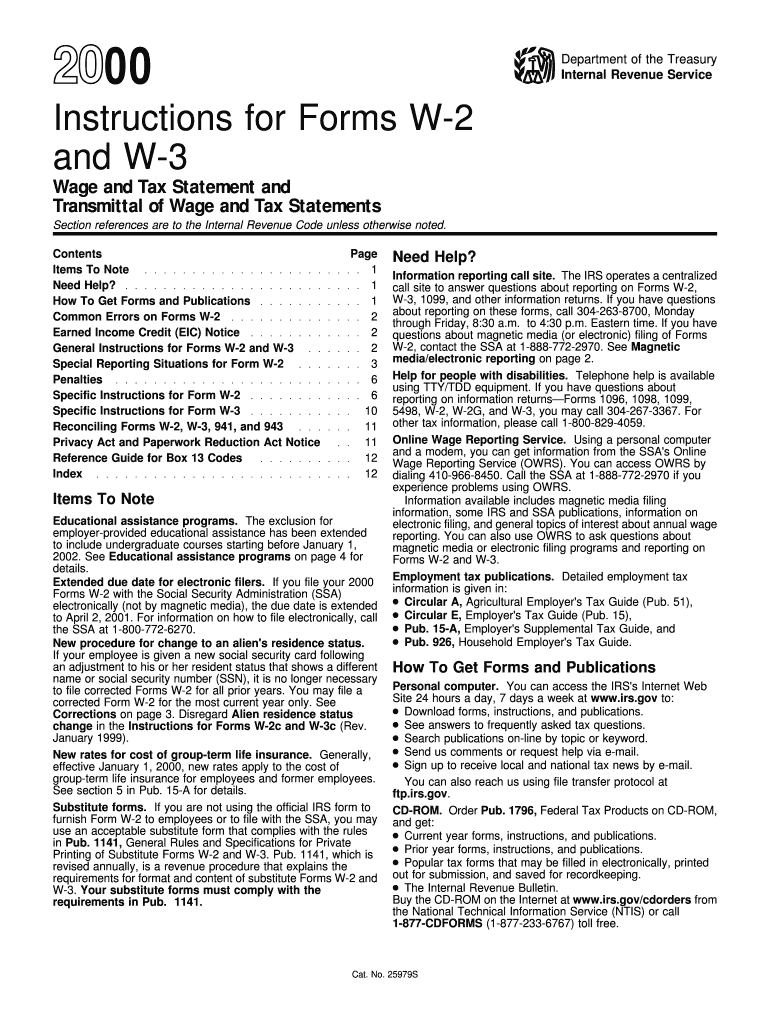

Instructions for W 2 and W 3 Instructions for W 2 and W 3, Wage and Tax Statement Form

Understanding Form 8863 Instructions

Form 8863 is used to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits help offset the costs of higher education for eligible students. It is essential to understand the specific requirements and instructions for completing this form to ensure accurate filing and maximization of potential credits.

Steps to Complete Form 8863

Completing Form 8863 involves several key steps to ensure that you accurately claim your education credits. Begin by gathering necessary information, including your adjusted gross income, the number of qualified students, and the amount of qualified education expenses. Follow these steps:

- Fill out Part I to determine the American Opportunity Credit.

- Complete Part II for the Lifetime Learning Credit.

- Calculate the total credits and ensure that they do not exceed the maximum allowable amounts.

- Transfer the total credits to your Form 1040 or 1040-SR.

Eligibility Criteria for Education Credits

To qualify for the education credits claimed on Form 8863, you must meet specific eligibility criteria. These include:

- You must be enrolled at least half-time in a degree or certificate program.

- The student must not have a felony drug conviction.

- Income limits apply, with phase-out thresholds based on your modified adjusted gross income (MAGI).

Required Documents for Filing

When filing Form 8863, it is crucial to have the necessary documentation to support your claims. Required documents include:

- Form 1098-T, which reports tuition payments made to your educational institution.

- Receipts for qualified education expenses, such as books and supplies.

- Your Social Security number and that of the student.

