Gst190e Form

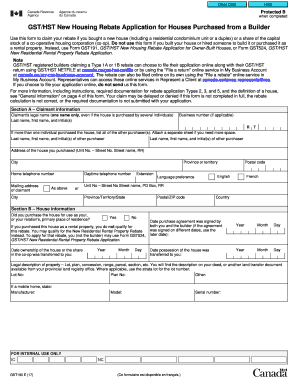

What is the GST190e?

The GST190e form is a crucial document used in the housing rebate application process. It is specifically designed for individuals seeking to claim a rebate on the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) related to their housing expenses. This form is essential for ensuring that applicants receive the appropriate financial relief associated with their housing costs. The GST190e provides a structured way to report relevant information, making it easier for both applicants and processing authorities to manage claims efficiently.

Steps to Complete the GST190e

Completing the GST190e form requires careful attention to detail. Here are the key steps involved:

- Gather Required Information: Collect all necessary documents, including proof of purchase, receipts, and any previous tax filings that may be relevant.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number. Ensure that all details are accurate to avoid delays.

- Report Housing Expenses: Clearly outline your housing expenses, including rent or purchase details, and any applicable GST or HST amounts paid.

- Review and Sign: Carefully review the completed form for any errors. Sign and date the form to validate your application.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the correct address.

Legal Use of the GST190e

The GST190e form is legally binding when completed and submitted according to the guidelines set forth by the relevant authorities. It must comply with eSignature laws, ensuring that electronic submissions are treated with the same legal weight as traditional paper forms. To maintain its validity, applicants should ensure that their submissions meet all regulatory requirements, including proper documentation and accurate reporting of information. Utilizing a reliable eSignature platform can further enhance the legal standing of your submission, providing a digital certificate that verifies the authenticity of your signature.

Eligibility Criteria

To qualify for the GST190e rebate, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of the United States.

- Having incurred eligible housing expenses, such as rent or home purchase costs.

- Being able to provide supporting documentation, such as receipts or tax returns.

- Meeting income thresholds set by the tax authorities, which may vary by state.

It is important for applicants to review these criteria carefully to ensure they qualify before submitting the form.

Form Submission Methods

The GST190e form can be submitted through various methods, providing flexibility for applicants. The available submission options include:

- Online Submission: Many applicants prefer to submit their forms electronically through designated portals, which often provide immediate confirmation of receipt.

- Mail Submission: For those who prefer traditional methods, mailing the completed form to the appropriate address is an option. Ensure that you use a reliable mailing service to track your submission.

- In-Person Submission: Some applicants may choose to deliver their forms in person at local tax offices, where they can receive assistance and confirmation of submission.

Required Documents

When completing the GST190e form, applicants must provide several supporting documents to substantiate their claims. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Receipts for housing expenses, including rent agreements or purchase contracts.

- Previous tax returns, if applicable, to demonstrate income levels.

- Any additional documentation that may be required by state-specific regulations.

Having these documents ready can streamline the application process and help ensure a successful claim.

Quick guide on how to complete gst190e

Prepare Gst190e effortlessly on any gadget

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gst190e on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Gst190e with ease

- Find Gst190e and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow makes available specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choice. Modify and eSign Gst190e and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst190e

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the rc7190 ws and how does it benefit my business?

The rc7190 ws is an advanced solution for electronic signatures and document management. By utilizing airSlate SignNow, businesses can streamline their document workflows, improve efficiency, and reduce turnaround time. This tool is particularly beneficial for organizations looking to enhance security and compliance in their signing processes.

-

How much does the rc7190 ws cost?

Pricing for the rc7190 ws varies based on the plan you choose, accommodating businesses of all sizes. airSlate SignNow offers flexible pricing options to ensure you get the best value for your investment. Check their website for the latest pricing details and any special offers.

-

What features are included with the rc7190 ws?

The rc7190 ws includes a variety of features such as customizable templates, in-person signing, and automated reminders. Additionally, the solution supports multiple file formats and provides a secure way to store and manage signed documents. These features collectively enhance user experience and document management efficiency.

-

Can the rc7190 ws integrate with other software solutions?

Yes, the rc7190 ws can seamlessly integrate with numerous third-party applications and software platforms. By doing so, it ensures that your document signing processes are integrated with your existing workflows, enhancing productivity. Popular integrations include CRM systems, cloud storage services, and accounting software.

-

Is the rc7190 ws suitable for small businesses?

Absolutely! The rc7190 ws is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. With its user-friendly interface and scalable features, small businesses can leverage the power of electronic signatures without a steep learning curve.

-

Are there any mobile options for the rc7190 ws?

Yes, the rc7190 ws is mobile-friendly, allowing users to manage and sign documents on-the-go. The mobile application enables users to access their documents, send for signatures, and track the status of their files from their smartphones or tablets. This mobility enhances convenience and responsiveness in business operations.

-

What are the security features of the rc7190 ws?

The rc7190 ws prioritizes security with features such as encryption, password protection, and audit trails. These security measures ensure that your documents and signatures are secure throughout the signing process, meeting compliance standards and protecting sensitive information. Trust in the robust security framework of airSlate SignNow.

Get more for Gst190e

- Fpz 66 form

- Workshop job card template download form

- Bctesg form pdf

- Supplemental information regarding parties form pinellas county pinellasclerk

- Scorepointe player cards waiver pub form

- 99 form 706me maine estate tax return

- Real estate withholding payment voucher form

- State of maine international fuel tax agreement application form

Find out other Gst190e

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile