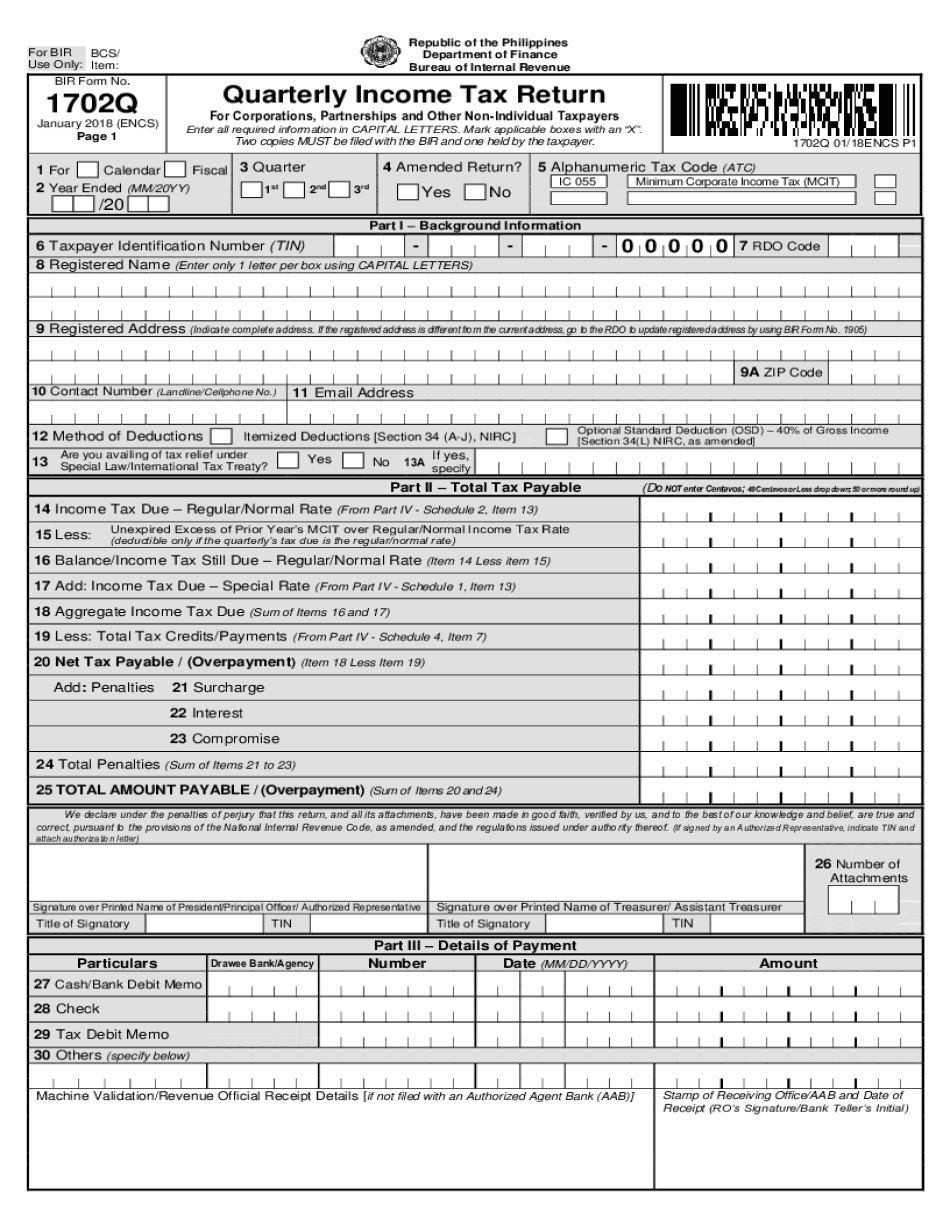

Quarterly Income Tax Return Form

What is the Quarterly Income Tax Return

The Quarterly Income Tax Return is a tax form used by businesses and self-employed individuals in the United States to report income and calculate taxes owed on a quarterly basis. This form is essential for ensuring compliance with federal tax regulations, as it allows taxpayers to remit estimated tax payments throughout the year rather than in a lump sum at tax time. The use of this form helps to avoid underpayment penalties and ensures that taxpayers remain current with their tax obligations.

