Form 8863 Education Credits Hope and Lifetime Learning Credits

What is the Form 8863 Education Credits Hope And Lifetime Learning Credits

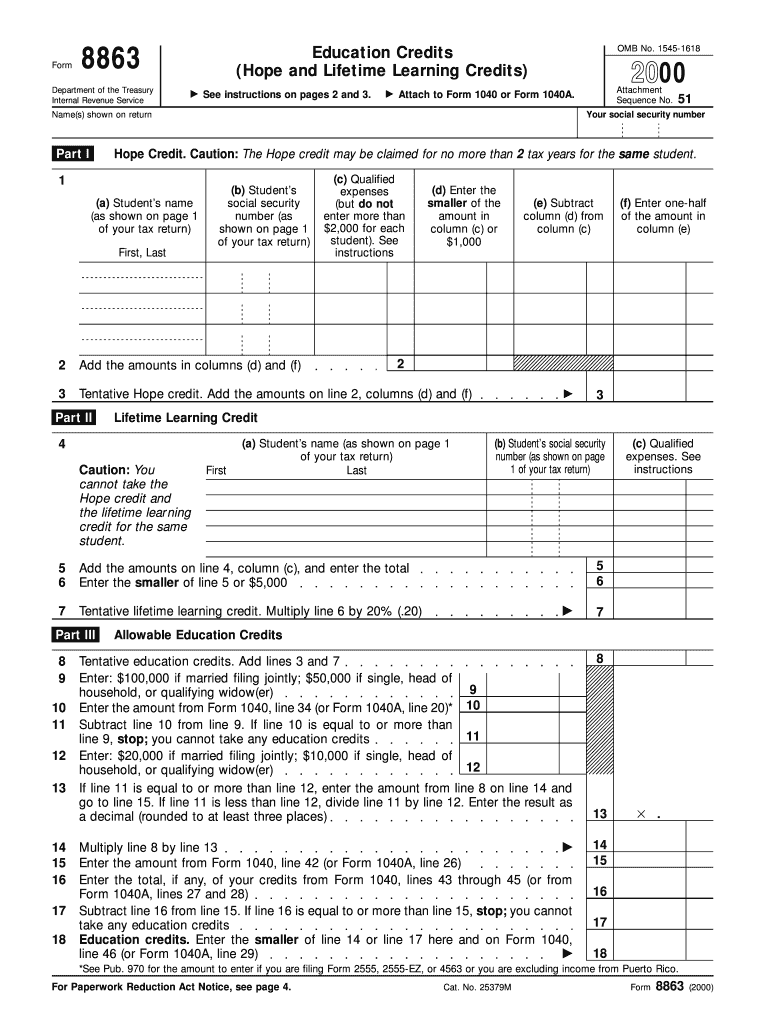

The Form 8863 is a tax form used by U.S. taxpayers to claim education credits, specifically the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). The AOTC allows eligible students to receive a credit for qualified education expenses incurred during their first four years of higher education. In contrast, the LLC provides a credit for qualified tuition and related expenses for students enrolled in eligible educational institutions, regardless of the number of years they have been in school. Understanding the distinctions between these credits is essential for maximizing potential tax benefits.

How to use the Form 8863 Education Credits Hope And Lifetime Learning Credits

To use Form 8863, taxpayers must first determine their eligibility for the AOTC or LLC based on their educational expenses and enrollment status. After confirming eligibility, the next step is to complete the form by providing necessary information about the student, including their Social Security number and details about the educational institution. Taxpayers must also calculate the amount of credit they are eligible to claim based on the qualified expenses incurred. Once completed, the form should be attached to the taxpayer's Form 1040 when filing their federal income tax return.

Steps to complete the Form 8863 Education Credits Hope And Lifetime Learning Credits

Completing Form 8863 involves several key steps:

- Gather necessary documentation, including receipts for qualified educational expenses and the student's enrollment status.

- Fill out the student information section, providing details such as the student's name and Social Security number.

- Complete the sections for the AOTC and LLC, ensuring that the appropriate expenses are listed and calculations are accurate.

- Double-check all entries for accuracy, as errors can lead to delays or issues with the IRS.

- Attach Form 8863 to your Form 1040 and submit your tax return by the filing deadline.

Eligibility Criteria

Eligibility for the education credits on Form 8863 depends on several factors. For the AOTC, the student must be enrolled at least half-time in a degree or certificate program for the first four years of higher education. The LLC is available for any level of post-secondary education, but the student must be enrolled in an eligible institution. Additionally, income limits apply, and taxpayers must meet specific adjusted gross income (AGI) thresholds to qualify for these credits. It is important to review IRS guidelines to ensure compliance with these criteria.

Required Documents

When completing Form 8863, taxpayers should gather the following documents:

- Form 1098-T, which reports qualified tuition and related expenses paid to the educational institution.

- Receipts for any additional educational expenses, such as books and supplies.

- Documentation proving the student's enrollment status, if not included in Form 1098-T.

- Taxpayer's Social Security number and the student's Social Security number.

IRS Guidelines

The IRS provides specific guidelines for completing Form 8863, including detailed instructions on eligibility, qualified expenses, and how to calculate the credits. Taxpayers should refer to IRS Publication 970, which outlines the rules for education credits and provides examples to help clarify the process. Staying informed about any updates or changes to these guidelines is crucial for ensuring accurate filing and maximizing potential tax benefits.

Quick guide on how to complete 2000 form 8863 education credits hope and lifetime learning credits

Effortlessly Prepare Form 8863 Education Credits Hope And Lifetime Learning Credits on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed agreements, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any interruptions. Manage Form 8863 Education Credits Hope And Lifetime Learning Credits on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Form 8863 Education Credits Hope And Lifetime Learning Credits Without Difficulty

- Find Form 8863 Education Credits Hope And Lifetime Learning Credits and then click Get Form to start.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which is instantaneous and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8863 Education Credits Hope And Lifetime Learning Credits and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why is Ikea requiring me to email them my credit card information in order to make a lousy appointment to see a kitchen planner? They’re requiring me to fill out forms, scan them, and email back.

The reason they are requiring your credit card information is because Ikea’s kitchen planning service isn’t free. In some cases, a portion of the planning and/or measuring fees may be reimbursed when you place your kitchen purchase, but the details may vary from store to store.

-

Are there any network marketers out there who would be absolutely excited about helping people become educated and more aware of their credit/credit scores including learning how to budget the money they are already making?

Do a Google search for "Financial Education." Groups like AARP do a lot of public service to educate people about personal finance. So do a lot of community colleges, as well as the banks, credit unions, and the credit bureaus. I do not understand what you mean by "network marketers" in this context. What is it that you are trying to do? Get a job?

-

I had a hard inquiry to a credit reporting agency that I did not generate in anyway shape or form. How do I contact the credit reporting agency and company where credit was requested to find out what was applied for and who applied?

You challenge the hard inquiry in writing with the agencies that are reporting it.Your credit report will show the name of the firms that placed the hard inquiry and the date of the inquiry. Most of the time that is sufficient to jog your memory but if it isn't, the credit reporting agencies will provide additional information about inquiry in response to your challenge.

-

How do I get out of this vicious cycle of loans and credit cards? I have $100000 outstanding with the banks. No job, no property & perhaps, no hope. I really don’t want to give up. We’re a family of 3 people & 12 pets. What are your suggestions?

Give your pets to a shelter.Get a job. Any job. Or two or three. You are in dire straights and need to give up your pride.Spend no more than 30% of your combined gross income on housing (rent or mortgage).Give up Starbucks or the beer at the pub (and at home too).Ditto for online shopping, the gym, your nails, etc.In other words, get on a strict budget, maybe one or no cars.None of you should have iPhones. Get flip phones for all.Get rid of Netflix, Amazon Prime, HBO, et al. Dump cable. (I did and I’m not in debt.)Make a spreadsheet of your bills and how much MORE than the minimum you need to pay to pay it down. And if you don’t have spreadsheet skills, ask in your circle for help.Cut up your credit cards and only use debit or prepaid cards.That’s top of mind, for starters.

