Ca 590 Form

What is the CA 590 Form

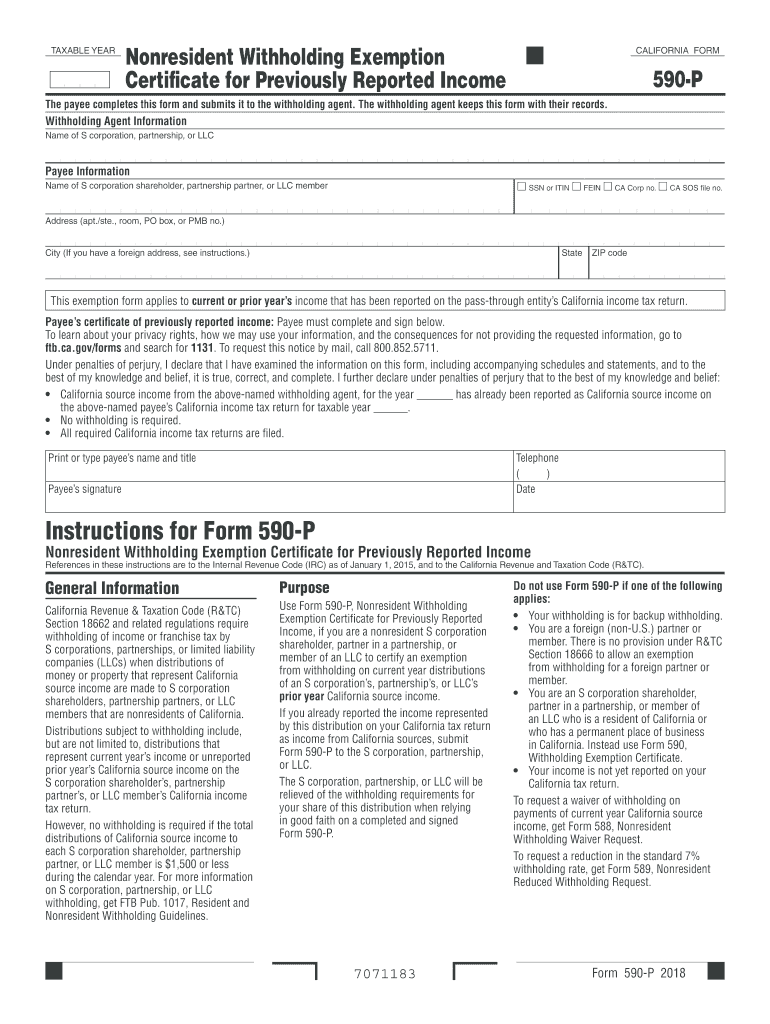

The CA 590 Form, also known as the 2019 Form 590, is a California tax form used primarily for reporting the withholding of California state income tax for certain payments made to non-residents. This form is essential for ensuring compliance with California tax laws, particularly for businesses and individuals making payments to non-resident contractors or service providers. The form helps to document the amount withheld and ensures that the correct tax is remitted to the state.

How to use the CA 590 Form

Using the CA 590 Form involves several important steps. First, determine if you need to withhold taxes on payments made to non-residents. If applicable, complete the form by providing the necessary information, including the payee's details and the amount withheld. After filling out the form, submit it to the California Franchise Tax Board along with any required payments. It is crucial to keep a copy for your records, as this can be useful for future reference or in case of audits.

Steps to complete the CA 590 Form

Completing the CA 590 Form requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including the payee's name, address, and taxpayer identification number.

- Indicate the type of payment being made and the corresponding amount.

- Calculate the amount of tax to be withheld based on the applicable withholding rates.

- Fill in the form with the gathered information, ensuring all fields are completed accurately.

- Review the form for any errors before submission.

Legal use of the CA 590 Form

The CA 590 Form is legally binding when completed and submitted in accordance with California tax regulations. It serves as proof of the withholding tax obligations for payments made to non-residents. To ensure its legal validity, it is important to follow all instructions and guidelines provided by the California Franchise Tax Board. Non-compliance with the requirements can lead to penalties and interest on unpaid taxes.

Key elements of the CA 590 Form

Several key elements are essential for the proper completion of the CA 590 Form. These include:

- Payee Information: Full name, address, and taxpayer identification number of the non-resident receiving payment.

- Payment Details: Type of payment and the total amount being paid.

- Withholding Amount: The calculated amount of tax withheld based on the payment type and applicable rates.

- Signature: The form must be signed by the payer to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the CA 590 Form are crucial to avoid penalties. Typically, the form must be submitted by the end of the month following the payment date. For example, if a payment is made in January, the form should be filed by the end of February. It is advisable to check for any updates or changes to deadlines each tax year, as these can vary based on state regulations.

Quick guide on how to complete ca 590 form 2021

Effortlessly Prepare Ca 590 Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ca 590 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Modify and Electronically Sign Ca 590 Form with Ease

- Find Ca 590 Form and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ca 590 Form and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca 590 form 2021

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is ca590 and how does it relate to airSlate SignNow?

The term 'ca590' refers to the special features and integrations available within airSlate SignNow that enhance document signing and management. This solution is designed to streamline workflows, ensuring that businesses can efficiently send and eSign documents without hassle. By utilizing ca590, users can optimize their document processes, saving time and resources.

-

What are the pricing options for airSlate SignNow's ca590 features?

AirSlate SignNow offers competitive pricing tiers that include access to the ca590 features, making it affordable for businesses of all sizes. Depending on the plan, users can benefit from various functionalities related to document sending and eSigning, ensuring they only pay for what they need. Detailed pricing information can be found on the airSlate SignNow website.

-

What key features are included in airSlate SignNow's ca590 package?

The ca590 package includes essential features such as secure electronic signatures, customizable templates, and real-time document tracking. These tools are designed to improve efficiency and ensure compliance in document management. Additionally, ca590 supports integrations with popular applications, enhancing overall productivity.

-

How can ca590 benefit my business?

By using the ca590 features of airSlate SignNow, your business can signNowly streamline the document signing process, enhancing overall efficiency. With an easy-to-use interface and support for multiple file formats, you’ll reduce turnaround times for approvals and signatures. Ultimately, ca590 helps improve customer satisfaction and operational workflows.

-

Is there a free trial available for the ca590 features?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore the functionalities of the ca590 features without any commitment. This trial provides a hands-on experience with the platform's intuitive tools, enabling businesses to assess their specific document management needs. Start with the trial today to see if ca590 fits your requirements.

-

Can I integrate ca590 with other applications?

Absolutely! The ca590 features within airSlate SignNow support integrations with a variety of applications, including CRM systems and cloud storage services. This capability ensures seamless data flow and enhances your existing workflows. Check the official documentation for a complete list of compatible integrations.

-

What kind of support is available for users of ca590?

Users of ca590 within airSlate SignNow have access to comprehensive support options, including a knowledge base, tutorials, and customer service assistance. Whether you have questions or need help with onboarding, the dedicated support team is ready to assist you. Ensure you leverage these resources for the best experience with ca590.

Get more for Ca 590 Form

- Moneygram receipt generator form

- Zipcar incident report form

- Bucks county intermediate unit form

- British council admission form

- Dd form 1131

- Svat 03 tqb form 2b total output declaration from to

- Junior deputy certificate pub st louis county stlouiscountymn form

- Dr 1002 colorado salesuse tax rates if you are using a screen reader or other assistive technology please note that colorado form

Find out other Ca 590 Form

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later