Member Information for the Overseas Scheme Manager

Understanding the Member Information for the Overseas Scheme Manager

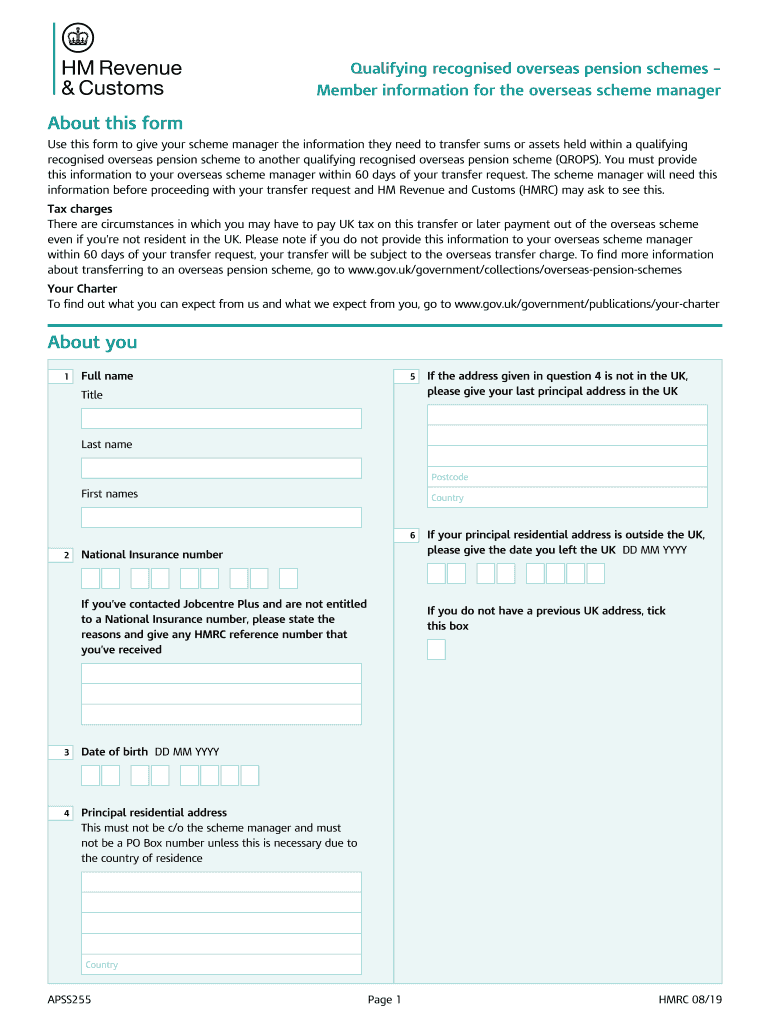

The Member Information for the Overseas Scheme Manager is a crucial document for individuals who are part of overseas pension schemes. This form collects essential details about the member, including personal identification, pension plan specifics, and residency status. It serves as a foundation for ensuring compliance with regulations set forth by HMRC regarding overseas pensions. Understanding the components of this form is vital for accurate submission and adherence to legal requirements.

Steps to Complete the Member Information for the Overseas Scheme Manager

Completing the Member Information for the Overseas Scheme Manager involves several key steps:

- Gather necessary personal information, including your name, address, and National Insurance number.

- Provide details about your overseas pension scheme, such as the scheme name and registration number.

- Indicate your residency status and any relevant tax information.

- Review all entries for accuracy to prevent delays or issues with processing.

- Submit the completed form through the designated channels, ensuring you keep a copy for your records.

Legal Use of the Member Information for the Overseas Scheme Manager

The legal use of the Member Information for the Overseas Scheme Manager is governed by regulations set by HMRC. This form must be completed accurately to ensure that pension benefits are recognized and that the member remains compliant with tax obligations. Failure to provide correct information may result in penalties or delays in accessing pension funds. It is essential to understand the legal implications of the information provided on this form.

Required Documents for Submission

When completing the Member Information for the Overseas Scheme Manager, certain documents may be required to support your application. These may include:

- Proof of identity, such as a passport or driver's license.

- Documentation of your overseas pension scheme, including any official letters or statements.

- Tax residency certificates, if applicable, to clarify your tax status.

Having these documents ready can streamline the submission process and ensure compliance with HMRC requirements.

Eligibility Criteria for the Member Information for the Overseas Scheme Manager

Eligibility to complete the Member Information for the Overseas Scheme Manager typically includes individuals who are members of overseas pension schemes recognized by HMRC. This may include:

- UK residents with overseas pension schemes.

- Individuals who have transferred their pensions abroad.

- Those seeking to claim tax relief on contributions made to overseas schemes.

Understanding these criteria is essential for ensuring that you meet the requirements for completing the form.

Form Submission Methods

The Member Information for the Overseas Scheme Manager can be submitted through various methods to accommodate different preferences:

- Online submission via the HMRC portal for quicker processing.

- Mailing a hard copy of the completed form to the designated HMRC address.

- In-person submission at specific HMRC offices, if applicable.

Choosing the right submission method can impact the speed and efficiency of your application processing.

Quick guide on how to complete member information for the overseas scheme manager

Effortlessly prepare Member Information For The Overseas Scheme Manager on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Member Information For The Overseas Scheme Manager on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related activity today.

The simplest way to modify and electronically sign Member Information For The Overseas Scheme Manager with ease

- Locate Member Information For The Overseas Scheme Manager and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Member Information For The Overseas Scheme Manager and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the member information for the overseas scheme manager

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is an HMRC recognised form?

An HMRC recognised form is a document that is approved by HMRC for use in various tax and financial processes. These forms are essential for ensuring compliance and accuracy in financial reporting and management.

-

How can airSlate SignNow help with HMRC recognised forms?

airSlate SignNow streamlines the process of sending and signing HMRC recognised forms digitally. With our easy-to-use platform, you can quickly prepare, send, and obtain signatures on these forms, ensuring timely compliance and reducing the paper workload.

-

What features does airSlate SignNow offer for handling HMRC recognised forms?

Our platform includes features like templating, in-app integrations, and real-time tracking of HMRC recognised forms. You can customize documents to fit your needs and access them from anywhere to ensure you're always compliant.

-

Is airSlate SignNow cost-effective for managing HMRC recognised forms?

Yes, airSlate SignNow provides a cost-effective solution for managing HMRC recognised forms. Our pricing plans are designed to accommodate businesses of all sizes, making it affordable to streamline document management processes.

-

Can I integrate airSlate SignNow with other software for HMRC recognised forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage HMRC recognised forms efficiently alongside your existing workflow systems like CRM and accounting platforms.

-

What are the benefits of using airSlate SignNow for HMRC recognised forms?

By using airSlate SignNow for HMRC recognised forms, you benefit from enhanced efficiency and reduced turnaround time. Our digital solution ensures your documents are secure, compliant, and accessible from anywhere, saving you both time and resources.

-

Is it safe to use airSlate SignNow for sensitive HMRC recognised forms?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication measures. This ensures that your sensitive HMRC recognised forms are protected, maintaining confidentiality and compliance with regulations.

Get more for Member Information For The Overseas Scheme Manager

- Mccracken county tax administrator form

- Ford l9000 parts diagram form

- Hamilton county sheriff release form hamilton county ohio hamilton co

- Fin 312 form

- Fillable schedule a form

- Privately owned weapons authorizationacknowledgement form

- Fh reg 19011 military affiliation pupose stora form

- Seattle schools servicelearning form and reflectio

Find out other Member Information For The Overseas Scheme Manager

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document