-

How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.

“How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.”I have a certain sympathy for landlords. It isn’t an easy way to make a living. You have huge capital tied up in immobile investments. One destructive tenant can wipe out the profits from 20 good ones.If you want a landlord who will show the property without asking questions until and unless you show an interest, you can probably find that. We had that when we rented our first apartment after retiring and selling our house (Liberty Lake Apts in Boise ID - great place BTW, we recommend them). The nice office lady showed us around the complex, and let us inside an empty unit just like the one we eventually rented. (That empty unit was already promised to someone else; the one we eventually rented was still occupied). Then we went back to the office and filled out applications.But anyways, it all comes down to supply and demand in a free market. If you want a landlord who asks no questions, you can find one. Probably a “slumlord” who doesn’t maintain the property and has lots of anti-social, destructive tenants who would make dangerous neighbors. If there is a glut of housing in your market, you can find landlords who bend over backwards to court you. If there is a housing shortage, you have to play by the landlords’ rules.

-

How can I produce an outcome with new inputs by machine learning? I am currently working on finance data and trying to figure out whether a person can pay the debt or not with inputs such as income grade, credit grade, type of house, etc.

I guess you want to build a classification model.Credit Card Fraud DetectionGo there look up most voted kernels.

Create this form in 5 minutes!

How to create an eSignature for the 2000 form 8863 education credits hope and lifetime learning credits

How to generate an eSignature for your 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits online

How to make an eSignature for your 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits in Google Chrome

How to generate an eSignature for putting it on the 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits in Gmail

How to create an eSignature for the 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits from your smartphone

How to make an electronic signature for the 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits on iOS devices

How to make an eSignature for the 2000 Form 8863 Education Credits Hope And Lifetime Learning Credits on Android devices

People also ask

-

What are education credits on 1040 and how do they benefit me?

Education credits on 1040 refer to tax credits that reduce your tax liability for qualified education expenses. By claiming these credits, such as the American Opportunity Credit or Lifetime Learning Credit, you can potentially save signNow money on your tax return, helping offset tuition, fees, and other related costs.

-

How can I claim education credits on 1040 using airSlate SignNow?

To claim education credits on 1040 while using airSlate SignNow, you can easily eSign and submit any necessary documents related to your education expenses. Our platform allows seamless management and submission of tax-related documents, ensuring you don’t miss any tax benefits associated with education credits.

-

Are there any specific requirements for education credits on 1040?

Yes, to claim education credits on 1040, you must meet certain criteria, including enrollment in an eligible educational institution and having qualifying education expenses. Keep track of your documentation, as you'll need this information when preparing your tax return.

-

What features does airSlate SignNow offer for managing education credit documentation?

airSlate SignNow offers features such as secure eSigning, document tracking, and easy integration with various tax software that makes managing education credit documentation efficient. This ensures that you can submit your information accurately to maximize your education credits on 1040.

-

How does airSlate SignNow help in saving costs when claiming education credits on 1040?

Using airSlate SignNow can be a cost-effective solution, as it reduces the need for physical paperwork and simplifies the process of gathering and submitting essential documents. This streamlined approach can ultimately save you time and money that could be used to claim your education credits on 1040.

-

Can I use airSlate SignNow for multiple tax years when claiming education credits on 1040?

Yes, airSlate SignNow allows you to store and manage documents related to multiple tax years. This capability is beneficial for tracking your education expenses over time, ensuring you can take advantage of education credits on 1040 each year.

-

What integrations does airSlate SignNow support for handling education credits on 1040?

airSlate SignNow integrates with various tax preparation software, making it easy for users to manage their education credit claims more effectively. This integration facilitates seamless data transfer when claiming education credits on 1040, helping you ensure accuracy and timeliness.

Get more for Form 8863 Education Credits Hope And Lifetime Learning Credits

Find out other Form 8863 Education Credits Hope And Lifetime Learning Credits

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement