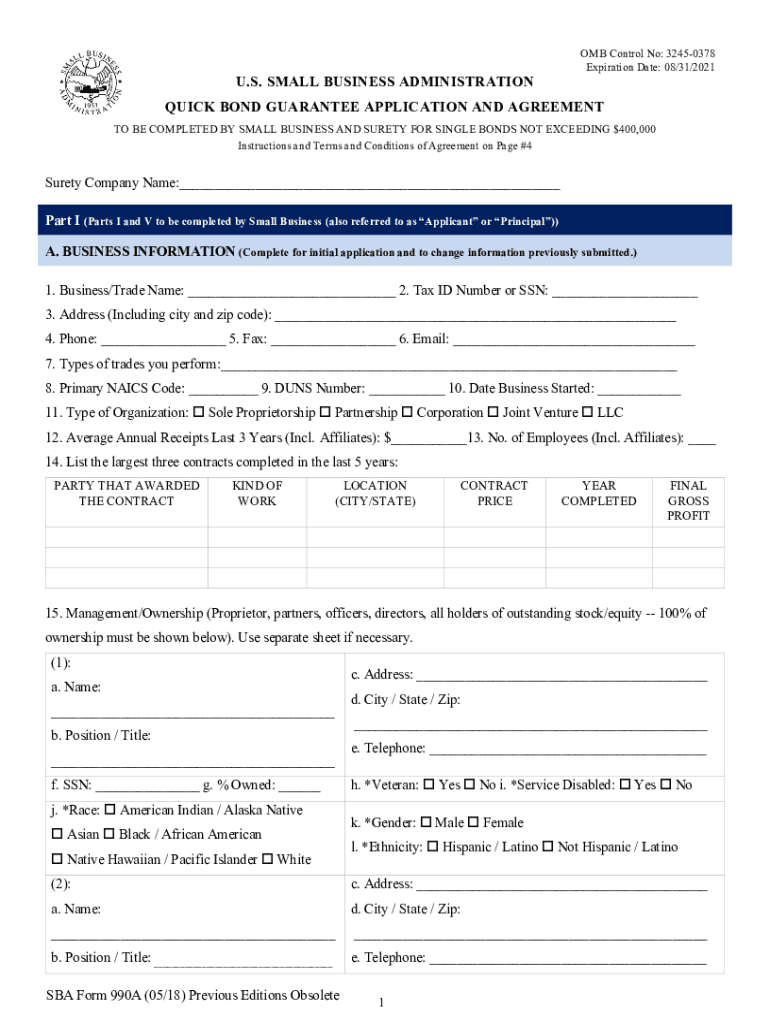

Office of Surety Guarantees Quick Bond Guarantee Application and Agreement Form 990A

What is the SBA Bond Guarantee Program?

The SBA Bond Guarantee Program is designed to assist small businesses in obtaining surety bonds, which are often required for government contracts. This program helps businesses that may not qualify for traditional bonding by providing a guarantee to surety companies, thereby reducing the risk associated with bonding smaller contractors. The program aims to promote the growth of small businesses by ensuring they have access to necessary bonding, which can enhance their competitiveness in the marketplace.

Steps to Complete the SBA Bond Application

Completing the SBA bond application involves several key steps to ensure that your submission is accurate and complete. Start by gathering all necessary documentation, including financial statements, business licenses, and any relevant contracts. Next, fill out the SBA bond application form, ensuring that all information is truthful and up-to-date. After completing the form, review it for accuracy, and then submit it along with the required documents to the appropriate surety company or the SBA. It is advisable to keep copies of all submitted materials for your records.

Eligibility Criteria for the SBA Bond Guarantee Program

To qualify for the SBA Bond Guarantee Program, businesses must meet specific eligibility criteria. Primarily, the business must be a small business as defined by the SBA, which typically means it has fewer than five hundred employees. Additionally, the business must demonstrate the ability to perform the contract for which the bond is being requested. Other factors, such as financial stability and prior bonding history, may also be considered. Understanding these criteria can help streamline the application process and increase the chances of approval.

Required Documents for the SBA Bond Application

When applying for an SBA bond, several documents are required to support your application. These typically include:

- Completed SBA bond application form

- Financial statements, including balance sheets and income statements

- Business licenses and registrations

- Contracts related to the projects for which bonding is requested

- Personal financial statements from business owners

Having these documents ready can facilitate a smoother application process and help ensure that your submission is complete.

How to Use the SBA Bond Application Form

The SBA bond application form is a crucial document for small businesses seeking bonding. To use the form effectively, start by carefully reading the instructions provided. Fill out each section with accurate information, ensuring that you provide all requested details. If applicable, attach any required supplementary documents that support your application. Once completed, review the form for any errors or omissions before submitting it to the relevant surety company or the SBA. Proper use of the form can significantly impact the approval process.

Legal Use of the SBA Bond Application

The legal use of the SBA bond application is essential for ensuring compliance with bonding regulations. The application must be filled out truthfully, as any misrepresentation can lead to denial of the bond or legal repercussions. Additionally, understanding the legal implications of the bond agreement is crucial, as it outlines the responsibilities of the business and the surety company. By adhering to legal guidelines, businesses can protect themselves and ensure that they are eligible for bonding under the SBA program.

Quick guide on how to complete office of surety guarantees quick bond guarantee application and agreement form 990a

Complete Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to generate, modify, and eSign your documents promptly without delays. Handle Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A on any gadget using airSlate SignNow Android or iOS applications, and enhance any document-related task today.

The simplest method to modify and eSign Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A with ease

- Obtain Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the office of surety guarantees quick bond guarantee application and agreement form 990a

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is an SBA bond and how does it work?

An SBA bond is a type of surety bond that helps small businesses secure financing and contract opportunities. These bonds are backed by the Small Business Administration, providing a guarantee to the project owner that the contractor will fulfill their obligations. With an SBA bond, businesses can enhance their credibility and increase their chances of winning contracts.

-

How can airSlate SignNow help with the SBA bond application process?

airSlate SignNow offers a streamlined eSignature solution that simplifies the SBA bond application process. With our platform, you can quickly prepare, send, and sign documents online, ensuring faster processing times. Our user-friendly interface allows businesses to complete their SBA bond applications with ease, enhancing efficiency and compliance.

-

What are the costs associated with obtaining an SBA bond?

The costs for obtaining an SBA bond can vary based on several factors, including the size of the bond and the applicant's creditworthiness. Typically, you can expect to pay a premium ranging from 1% to 3% of the total bond amount. Utilizing airSlate SignNow can help reduce administrative costs and streamline your documentation, making the process more affordable.

-

What are the benefits of using airSlate SignNow for SBA bonds?

Using airSlate SignNow for SBA bonds provides numerous advantages, including increased efficiency, enhanced document security, and improved collaboration. Our platform ensures that all your signatures are legally binding and securely stored. Additionally, it allows you to track the status of your documents in real time, which can signNowly speed up the bonding process.

-

Can I integrate airSlate SignNow with other tools for managing SBA bonds?

Yes, airSlate SignNow offers robust integrations with various third-party applications such as CRM tools, project management software, and accounting systems. This allows you to seamlessly manage your SBA bond documents along with other business operations. The integration capabilities enhance productivity and ensure that all your data is in one place.

-

How long does it take to receive an SBA bond once the documents are signed?

The time it takes to receive an SBA bond after signing documents typically ranges from a few days to a couple of weeks. Factors such as the efficiency of your bonding agency, the completeness of the application, and any additional requirements may influence the timeline. Utilizing airSlate SignNow can help expedite this process by ensuring everything is accurately signed and submitted without delays.

-

Are there specific requirements to qualify for an SBA bond?

To qualify for an SBA bond, businesses usually need to provide documentation demonstrating financial stability, experience in their industry, and a clean legal record. Each bonding company may have its own set of requirements, making it important to check with them directly. With airSlate SignNow, you can easily gather and submit necessary documents, improving your chances of qualifying for the SBA bond.

Get more for Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A

Find out other Office Of Surety Guarantees Quick Bond Guarantee Application And Agreement Form 990A

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document