0619e Form

What is the 0619e Form

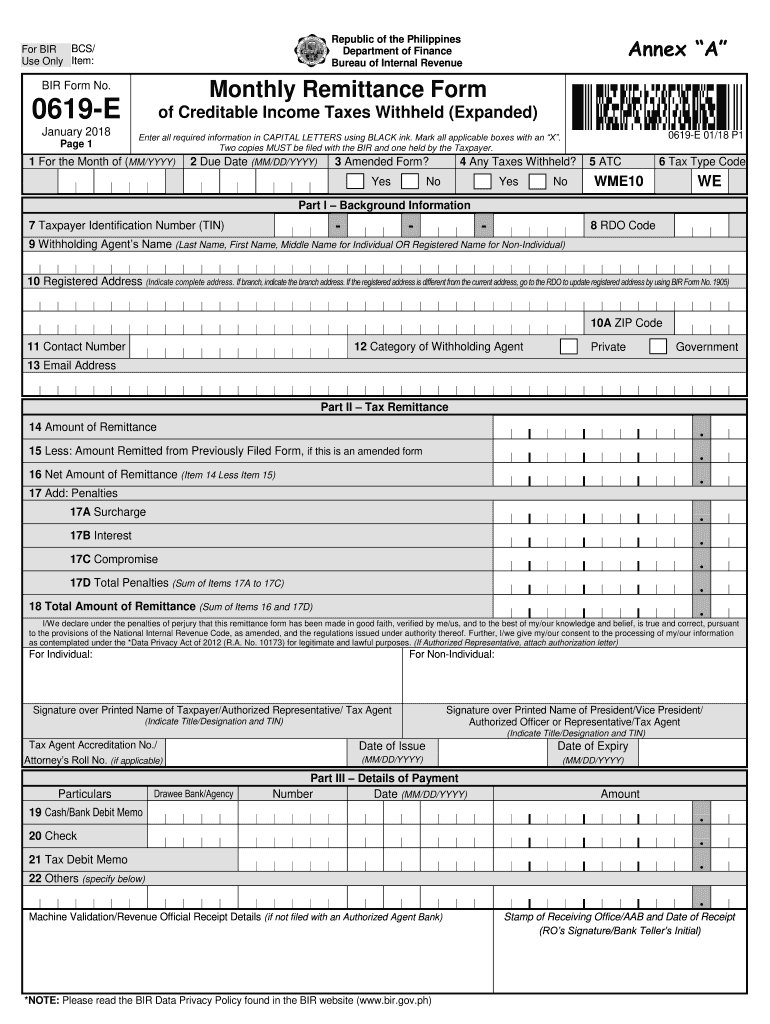

The 0619e Form, commonly referred to as the BIR Form 0619e, is a document used by taxpayers in the Philippines to report creditable income taxes withheld on certain income payments. This form is especially relevant for businesses and individuals who need to declare taxes withheld by their clients or customers. It is essential for ensuring compliance with tax regulations set forth by the Philippines Bureau of Internal Revenue (BIR).

How to use the 0619e Form

Using the 0619e Form involves several steps that ensure accurate reporting of withheld taxes. Taxpayers must first gather all necessary financial information related to income payments received. Once the data is compiled, the form can be filled out electronically or printed for manual completion. After filling out the form, it must be submitted to the BIR along with any required attachments, ensuring that all figures are accurate to avoid penalties.

Steps to complete the 0619e Form

Completing the 0619e Form requires careful attention to detail. Begin by entering your taxpayer identification number (TIN) and the relevant tax period. Next, report the total amount of income payments received and the corresponding taxes withheld. Ensure that all calculations are accurate, as discrepancies can lead to compliance issues. After completing the form, review it thoroughly before submission to ensure all information is correct.

Legal use of the 0619e Form

The 0619e Form is legally binding when filled out correctly and submitted to the BIR. It is crucial for taxpayers to understand that the information provided on this form must be truthful and accurate, as false declarations can result in penalties or legal repercussions. Compliance with the requirements set forth by the BIR is essential for maintaining good standing and avoiding issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 0619e Form are critical for compliance. Taxpayers must submit the form on or before the due date specified by the BIR for the corresponding tax period. Missing a deadline can lead to penalties or interest charges. It is advisable to keep track of these dates and plan submissions in advance to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 0619e Form can be submitted through various methods, providing flexibility for taxpayers. Options include electronic submission via the BIR's online portal, mailing a printed copy to the appropriate BIR office, or delivering it in person. Each method has its own requirements and processing times, so it is important to choose one that best fits your needs and ensures timely submission.

Quick guide on how to complete 0619e form

Prepare 0619e Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 0619e Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and electronically sign 0619e Form with ease

- Locate 0619e Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 0619e Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 0619e form

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the bir 0619 e form download, and how can it benefit my business?

The bir 0619 e form download is a digital version of a tax form used for filing income taxes in the Philippines. By utilizing this form, businesses can streamline their tax submission process, reduce errors, and ensure compliance with regulations. With airSlate SignNow, you can easily eSign and manage this form, making it a valuable tool for any business.

-

Is there a cost associated with the bir 0619 e form download through airSlate SignNow?

Yes, while the bir 0619 e form download itself is free, using airSlate SignNow requires a subscription plan. However, the pricing is competitive and offers great value for businesses looking to enhance their document management capabilities. With a subscription, you gain access to additional features that can boost productivity.

-

Can I use airSlate SignNow to fill out the bir 0619 e form before downloading?

Absolutely! airSlate SignNow allows you to fill out the bir 0619 e form directly within the platform before you download it. This feature ensures that your information is correctly inputted, resulting in a smoother filing process and minimizing mistakes.

-

Are there any integrations available that support the bir 0619 e form download?

Yes, airSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and more. These integrations make it easier to manage your documents and access the bir 0619 e form download from your preferred platforms, enhancing your workflow.

-

How secure is the bir 0619 e form download process with airSlate SignNow?

Security is a top priority for airSlate SignNow. All documents, including the bir 0619 e form download, are protected with industry-standard encryption. We ensure that your sensitive data is secure throughout the entire process, from signing to downloading.

-

Can I track the status of my bir 0619 e form download?

Yes, airSlate SignNow provides comprehensive tracking features. You can monitor the status of your bir 0619 e form download and receive notifications when it has been completed or if any actions are required. This feature keeps you updated throughout the signing process.

-

What features does airSlate SignNow provide for managing the bir 0619 e form download?

airSlate SignNow offers a range of features for managing the bir 0619 e form download, including easy eSigning, document sharing, and template creation. These tools help streamline your documentation process and ensure that you can handle various forms efficiently.

Get more for 0619e Form

- Ohio physician assistant supervision agreement form

- Sweetheart of the song tra bong pdf form

- Sample letter of incapacity from doctor form

- Sheikh mohammed and the making of dubai inc form

- Blank daily chore chart template form

- Nyc 245 751954366 form

- State controller malia m cohen is available for interviews on form

- Ca form 568 limited liability company return of income

Find out other 0619e Form

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast