Real Estate Withholding Payment Voucher 2024-2026

What is the Real Estate Withholding Payment Voucher

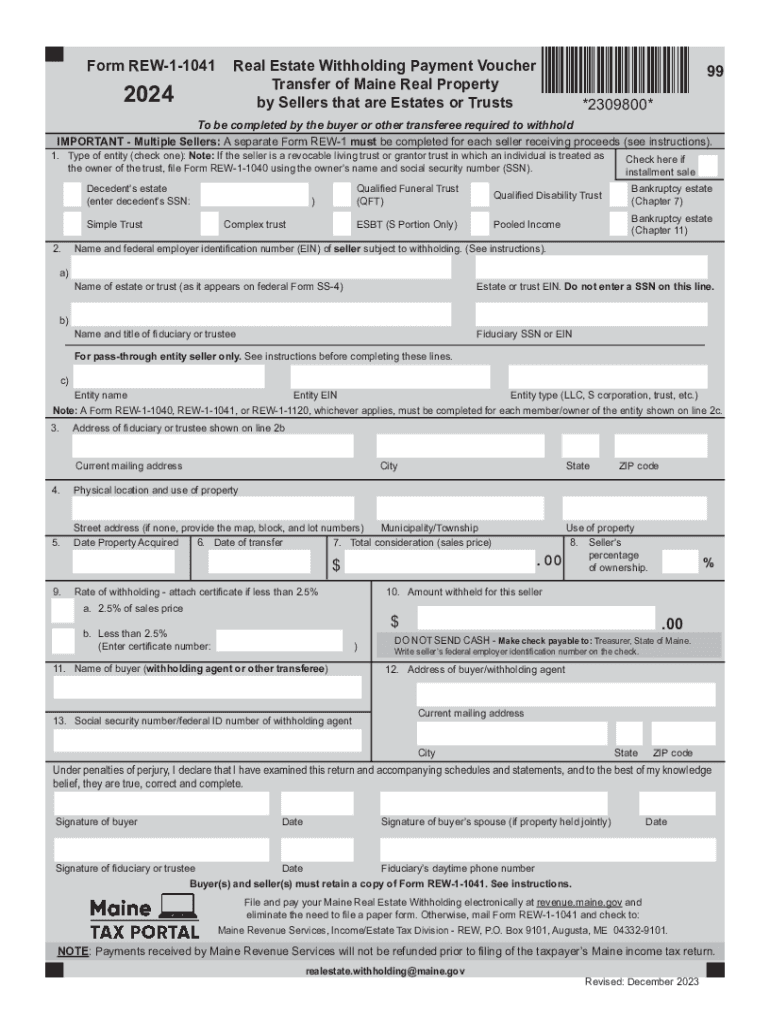

The Real Estate Withholding Payment Voucher is a tax form used in the United States, specifically designed for transactions involving the sale of real property by non-residents. This form is essential for ensuring that the appropriate amount of tax is withheld from the proceeds of the sale. The voucher typically accompanies the payment made to the state tax authority, helping to facilitate compliance with state tax laws. It serves as a record of the withholding amount and provides necessary information about the transaction and the seller.

How to use the Real Estate Withholding Payment Voucher

To use the Real Estate Withholding Payment Voucher, sellers must first complete the form accurately. This involves providing details such as the seller's name, address, and taxpayer identification number, as well as information about the property being sold. Once the form is completed, it should be submitted along with the payment to the appropriate state tax authority. It is important to retain a copy of the voucher for personal records, as it may be needed for future reference or tax filings.

Steps to complete the Real Estate Withholding Payment Voucher

Completing the Real Estate Withholding Payment Voucher involves several key steps:

- Gather necessary information, including the seller's details and property specifics.

- Fill out the form, ensuring that all sections are completed accurately.

- Calculate the withholding amount based on the sale price and applicable state tax rates.

- Review the form for accuracy before submission.

- Submit the completed voucher along with the payment to the state tax authority.

Key elements of the Real Estate Withholding Payment Voucher

Important elements of the Real Estate Withholding Payment Voucher include:

- Seller Information: Name, address, and taxpayer identification number.

- Property Details: Address and description of the property sold.

- Withholding Amount: The total amount to be withheld based on the sale price.

- Payment Information: Details regarding the payment method and submission.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Withholding Payment Voucher vary by state. Generally, the form must be submitted at the time of closing or shortly thereafter. It is crucial for sellers to be aware of specific state deadlines to avoid penalties. Keeping track of these dates ensures compliance with state tax regulations and helps prevent any issues with the sale process.

Penalties for Non-Compliance

Failure to comply with the requirements related to the Real Estate Withholding Payment Voucher can result in significant penalties. These may include fines or additional tax liabilities imposed by the state tax authority. Non-compliance can also lead to complications during the sale process, potentially delaying transactions or affecting the seller's ability to receive proceeds from the sale. Therefore, it is essential to adhere to all filing requirements and deadlines.

Quick guide on how to complete real estate withholding payment voucher

Effortlessly Prepare Real Estate Withholding Payment Voucher on Any Device

Digital document management has become favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Manage Real Estate Withholding Payment Voucher on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and eSign Real Estate Withholding Payment Voucher with Ease

- Locate Real Estate Withholding Payment Voucher and then click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Adjust and eSign Real Estate Withholding Payment Voucher while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate withholding payment voucher

Create this form in 5 minutes!

How to create an eSignature for the real estate withholding payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Real Estate Withholding Payment Voucher?

A Real Estate Withholding Payment Voucher is a document used in real estate transactions to report and remit withholding taxes to the state. It ensures compliance with tax regulations when selling property. Understanding this voucher is crucial for both buyers and sellers to avoid penalties.

-

How can airSlate SignNow help with the Real Estate Withholding Payment Voucher?

airSlate SignNow simplifies the process of creating and signing the Real Estate Withholding Payment Voucher. Our platform allows users to easily fill out, eSign, and send the voucher securely. This streamlines the transaction process and ensures timely compliance with tax obligations.

-

What are the pricing options for using airSlate SignNow for the Real Estate Withholding Payment Voucher?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Users can choose from monthly or annual subscriptions, with options that include features specifically designed for handling documents like the Real Estate Withholding Payment Voucher. Check our website for detailed pricing information.

-

Are there any integrations available for managing the Real Estate Withholding Payment Voucher?

Yes, airSlate SignNow integrates seamlessly with various platforms to enhance your workflow. You can connect with CRM systems, cloud storage services, and other tools to manage the Real Estate Withholding Payment Voucher efficiently. This integration helps streamline document management and improves productivity.

-

What are the benefits of using airSlate SignNow for real estate transactions?

Using airSlate SignNow for real estate transactions, including the Real Estate Withholding Payment Voucher, offers numerous benefits. It provides a user-friendly interface, ensures document security, and speeds up the signing process. This efficiency can lead to quicker closings and improved client satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents like the Real Estate Withholding Payment Voucher?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents, including the Real Estate Withholding Payment Voucher. Our platform uses encryption and secure cloud storage to ensure that your data remains confidential and safe from unauthorized access.

-

Can I track the status of my Real Estate Withholding Payment Voucher with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Real Estate Withholding Payment Voucher. You can see when the document is viewed, signed, and completed, giving you peace of mind and keeping you informed throughout the process.

Get more for Real Estate Withholding Payment Voucher

- Lease purchase agreements package michigan form

- Cancellation release 497311677 form

- Michigan premarital form

- Painting contractor package michigan form

- Framing contractor package michigan form

- Foundation contractor package michigan form

- Plumbing contractor package michigan form

- Brick mason contractor package michigan form

Find out other Real Estate Withholding Payment Voucher

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe