Irs Address Change Form 8822

What is the IRS Address Change Form 8822

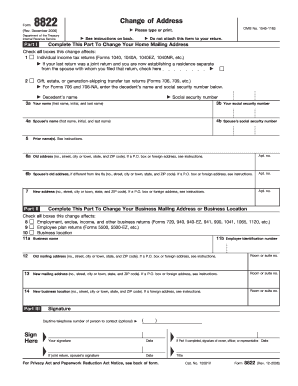

The IRS Address Change Form 8822 is a document used by individuals and businesses to officially notify the Internal Revenue Service of a change in their mailing address. This form ensures that the IRS has the most current address on file, which is crucial for receiving important tax documents and correspondence. The form is applicable to both individuals and businesses, allowing them to maintain accurate records with the IRS.

How to Use the IRS Address Change Form 8822

To use the IRS Address Change Form 8822, individuals must complete the form with their new address information and any other required details. It is important to fill out the form accurately to avoid any delays in processing. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the specific instructions provided on the form. Individuals should ensure they keep a copy of the submitted form for their records.

Steps to Complete the IRS Address Change Form 8822

Completing the IRS Address Change Form 8822 involves several key steps:

- Obtain the form from the IRS website or other authorized sources.

- Fill in your personal information, including your name, old address, and new address.

- If applicable, provide the name of your spouse if you are filing jointly.

- Sign and date the form to certify that the information is correct.

- Submit the completed form to the IRS via the specified submission method.

Legal Use of the IRS Address Change Form 8822

The IRS Address Change Form 8822 is legally recognized as a valid means of updating your address with the IRS. To ensure its legal standing, the form must be completed accurately and submitted in accordance with IRS guidelines. Compliance with this process is essential, as it helps prevent issues related to tax notifications and correspondence, which could lead to penalties or delays in tax processing.

Key Elements of the IRS Address Change Form 8822

Key elements of the IRS Address Change Form 8822 include:

- Personal Information: Name, Social Security Number, and old address.

- New Address: Complete address details where correspondence should be sent.

- Signature: Required to validate the information provided.

- Spousal Information: If applicable, details about your spouse must be included for joint filers.

Form Submission Methods

The IRS Address Change Form 8822 can be submitted through various methods. The primary method is by mail, where individuals send the completed form to the address specified in the instructions. Some taxpayers may also have the option to submit the form electronically, depending on the IRS guidelines for the current tax year. It is essential to follow the instructions carefully to ensure proper processing.

Quick guide on how to complete irs address change form 8822

Prepare Irs Address Change Form 8822 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the needed form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Address Change Form 8822 on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to alter and electronically sign Irs Address Change Form 8822 effortlessly

- Obtain Irs Address Change Form 8822 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Irs Address Change Form 8822 and guarantee outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs address change form 8822

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the address change form IRS and why is it necessary?

The address change form IRS is a crucial document that taxpayers must submit to inform the IRS about any change in their residential or mailing address. Failing to submit this form can lead to miscommunication and delays in receiving important tax-related information. It's essential for maintaining accurate records with the IRS.

-

How can airSlate SignNow assist with the address change form IRS?

airSlate SignNow simplifies the process of completing and submitting the address change form IRS. Our platform allows users to fill out the form digitally, ensuring accuracy and speed. Plus, with eSignature capabilities, you can sign and send your form seamlessly without the need for printing or scanning.

-

Is there a fee to use airSlate SignNow for the address change form IRS?

airSlate SignNow offers a cost-effective solution for managing documents, including the address change form IRS. While there may be different pricing plans depending on the features you choose, the benefits and efficiency provided by our platform make it a valuable investment for taxpayers and businesses alike.

-

What features does airSlate SignNow offer for processing the address change form IRS?

airSlate SignNow provides various features to help with the address change form IRS, including customizable templates, electronic signatures, and secure document storage. Our user-friendly interface ensures that anyone can complete the form quickly and efficiently, eliminating the complexities of traditional paperwork.

-

Can I integrate airSlate SignNow with other applications for the address change form IRS?

Yes, airSlate SignNow supports integration with various applications to facilitate the processing of the address change form IRS. This feature allows you to connect with your favorite tools and software, streamlining your document management process while ensuring that your address change form is completed and filed efficiently.

-

What benefits do I gain by using airSlate SignNow for the address change form IRS?

Using airSlate SignNow for the address change form IRS provides several benefits, such as enhancing document accuracy, reducing processing time, and minimizing the risk of errors. Our platform enables secure online submissions and keeps your documents organized, providing peace of mind while managing your tax information.

-

How secure is the airSlate SignNow platform for submitting the address change form IRS?

The security of your documents, including the address change form IRS, is a top priority for airSlate SignNow. We implement advanced encryption protocols and maintain strict compliance with industry standards to ensure that your personal information remains safe and confidential throughout the signing and submission process.

Get more for Irs Address Change Form 8822

Find out other Irs Address Change Form 8822

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free