Steps to complete the Quarterly Income Tax Return

Completing the Quarterly Income Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, calculate your total income for the quarter, taking into account any deductions or credits applicable to your situation. After determining your taxable income, use the appropriate tax rates to calculate the amount owed. Finally, fill out the form accurately, ensuring all sections are completed, and submit it by the designated deadline.

Legal use of the Quarterly Income Tax Return

The legal use of the Quarterly Income Tax Return is governed by federal tax laws, which require taxpayers to report their income and pay taxes on that income in a timely manner. This form must be filled out correctly to avoid legal repercussions, such as fines or audits. Utilizing a reliable eSignature platform, like signNow, can help ensure that the form is signed and submitted securely, maintaining compliance with legal standards for electronic documents.

Required Documents

To complete the Quarterly Income Tax Return, several documents are necessary. These typically include:

- Income statements showing earnings for the quarter

- Expense records to identify deductible costs

- Previous tax returns for reference

- Any relevant tax credits or deductions documentation

Having these documents readily available can streamline the process and help ensure that the information reported is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Quarterly Income Tax Return are crucial for compliance. Typically, these returns are due four times a year, with deadlines falling on the fifteenth day of the month following the end of each quarter. For example, the deadlines for the first quarter (January to March) would be April 15, the second quarter (April to June) would be July 15, and so on. It is important to mark these dates on your calendar to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Quarterly Income Tax Return can be submitted through various methods, depending on the taxpayer's preference. Common submission methods include:

- Online submission through the IRS e-file system or authorized e-file providers

- Mailing a physical copy of the completed form to the appropriate IRS address

- In-person submission at designated IRS offices, although this method is less common

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely delivery.

Quick guide on how to complete quarterly income tax return

Prepare Quarterly Income Tax Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Quarterly Income Tax Return on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to adjust and electronically sign Quarterly Income Tax Return with ease

- Find Quarterly Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign function, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Quarterly Income Tax Return and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarterly income tax return

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a BIR Form 2307 fillable template?

A BIR Form 2307 fillable template is a digital version of the tax form that allows users to easily input and edit information. Using airSlate SignNow, you can quickly create, fill out, and send this form, ensuring accuracy and compliance with tax regulations.

-

How can airSlate SignNow streamline the filling of BIR Form 2307?

airSlate SignNow simplifies the process of filling out BIR Form 2307 by providing an intuitive interface for entering information. With features like auto-saving and templating, you can efficiently complete your forms without the hassle of printed paperwork.

-

Is airSlate SignNow suitable for small businesses needing BIR Form 2307 fillable?

Yes, airSlate SignNow is an ideal solution for small businesses looking for a cost-effective and efficient way to manage BIR Form 2307 fillable. The platform offers competitive pricing plans that cater to the needs of various business sizes.

-

Can I save and retrieve my BIR Form 2307 fillable documents with airSlate SignNow?

Absolutely! With airSlate SignNow, all your BIR Form 2307 fillable documents are securely stored in the cloud. This convenient feature allows for easy retrieval and editing whenever you need to update your forms.

-

What integrations does airSlate SignNow offer for BIR Form 2307 fillable?

airSlate SignNow integrates with various popular applications such as Google Drive, Salesforce, and Dropbox, enhancing workflow efficiency. This means you can easily access your BIR Form 2307 fillable documents from your preferred tools.

-

How does airSlate SignNow ensure the security of my BIR Form 2307 fillable documents?

Security is a top priority at airSlate SignNow, which employs advanced encryption protocols to protect your BIR Form 2307 fillable documents. Additionally, the platform complies with various regulatory standards, ensuring your sensitive information remains secure.

-

Can I eSign the BIR Form 2307 fillable using airSlate SignNow?

Yes, airSlate SignNow enables users to eSign their BIR Form 2307 fillable documents seamlessly. The platform's eSignature capability ensures your form is legally binding while saving time on physical signatures.

Get more for Quarterly Income Tax Return

- Exhibit cover sheet template 33051837 form

- Kampeer checklist form

- Review of systems vs physical exam form

- Declaration of domicile brevard county form

- Sars patient contact log tool for logging health care staff caring for sars patients health ny form

- Cpap competency test scenarios form

- Tpcastt 74781802 form

- Paes lab pdf form

Find out other Quarterly Income Tax Return

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form