Form 656 B Rev 4 Form 656 Booklet Offer in Compromise

What is the Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

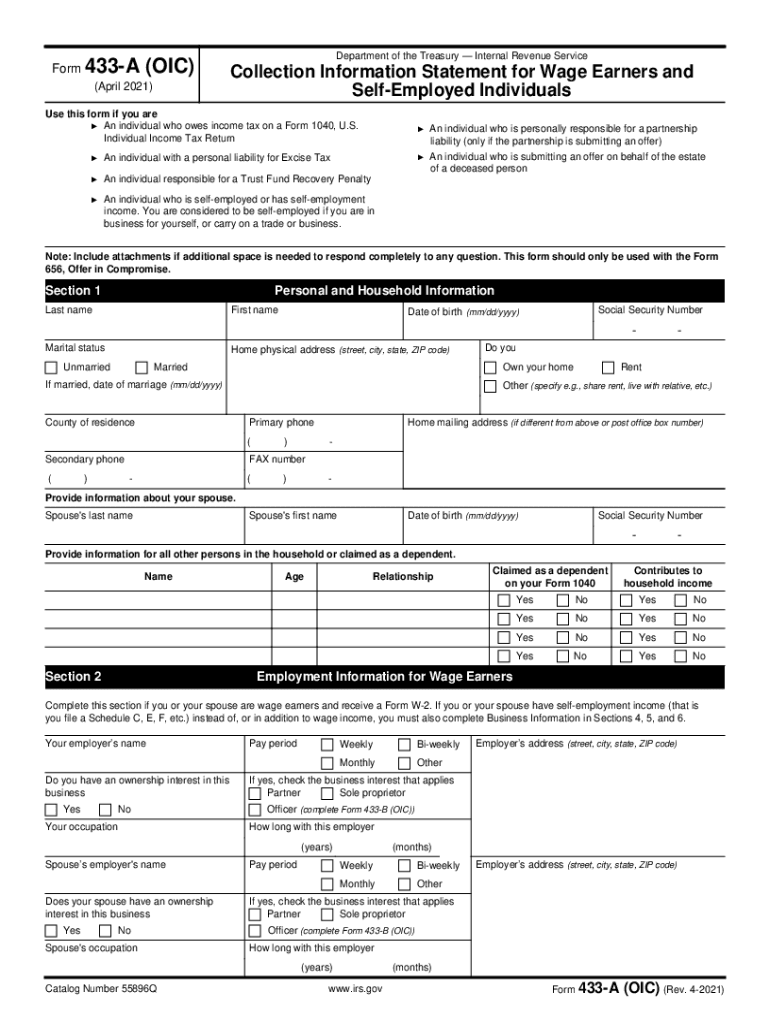

The Form 656 B, also known as the Offer in Compromise booklet, is a crucial document for taxpayers seeking to settle their tax liabilities with the IRS for less than the full amount owed. This form is particularly relevant for individuals who are unable to pay their tax debts in full and wish to negotiate a more manageable payment option. The 2021 Offer in Compromise program allows taxpayers to propose a settlement based on their financial situation, which may be accepted by the IRS if it meets certain criteria.

How to use the Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

Using the Form 656 B involves several steps to ensure that your offer is properly submitted and considered by the IRS. First, you need to gather all necessary financial information, including income, expenses, and assets. Next, complete the form accurately, providing detailed information about your financial situation. After filling out the form, review it carefully to ensure all information is correct. Finally, submit the form along with any required documentation and the appropriate fee to the IRS for evaluation.

Steps to complete the Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

Completing the Form 656 B requires careful attention to detail. Start by downloading the form from the IRS website. Fill out your personal information, including your name, address, and Social Security number. Next, provide a comprehensive overview of your financial situation, detailing your income, monthly expenses, and assets. Make sure to include any necessary supporting documents, such as pay stubs or bank statements. Once you have completed the form, double-check for accuracy and sign where indicated before submitting it to the IRS.

Legal use of the Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

The legal use of the Form 656 B is governed by IRS regulations that outline the criteria for submitting an Offer in Compromise. This form must be used in accordance with the guidelines provided by the IRS to ensure that the offer is valid and can be accepted. It is essential to comply with all legal requirements, including providing truthful and complete information, to avoid penalties or rejection of your offer.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form 656 B, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include demonstrating an inability to pay the full tax liability, showing that the offer is in the best interest of both the taxpayer and the IRS, and providing evidence of financial hardship. It is important to review these eligibility requirements carefully to determine if you qualify before submitting your application.

Required Documents

When submitting the Form 656 B, certain documents are required to support your offer. These typically include proof of income, such as pay stubs or tax returns, documentation of monthly expenses, and any relevant financial statements. Additionally, you may need to provide a completed Form 433-A or Form 433-B, which details your financial situation. Ensuring that all required documents are included will help facilitate the review process by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 656 B can be submitted to the IRS through various methods. Taxpayers have the option to file the form online through the IRS website, which can expedite the process. Alternatively, you can mail the completed form to the appropriate IRS address specified in the instructions. In-person submissions are generally not accepted, so it is crucial to choose one of the available methods for submission to ensure your offer is considered.

Quick guide on how to complete form 656 b rev 4 2021 form 656 booklet offer in compromise

Effortlessly Prepare Form 656 B Rev 4 Form 656 Booklet Offer In Compromise on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It offers a superior eco-friendly substitute to conventional printed and signed documents, allowing you to easily locate the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly, without any hold-ups. Manage Form 656 B Rev 4 Form 656 Booklet Offer In Compromise on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

Steps to Modify and Electronically Sign Form 656 B Rev 4 Form 656 Booklet Offer In Compromise with Ease

- Locate Form 656 B Rev 4 Form 656 Booklet Offer In Compromise and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow takes care of all your document management needs with just a few clicks from your selected device. Alter and electronically sign Form 656 B Rev 4 Form 656 Booklet Offer In Compromise to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 656 b rev 4 2021 form 656 booklet offer in compromise

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is 656 b in airSlate SignNow?

656 b refers to a specific feature in airSlate SignNow that enhances document workflows. This feature allows for seamless electronic signatures and document management, making it an essential tool for businesses focusing on efficiency and compliance.

-

How can I integrate 656 b with my existing tools?

airSlate SignNow's 656 b can easily integrate with popular applications like Salesforce, Google Drive, and Dropbox. This seamless integration helps streamline your document processes, enhancing productivity while maintaining secure eSignatures.

-

Is there a free trial for 656 b features in airSlate SignNow?

Yes, airSlate SignNow offers a free trial that includes access to the 656 b features. This allows you to explore its functionalities and assess how it meets your business requirements before committing to a subscription.

-

What are the pricing options for using 656 b?

airSlate SignNow offers competitive pricing plans for accessing 656 b features. Pricing varies based on the number of users and additional features required, ensuring that businesses of all sizes can find a suitable plan.

-

What are the key benefits of using 656 b for document signing?

The primary benefits of 656 b encompass increased efficiency and reduced turnaround times for document signing. This feature allows users to eSign documents from anywhere, which can signNowly accelerate business processes.

-

How secure is the 656 b feature in airSlate SignNow?

The 656 b feature in airSlate SignNow is designed with security in mind, employing encryption and secure data storage protocols. This ensures that all your documents and signatures remain protected and compliant with industry standards.

-

Can I use 656 b for international document signing?

Absolutely! The 656 b feature in airSlate SignNow supports international document signing, allowing you to send and receive signed documents from anywhere in the world. This capability is particularly useful for businesses with global operations.

Get more for Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

Find out other Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free