Filing Deadlines for Form 8863

Form 8863 must be filed alongside your federal tax return. The typical deadline for filing your tax return is April 15, unless you file for an extension. Be mindful of these important dates to ensure timely submission and avoid penalties.

Common Mistakes to Avoid

When completing Form 8863, it is essential to avoid common mistakes that could lead to delays or rejections. Some frequent errors include:

- Incorrectly calculating the education credits.

- Failing to provide required documentation.

- Not checking for eligibility before filing.

Legal Use of Form 8863

Form 8863 is legally binding when completed accurately and submitted according to IRS guidelines. Ensure compliance with all IRS regulations to avoid any issues with your tax return. Using a reliable eSignature platform can help ensure that your submission is secure and legally recognized.

Quick guide on how to complete 2000 instructions for w 2 and w 3 2000 instructions for w 2 and w 3 wage and tax statement

Complete Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement effortlessly on any device

Web-based document management has surged in popularity among companies and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement without hassle

- Locate Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement and facilitate excellent communication at any step of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a copy of my wage and tax statements (Form W-2)?

Ask your employer (or former employer). They were obligated to provide it to you by now. If they haven’t, perhaps they do not have your current address.If they know where to find you but are refusing to provide you your W-2, they are breaking the law. You should report them to the IRS as they may not be paying the taxes they have withheld from your wages which would be stealing from you (as well as the government). Report them immediately. You might even get a reward for turning them in.

-

Do I need to file a W-2 and W-3 Form?

Do I need to file IRS W-2 and W-3 forms?!As an employer you must prepare Form W-2 annually for your employees to show their total gross earnings, Social Security earning, Medicare earnings, federal, and state taxes withheld from wages. The purpose of this form is to provide employees with information that must be included on their income tax form. Form W-2 also gives the Social Security Administration (SSA) and the IRS information to verify your employee’s income tax return. Here is how to successfully file your IRS W-2 and W-3 Forms.How To Successfully File Your IRS W-2 with Form W-3When is Form W-2 Due?As of 2016, W-2 Forms must be filed with the Social Security Administration (SSA) by January 31st. This change was implemented to reduce tax fraud. You must provide W-2 Forms to your employees no later than January 31st, with information pertaining to the previous fiscal year.All paper file W-2 Forms must include a transmittal Form W-3. The January 31 deadline applies to paper and online submissions to the SSA. If you fail to file by the deadline, it will result in a penalty.What is Form W-3?Transmittal Form W-3 is a summary of the information found on all W-2 Forms filed. Form W-3 must be included when paper filing with the SSA. If you paper file and fail to include this form your submissions will not be accepted, and you will incur a penalty.W-3 Forms are not required if you choose to e-file your W-2 Forms with the SSA. You can directly e-file your W-2 Forms today using ExpressEfile. Upgrade from paper filing to e-filing for just $0.99 per form, that’s right, it’s less than a dollar! Before submission, your W-2 Forms will undergo our built-in error check to ensure error-free IRS form transmissions. Quickly and securely e-file your W-2 Forms in just a few clicks!E-File W-2 Forms Today!

-

How do I file IRS W-2 and W-3 forms?

Here’s how to file IRS W-2 and W-3 forms:As an employer you must prepare Form W-2 annually for your employees to show their total gross earnings, Social Security earning, Medicare earnings, federal, and state taxes withheld from wages. The purpose of this form is to provide employees with information that must be included on their income tax form. Form W-2 also gives the Social Security Administration (SSA) and the IRS information to verify your employee’s income tax return. Here is how to successfully file your IRS W-2 and W-3 Forms.How To Successfully File Your IRS W-2 with Form W-3When is Form W-2 Due?As of 2016, W-2 Forms must be filed with the Social Security Administration (SSA) by January 31st. This change was implemented to reduce tax fraud. You must provide W-2 Forms to your employees no later than January 31st, with information pertaining to the previous fiscal year.All paper file W-2 Forms must include a transmittal Form W-3. The January 31 deadline applies to paper and online submissions to the SSA. If you fail to file by the deadline, it will result in a penalty.What is Form W-3?Transmittal Form W-3 is a summary of the information found on all W-2 Forms filed. Form W-3 must be included when paper filing with the SSA. If you paper file and fail to include this form your submissions will not be accepted, and you will incur a penalty.W-3 Forms are not required if you choose to e-file your W-2 Forms with the SSA. You can directly e-file your W-2 Forms today using ExpressEfile. Upgrade from paper filing to e-filing for just $0.99 per form, that’s right, it’s less than a dollar! Before submission, your W-2 Forms will undergo our built-in error check to ensure error-free IRS form transmissions. Quickly and securely e-file your W-2 Forms in just a few clicks!E-File W-2 Forms Today!

-

Do the combinations [math]c\pmb{v}+c\pmb{w}[/math] fill out any of [math]\frac{1}{3}\pmb{v}+\frac{1}{3}\pmb{w}[/math] and [math]\frac{2}{3}\pmb{v}+\frac{2}{3}\pmb{w}[/math] where [math]\pmb{v},\pmb{w}[/math] are vectors on the [math]xy[/math] plane and [math]c[/math] is a real number?

I think your question must have a mistake in it. As it stands the answer is obviously yes because you can let c = 1/3 to get the first vector and c = 2/3 to get the second vector.

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

Create this form in 5 minutes!

How to create an eSignature for the 2000 instructions for w 2 and w 3 2000 instructions for w 2 and w 3 wage and tax statement

How to create an electronic signature for the 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement online

How to generate an eSignature for your 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement in Chrome

How to create an eSignature for signing the 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement in Gmail

How to generate an electronic signature for the 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement right from your smart phone

How to create an eSignature for the 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement on iOS devices

How to make an electronic signature for the 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement on Android devices

People also ask

-

What are the Instructions For W 2 And W 3, Wage And Tax Statement?

The Instructions For W 2 And W 3 provide detailed guidance on how to fill out the Wage and Tax Statement forms correctly. These instructions are essential for employers to report employee wages and taxes withheld to the IRS. Familiarizing yourself with these instructions helps ensure compliance and avoids potential penalties.

-

How can airSlate SignNow help with completing the Instructions For W 2 And W 3?

airSlate SignNow streamlines the process of completing the Instructions For W 2 And W 3, allowing users to fill out, sign, and send these forms electronically. Our platform eliminates paperwork hassles, making it easier for businesses to manage their tax documents efficiently. With eSign capabilities, you can ensure that all necessary signatures are obtained quickly.

-

Is there a cost associated with using airSlate SignNow for W 2 and W 3 instructions?

Yes, airSlate SignNow offers several pricing plans tailored to fit different business needs. Our cost-effective solution provides access to essential features for managing Instructions For W 2 And W 3, Wage And Tax Statement forms. Explore our plans to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers robust features such as customizable templates, eSignature capabilities, and document tracking. These tools simplify the process of handling Instructions For W 2 And W 3, Wage And Tax Statement forms, ensuring that your documents are completed accurately and efficiently. Additionally, you can store and retrieve documents easily.

-

Are there any integrations available with airSlate SignNow for tax-related software?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, enhancing your workflow for managing Instructions For W 2 And W 3. These integrations allow for a smoother data transfer and better coordination between systems, making tax filing more efficient. Check our integrations page for a full list of compatible applications.

-

How secure is airSlate SignNow when handling sensitive tax information?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols to protect your data while you manage Instructions For W 2 And W 3, Wage And Tax Statement forms. Our platform is compliant with industry standards, ensuring that your sensitive information remains confidential and secure.

-

Can I track the status of my W 2 and W 3 forms with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your W 2 and W 3 forms in real-time. Our document tracking feature allows you to see when forms are sent, viewed, and signed, ensuring that you stay informed throughout the entire process of completing the Instructions For W 2 And W 3.

Get more for Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement

- Inter generational faith formation registration form

- Unam online application form

- Ferpa release form stephen phillips memorial scholarship fund

- Planned absence request south burlington high school sbsd sbhs schoolfusion form

- Grammar hammer stage 5 form

- Ess 101 midterm form

- Senior yearbook ad templates form

- Bog waiver form

Find out other Instructions For W 2 And W 3 Instructions For W 2 And W 3, Wage And Tax Statement

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe