99 Form 706ME Maine Estate Tax Return 2024-2026

What is the 99 Form 706ME Maine Estate Tax Return

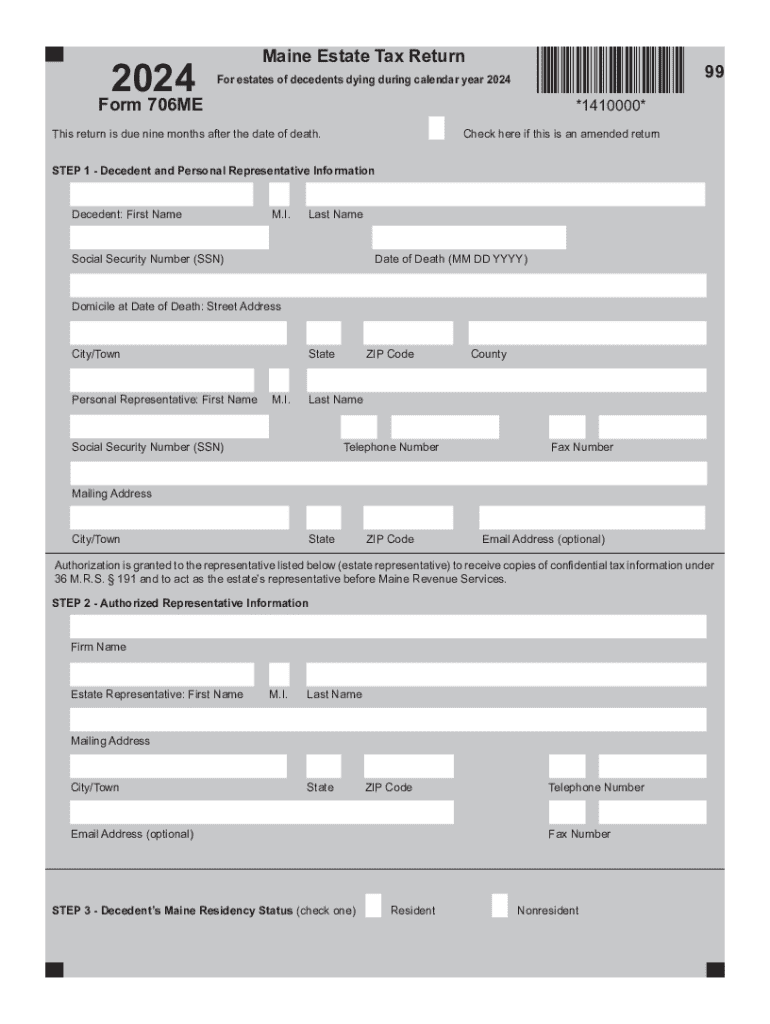

The 99 Form 706ME Maine Estate Tax Return is a state-specific tax form used to report the estate tax obligations of deceased individuals in Maine. This form is essential for estates that exceed the state’s exemption threshold. It ensures that the appropriate taxes are calculated and submitted to the state government, helping to facilitate the transfer of assets to beneficiaries legally and efficiently.

Steps to complete the 99 Form 706ME Maine Estate Tax Return

Completing the 99 Form 706ME requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation: Collect all relevant financial documents, including the decedent's will, asset valuations, and any prior tax returns.

- Determine the gross estate value: Calculate the total value of the estate, including real estate, personal property, and financial accounts.

- Identify deductions: List any allowable deductions, such as funeral expenses, debts, and administrative costs, which can reduce the taxable estate value.

- Complete the form: Fill out the 99 Form 706ME accurately, ensuring all sections are completed and calculations are verified.

- Review and sign: Have the form reviewed for accuracy, then sign and date it as required.

Key elements of the 99 Form 706ME Maine Estate Tax Return

The 99 Form 706ME includes several key elements that must be addressed:

- Decedent information: Full name, date of death, and Social Security number.

- Estate value: A detailed account of the gross estate, including all assets and liabilities.

- Deductions: A section for listing allowable deductions that reduce the taxable estate.

- Tax calculation: The form includes a calculation section to determine the estate tax owed based on the net taxable estate.

- Signature and certification: The form must be signed by the executor or personal representative of the estate.

Filing Deadlines / Important Dates

Filing the 99 Form 706ME is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. If additional time is needed, an extension request can be submitted, but it is important to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete the 99 Form 706ME, certain documents are required:

- Death certificate: Official documentation confirming the date of death.

- Will or trust documents: Legal documents outlining the distribution of the estate.

- Asset valuations: Appraisals or statements reflecting the value of estate assets.

- Debt documentation: Records of any debts owed by the decedent that may be deducted.

Form Submission Methods

The 99 Form 706ME can be submitted through various methods, ensuring flexibility for the filer. Options include:

- Mail: Completed forms can be mailed to the appropriate state tax office.

- In-person: Filers may also choose to submit the form directly at designated state tax offices.

Quick guide on how to complete 99 form 706me maine estate tax return

Complete 99 Form 706ME Maine Estate Tax Return effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your papers quickly without interruptions. Manage 99 Form 706ME Maine Estate Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign 99 Form 706ME Maine Estate Tax Return without breaking a sweat

- Obtain 99 Form 706ME Maine Estate Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign 99 Form 706ME Maine Estate Tax Return and guarantee efficient communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 99 form 706me maine estate tax return

Create this form in 5 minutes!

How to create an eSignature for the 99 form 706me maine estate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 99 Form 706ME Maine Estate Tax Return?

The 99 Form 706ME Maine Estate Tax Return is a tax form used to report the estate tax liability for estates in the state of Maine. It is essential for executors to complete this form accurately to ensure compliance with state tax laws. airSlate SignNow can help streamline the process of filling out and submitting the 99 Form 706ME Maine Estate Tax Return.

-

How can airSlate SignNow assist with the 99 Form 706ME Maine Estate Tax Return?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the 99 Form 706ME Maine Estate Tax Return. Our solution simplifies document management, allowing users to fill out forms electronically and securely. This not only saves time but also reduces the risk of errors in the tax return process.

-

What are the pricing options for using airSlate SignNow for the 99 Form 706ME Maine Estate Tax Return?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can manage your 99 Form 706ME Maine Estate Tax Return without breaking the bank. Visit our pricing page for detailed information on the plans available.

-

Are there any features specifically designed for the 99 Form 706ME Maine Estate Tax Return?

Yes, airSlate SignNow includes features tailored for the 99 Form 706ME Maine Estate Tax Return, such as customizable templates and automated workflows. These features help users efficiently manage their estate tax documents and ensure that all necessary information is included. Additionally, our platform allows for easy collaboration with other stakeholders involved in the estate process.

-

Can I integrate airSlate SignNow with other software for managing the 99 Form 706ME Maine Estate Tax Return?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your 99 Form 706ME Maine Estate Tax Return alongside your existing tools. Whether you use accounting software or document management systems, our platform can seamlessly connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the 99 Form 706ME Maine Estate Tax Return?

Using airSlate SignNow for the 99 Form 706ME Maine Estate Tax Return provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, ensuring that your estate tax return is processed promptly. Additionally, our user-friendly interface makes it accessible for everyone, regardless of technical expertise.

-

Is airSlate SignNow secure for handling the 99 Form 706ME Maine Estate Tax Return?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 99 Form 706ME Maine Estate Tax Return is handled safely. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are secure while using our platform.

Get more for 99 Form 706ME Maine Estate Tax Return

- Not renewing 497329581 form

- Guaranty performance

- Mortgage securing guaranty of performance of lease

- Discharge bankruptcy assets form

- Complaint objecting to discharge in bankruptcy proceeding for transfer removal destruction or concealment of property within form

- Discharge bankruptcy form

- Discharge debtor bankruptcy form

- Bankruptcy which have form

Find out other 99 Form 706ME Maine Estate Tax Return

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast