Form 8829 Expenses for Business Use of Your Home

What is the Form 8829 Expenses For Business Use Of Your Home

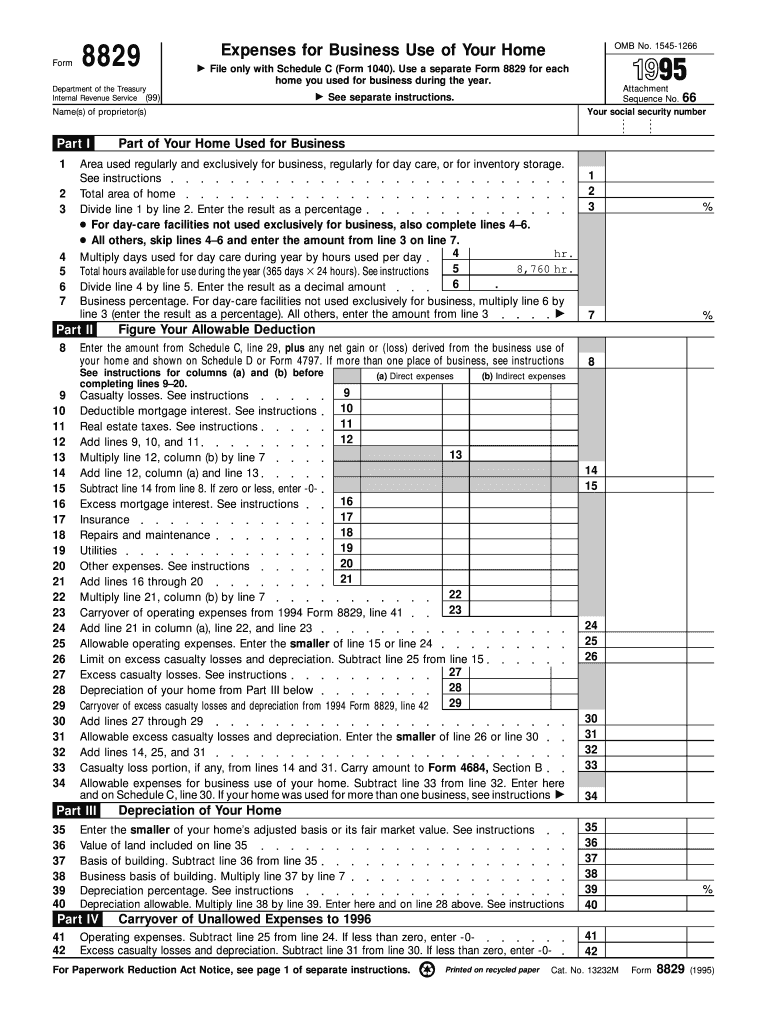

The Form 8829 is a tax document used by individuals who claim deductions for expenses related to the business use of their home. This form allows taxpayers to calculate and report the allowable expenses associated with maintaining a home office. The IRS requires this form to ensure that only eligible expenses are deducted, which can include utilities, mortgage interest, property taxes, and depreciation. Understanding the specifics of this form is crucial for maximizing potential tax benefits while remaining compliant with IRS regulations.

Steps to Complete the Form 8829 Expenses For Business Use Of Your Home

Completing the Form 8829 involves several key steps:

- Determine the percentage of your home used for business purposes. This is typically calculated by dividing the area used for business by the total area of your home.

- Gather documentation for all relevant expenses, including mortgage interest, utilities, repairs, and depreciation.

- Fill out the form by entering your calculated business percentage and the total expenses in the appropriate sections.

- Ensure that all calculations are accurate and that you have supporting documents for each expense claimed.

- Review the completed form for accuracy before submitting it with your tax return.

Legal Use of the Form 8829 Expenses For Business Use Of Your Home

The legal use of the Form 8829 is governed by IRS guidelines. To ensure compliance, taxpayers must accurately report their home office expenses and adhere to the requirements set forth by the IRS. This includes maintaining a dedicated space for business activities and keeping detailed records of all expenses claimed. Failure to comply with these legal requirements can result in penalties or disallowance of deductions.

Examples of Using the Form 8829 Expenses For Business Use Of Your Home

Consider a self-employed graphic designer who works from a dedicated room in their home. If the room constitutes ten percent of the total home area, they can claim ten percent of their home-related expenses, such as utilities and mortgage interest, on Form 8829. Another example could be a remote employee who uses a portion of their home for work-related activities, potentially qualifying for similar deductions if they meet the IRS criteria.

IRS Guidelines

The IRS provides specific guidelines for using Form 8829, detailing eligibility requirements and acceptable expenses. Taxpayers must ensure that their home office is used regularly and exclusively for business purposes. Additionally, the IRS outlines how to calculate the deduction based on actual expenses versus the simplified method, which allows for a standard deduction based on square footage. Familiarity with these guidelines helps taxpayers make informed decisions regarding their home office deductions.

Eligibility Criteria

To be eligible to use Form 8829, taxpayers must meet certain criteria set by the IRS. These include using part of their home exclusively for business, being self-employed or a qualified employee, and having a legitimate business activity. The space must be used regularly for business purposes, and taxpayers should maintain accurate records to substantiate their claims. Understanding these criteria is essential for anyone looking to benefit from the deductions associated with the business use of their home.

Quick guide on how to complete 1995 form 8829 expenses for business use of your home

Complete Form 8829 Expenses For Business Use Of Your Home effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 8829 Expenses For Business Use Of Your Home on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 8829 Expenses For Business Use Of Your Home without hassle

- Locate Form 8829 Expenses For Business Use Of Your Home and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivery for your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8829 Expenses For Business Use Of Your Home and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Does the United State's IRS allow you to claim business use of your home expenses on form 2106 if you don't itemize your expenses?

To claim business use of your home, you have to fill out form 8829, which separates direct and indirect expenses, and lists several different categories of expense. the details asked for on 8829 is all you will need unless you are audited, in which case you will have to back up the expenses claimed with the usual business records.I’m not entirely sure what you mean by ‘itemizing’ expenses. If you meant to ask whether you could claim business use of the home without itemizing deductions, the answer is definitely yes. They’re entirely different forms.

-

If you left a survey for burglars to fill out the next time they ransacked your home, how would they rate the experience?

How did you learn about us?Rumors about rural houses having little Security.Location: 5/10Location was alright. Around 500 meters to the nearest neighbor. But unfortunately an hour away from any sizable population (20,000 plus being a sizable population.)Transportation: 10/10Transportation was top notch. The owners of the property never lock their Minivan or Pick-up truck. The keys are always left in the vehicles. Both are moderately new and somewhat non-descriptive so a perfect getaway vehicle. Not only did they provide vehicles they also kept trailers in a easily accessible unlocked shed.Security: 9/10Security was lax. There is a gate but it isn’t locked. Doors aren’t locked unless the house is left unoccupied for more than 2 weeks. No cameras made it really easy. They did have a dog which made it a bit of a pain. He was easily disposed of as he was just a Labrador Retriever puppy. Owners are very light sleepers don’t rob if they’re around.Products: 10/10No place has better selection. The place had 3 DSLR cameras, 3 Workstation class desktops, 3 tablets, 4 drones, 6 Smartphones, 9 external monitors and 11 laptops. All of the items were of premium design and value (aka Apples or equivalent). The freezers and shelves were well stocked the rest of the property was much more appealing though.They also had a shop on the property with many tools ranging from mechanics to carpentry to fabrication. The tools were of medium quality. The shop also stored 2 ATV for added convenience. The shop wasn’t the jackpot though.The shed was the real treasure trove. This drive in shed held heavy equipment all with the keys in the ignition for easy accessibility. The average equipment’s value was around $100,000, with a combined value of around $1.5 Million. Unfortunately the heavy equipment is hard to transport and the market is too small to get away with it.The products all seemed gift wrapped for the taking. Everything was easy to find as it looked organized.Laws in the area: 10/10Owners aren’t allowed to use lethal force or even have a premeditated weapon for self defense. A robber in the area once accidentally locked himself into the garage place he was robbing. As the owners did not come home for a couple days he resorted to eating dog food. The end result was the owners were charged for negligence of the robber. Laws almost protect us. Owners are not supposed to attack us in any way or they may be charged.Would you recommend to your friends?If everybody is gone a resounding yes. Unfortunately that’s not very often as the house is occupied by Home-schooling kids, a Writer and the owner is a farmer who mostly works on property. Also if you intend to use brute force, bring a weapon. All the occupants are big. The average height is around 6 feet.BTW bring friends to help loot. It really requires a team of people to loot the place.

-

How likely are you to win a car from filling out a form at a mall? Who drives the new car home? What are your chances to win another car again?

I am going to get pretty literal here. Please forgive meHow likely are you to win a car from filling out a form at a mall? In the US, at least, this is usually spelled out somewhere on the form or on a website listed on the form. If it is not, you could ask (and may or may not get a truthful answer). If none of this works, you could probably be able to guess using a few factors: * How many people take the time to stop and enter (what percentage of passers-by, multiplied by amount of typical or expected foot-traffic)?* Are multiple entries allowed? * How long will entries be accepted before the drawing? As a rule of thumb, if the odds aren’t stated (and usually, even if they are) the odds are probably staggering. If you multiply the amount of time it takes to fill out the form by the amount of forms you would have to fill-out before you had an even 1% chance of winning the car, you would likely do better using that time to get a second job. Oh, and lastly, realize that the reason they are enticing you with the chance to win a car is that they are collecting your personal information on the form. It usually is quite a cheap way to generate a LOT of personal data, add you to mailing/dialing lists, etc. They folks running the drawing often gather another great bit of psychology about you: person who fills out form likes to enter “something for nothing” type contests (the drawing itself). This can be valuable to advertisers.Who drives the new car home? By definition of “home” the owner (presumably the winner) would drive the car “home”. If the car is driven to your house by an employee of the company running the lottery, they would just be driving the car to the winners residence…not their “home”.Frankly, I am not sure of what is meant by this question. I would assume that any winner of the drawing would either pick up the vehicle and drive it themselves away from the drawing or other site where the prize was moved to, possibly prepped for delivery tot he winner, or someone would deliver it to the winner’s home by driving it or trucking it there.What are your chances to win another car again? Your chances of winning the next drawing you entered would be EXACTLY the same as they would be had you lost the previous one, as specified in item number one. The odds of winning/losing do not change based on previous outcome. Think about it this way: If I just flipped a coin and it landed on “heads” 50 times in a row, what are the chances that it will be “heads” on the 51st attempt? EXACTLY (assuming there is nothing about the coin or flip that favors one side over the other) 1 in 2 or 50%, just as it was the first flip, just as it will be on the 51st millionth.Now the probability of winning 2 drawings, each with 1 million entries is staggeringly small. But they are two separate events, each governed independently by their own set of probabilities. Landing on heads 51 times in a row or winning 2 cars in consecutive drawings would be matters of remarkable coincidence: respectively 50 1 in 2 or 2 one in a million events happening to share the same outcome.Good luck

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

-

How can I sue someone for not filling out a change of address form and using my address as their business address (moved a year ago, CA)?

I do not think you have a lawsuit just because someone did not file a change of address with USPS. As per the previous answer, you would have to had suffered financial loss or injury due to the situation.As information, it is illegal to file a forwarding request on behalf of another person unless you have a power of attorney or are otherwise authorized to do so.To help stop receiving mail for previous residents write “Not at this address” on any first class mail and place it with outgoing mail. and write the names of those who should be receiving mail at your address on the mailbox (you may place it inside the flap where it is only visible to the carrier).Please note that any mail which has “or current resident”, or similar phrasing, will still be delivered to you even though it may also have the previous residents name. If you don’t want it, toss it into recycling.

-

How long does it take for Facebook to get back to you after you fill out your account form when you got locked out?

Up to 48 hrs.

Create this form in 5 minutes!

How to create an eSignature for the 1995 form 8829 expenses for business use of your home

How to create an eSignature for the 1995 Form 8829 Expenses For Business Use Of Your Home online

How to generate an electronic signature for your 1995 Form 8829 Expenses For Business Use Of Your Home in Chrome

How to generate an eSignature for signing the 1995 Form 8829 Expenses For Business Use Of Your Home in Gmail

How to create an electronic signature for the 1995 Form 8829 Expenses For Business Use Of Your Home straight from your mobile device

How to create an electronic signature for the 1995 Form 8829 Expenses For Business Use Of Your Home on iOS

How to generate an electronic signature for the 1995 Form 8829 Expenses For Business Use Of Your Home on Android

People also ask

-

What is Form 8829 Expenses For Business Use Of Your Home?

Form 8829 Expenses For Business Use Of Your Home is a tax form used by self-employed individuals to calculate the expenses related to using part of their home for business purposes. This form allows you to deduct certain expenses from your taxable income, potentially lowering your overall tax burden. Understanding how to fill out this form correctly is essential for maximizing your deductions.

-

How can airSlate SignNow help with Form 8829 Expenses For Business Use Of Your Home?

airSlate SignNow streamlines the process of managing documents related to Form 8829 Expenses For Business Use Of Your Home. With its easy-to-use interface, you can quickly prepare, send, and eSign your forms, ensuring compliance and accuracy. This helps you save time and reduces the stress associated with tax preparation.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers an array of features tailored for managing tax documents, including secure eSignature capabilities, document templates, and automated workflows. These features ensure that your Form 8829 Expenses For Business Use Of Your Home is completed accurately and efficiently. Additionally, you can track document status and receive notifications when forms are signed.

-

Is airSlate SignNow a cost-effective solution for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, offering flexible pricing plans that cater to various needs. By utilizing airSlate SignNow for your Form 8829 Expenses For Business Use Of Your Home and other documents, you can reduce administrative costs and streamline your tax preparation process. This ultimately contributes to better financial management.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow supports integration with popular accounting and tax preparation software, making it easier to manage your Form 8829 Expenses For Business Use Of Your Home alongside your financial records. These integrations help you maintain accurate documentation and ensure that all your data is synchronized seamlessly.

-

What are the benefits of using airSlate SignNow for signing tax forms?

Using airSlate SignNow for signing tax forms, including Form 8829 Expenses For Business Use Of Your Home, enhances convenience and security. The platform provides a legally binding eSignature solution that is compliant with regulations, ensuring your documents are accepted by the IRS. Additionally, you can access your signed forms anytime, anywhere, streamlining your tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security and employs advanced encryption to protect your sensitive tax documents, including Form 8829 Expenses For Business Use Of Your Home. With robust security features such as two-factor authentication and secure cloud storage, you can trust that your information remains confidential and safe from unauthorized access.

Get more for Form 8829 Expenses For Business Use Of Your Home

- Math 106 8 exam 2 math wsu form

- Radiology form

- Occupational therapy assistant observation form tridenttech

- Grammar hammer stage 6 skill check 1 answers form

- Transcript request form mt hood community college mhcc

- Group project rubric form

- Original document is required form

- Reading homework log granbury isd form

Find out other Form 8829 Expenses For Business Use Of Your Home

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF