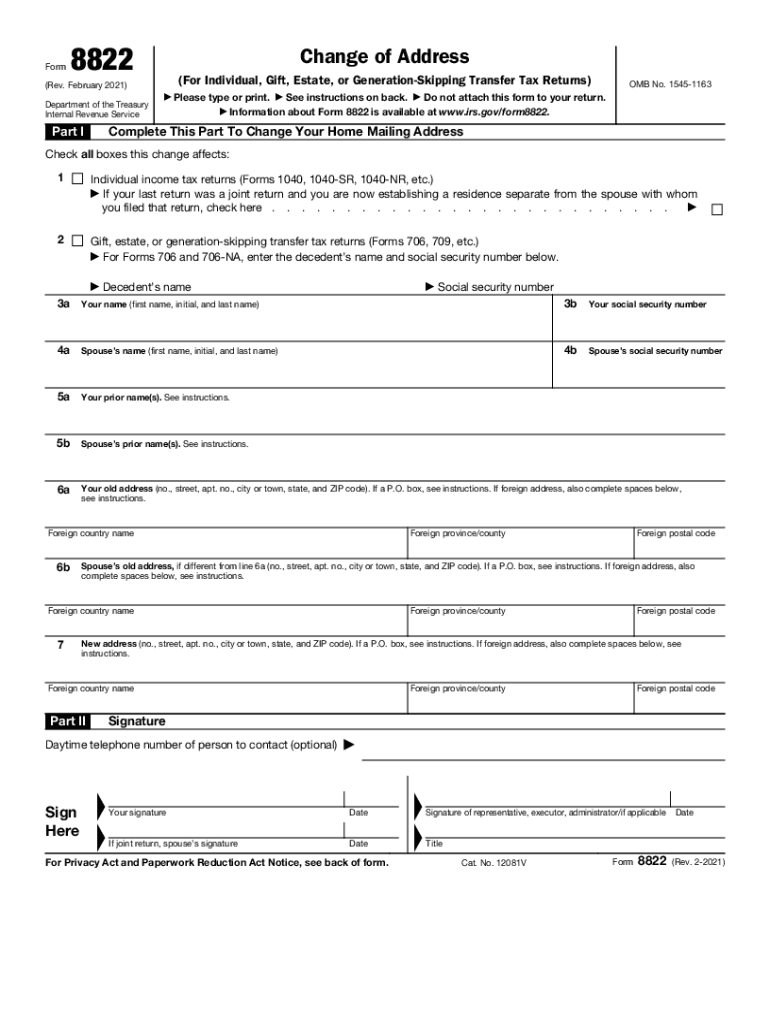

What is the Form 8822?

The Form 8822 is an official document used by individuals and businesses in the United States to notify the Internal Revenue Service (IRS) of a change of address. This form ensures that the IRS has the correct mailing address for taxpayers, which is crucial for receiving important tax information, refund checks, and other correspondence. The form is particularly necessary for those who have moved or changed their mailing address and want to ensure that their tax records are updated accordingly.

How to Use the Form 8822

Using the Form 8822 involves a straightforward process. First, download the form from the IRS website or obtain a physical copy. Next, carefully fill out the required fields, including your previous address, new address, and any other pertinent information. It is essential to ensure that all details are accurate to avoid any issues with your tax records. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the specific instructions provided for your situation.

Steps to Complete the Form 8822

Completing the Form 8822 requires several key steps:

- Download the form from the official IRS website.

- Provide your full name and Social Security number.

- Enter your previous address as listed in IRS records.

- Fill in your new address where you wish to receive IRS correspondence.

- Sign and date the form to certify that the information is accurate.

- Submit the form to the IRS using the address specified in the instructions.

Legal Use of the Form 8822

The Form 8822 serves a legal purpose by officially notifying the IRS of an address change. This notification is essential for maintaining accurate tax records and ensuring that taxpayers receive timely communications from the IRS. Failure to submit the form may lead to missed correspondence, including tax notices or refund checks, which can result in complications with tax filings and compliance.

Filing Deadlines / Important Dates

It is important to submit the Form 8822 as soon as you change your address to ensure that the IRS updates its records promptly. While there is no specific deadline for filing the form, doing so before the tax filing season begins is advisable. This helps prevent any potential delays in receiving tax-related documents or refunds. Additionally, if you are filing your tax return after moving, ensure that you use your new address on the return to avoid discrepancies.

Form Submission Methods

The Form 8822 can be submitted to the IRS through various methods. The most common method is by mailing the completed form to the address specified in the instructions. As of now, the IRS does not allow electronic submission of this form. It is crucial to ensure that the form is sent to the correct address to avoid processing delays. Keep a copy of the submitted form for your records as proof of the address change.

Quick guide on how to complete form 8822 rev february 2021 change of address

Complete Form 8822 Rev February Change Of Address with ease on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8822 Rev February Change Of Address on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The most efficient way to edit and eSign Form 8822 Rev February Change Of Address effortlessly

- Locate Form 8822 Rev February Change Of Address and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial sections of your documents or conceal sensitive information with the specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost files, tedious document searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 8822 Rev February Change Of Address and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8822 rev february 2021 change of address

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow about address?

AirSlate SignNow is about address management in document workflows, allowing users to easily send and eSign documents online. This tool streamlines the signing process while ensuring that your address details are accurately captured and processed. By focusing on your needs about address, airSlate SignNow simplifies both document creation and management.

-

How does airSlate SignNow address pricing concerns?

AirSlate SignNow provides flexible pricing plans that cater to different business sizes and needs. You can choose a plan that suits your requirements without overspending, ensuring that the features you need about address management are included. Transparent pricing allows you to understand what you're paying for before committing.

-

What features of airSlate SignNow are focused on address security?

AirSlate SignNow prioritizes security with features like advanced encryption and secure cloud storage to protect sensitive information, including address data. The platform complies with industry standards and regulations, ensuring only authorized users can access and manage address-related documents. This commitment to security helps build trust with your clients.

-

Can airSlate SignNow integrate with other applications for address management?

Yes, airSlate SignNow offers integrations with various applications that can enhance your workflow about address management. This includes CRM systems and other software that allow seamless transfer of address information. These integrations help reduce manual data entry and streamline document processing.

-

What are the benefits of using airSlate SignNow about address workflows?

Using airSlate SignNow for address workflows signNowly saves time, reduces errors, and improves efficiency in document processing. Automated address fields and real-time tracking ensure that all necessary details are captured correctly. By simplifying these workflows, businesses can focus more on their core activities.

-

How user-friendly is airSlate SignNow for managing addresses?

AirSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage addresses within documents. The intuitive interface allows users to quickly fill out address fields and send documents for eSigning. Even those with minimal technical expertise can efficiently use the platform.

-

Is there a free trial for airSlate SignNow that includes address features?

Yes, airSlate SignNow offers a free trial that provides access to basic features, including those related to managing addresses. This trial allows prospective users to experience the platform without any upfront investment, ensuring that all address-related functionalities are available for testing. It's a great way to determine if it's the right fit for your needs.

Get more for Form 8822 Rev February Change Of Address

Find out other Form 8822 Rev February Change Of Address

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading