Single Member Llc Operating Agreement Georgia Form

What is the Single Member LLC Operating Agreement in Georgia

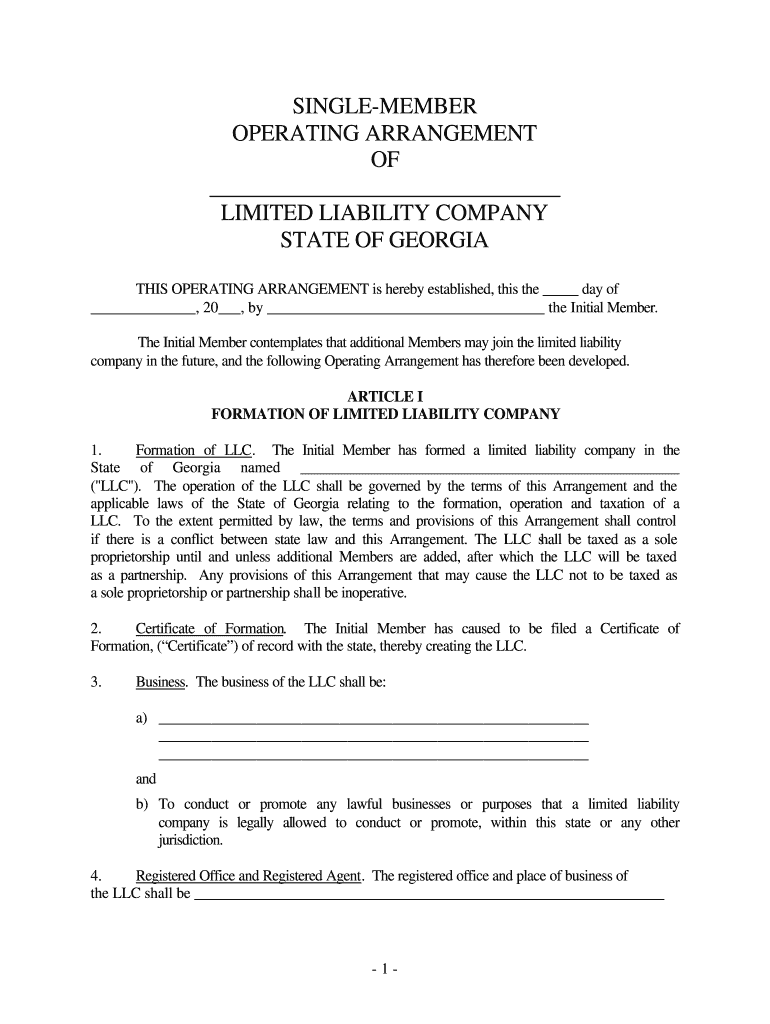

The Single Member LLC Operating Agreement in Georgia is a crucial legal document that outlines the management structure and operational procedures of a single-member limited liability company (LLC). This agreement serves to clarify the rights and responsibilities of the sole member, ensuring that the business operates smoothly and in accordance with state laws. While Georgia does not legally require an operating agreement for LLCs, having one can help protect the member's personal assets and provide a clear framework for business operations.

Key Elements of the Single Member LLC Operating Agreement in Georgia

When drafting a Single Member LLC Operating Agreement in Georgia, it is important to include several key elements to ensure its effectiveness and legal validity. These elements typically include:

- Company Name: The official name of the LLC as registered with the state.

- Business Purpose: A description of the business activities the LLC will engage in.

- Member Information: The name and address of the single member.

- Management Structure: Details on how the LLC will be managed, including decision-making processes.

- Financial Provisions: Guidelines for profit distribution, capital contributions, and financial management.

- Indemnification Clause: Provisions to protect the member from personal liability for business debts.

Steps to Complete the Single Member LLC Operating Agreement in Georgia

Completing a Single Member LLC Operating Agreement in Georgia involves several straightforward steps:

- Gather Information: Collect all necessary details about your LLC, including its name, purpose, and member information.

- Draft the Agreement: Use a template or create a document that includes all key elements specific to your LLC.

- Review for Compliance: Ensure that the agreement complies with Georgia state laws and reflects your business intentions.

- Sign the Agreement: The sole member should sign the document to formalize the agreement.

- Store the Document: Keep the signed agreement in a safe place, as it may be required for legal or financial purposes.

Legal Use of the Single Member LLC Operating Agreement in Georgia

The Single Member LLC Operating Agreement serves several legal purposes in Georgia. It acts as a binding contract that outlines the member's rights and responsibilities, which can be referenced in legal disputes or when dealing with financial institutions. Additionally, having a well-drafted operating agreement can help reinforce the LLC's status as a separate legal entity, thereby protecting the member's personal assets from business liabilities.

How to Obtain the Single Member LLC Operating Agreement in Georgia

Obtaining a Single Member LLC Operating Agreement in Georgia can be done through various methods:

- Online Templates: Many legal websites offer customizable templates for single member LLC operating agreements.

- Legal Professionals: Consulting with an attorney can ensure that the agreement meets all legal requirements and is tailored to your specific needs.

- Business Resources: Local business development centers or state resources may provide sample agreements and guidance.

State-Specific Rules for the Single Member LLC Operating Agreement in Georgia

In Georgia, while there are no specific state laws mandating the creation of an operating agreement for single-member LLCs, it is advisable to have one in place. The agreement should comply with the Georgia Limited Liability Company Act and reflect the unique aspects of the business. Additionally, the agreement should not contradict any provisions outlined in the state’s LLC formation documents.

Quick guide on how to complete georgia single member limited liability company llc operating agreement

Complete Single Member Llc Operating Agreement Georgia effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Single Member Llc Operating Agreement Georgia on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Single Member Llc Operating Agreement Georgia with ease

- Locate Single Member Llc Operating Agreement Georgia and click Get Form to begin.

- Utilize the tools we supply to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Single Member Llc Operating Agreement Georgia and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How is a Delaware limited liability company (LLC) without members and without an operating agreement dissolved?

A2ASection 18–801 of the Delaware Code states, among other provisions, that a limited liability company without members may be dissolved.The state-provided Certificate of Cancellation is to be signed by an “authorized person” before it is filed. Under the circumstances described in this question, the logical authorized person would be the authorized person who formed the LLC.

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Up to how many members can a limited liability company (LLC) have in California?

There is no limit on the number of members that a limited liability company (LLC) may have as far as California law is concerned.However, the LLC’s Articles of Organization or Operating Agreement may, but is not required to, place a limit on the number of members the LLC may have.

-

How do I fill up EIN form as a non us citizen for single member LLC? That is confusing to me?

I have helped dozens of international (non-U.S.) citizens obtain EINs for their entities and have blogged extensively about my experiences.It is understandable that you are confused. Although the instructions for Form SS-4 are relatively complete, some requirements may not be readily understood by non-Americans. Even more important, the IRS has certain policies, practices and expectations concerning foreigners that they don’t even publicize!I can’t take the time to tell you what to put in each of the dozens of lines on the Form. Instead, you should read Foreign Company Alert: Obtaining an EIN may be your Biggest Challenge in the U.S. It is long and detailed and reflects much of what I have learned about the process.I wish you the best!

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How is a single-member LLC owned by a nonresident alien taxed? Should I fill out a W-8 or am I deemed not to have U.S. activities?

Based on the facts as you have presented them:You are selling a product, as I see it, and not a service - although there's something of a gray area here, this is more like an intangible asset than it is providing a personal service for compensation. That product is being offered to US-based customers who are using it in the US - your focus is building up your market in the US, and you are doing that under the auspices of an LLC which is US-based. Looking at all of the facts and circumstances surrounding the conduct of your business, as you have presented them and as the IRS will look at them if asked, I conclude that you are conducting a business in the US and your income from US sources is effectively connected with the conduct of that business in the US, which means that you are subject to US taxes on that income.With that conclusion, Form W-8ECI is the proper form to provide to your US sources if you wish to prevent withholding on the income from your business.I want to add one point, since this seems to be coming up frequently - while an LLC is a disregarded entity for tax purposes, it is still a legal entity in the US - and the fact that you, as a nonresident alien, choose to operate a business under the auspices of a US-based LLC is a piece of evidence that can, under the appropriate set of facts and circumstances, be used by the IRS to support an argument that you are conducting business in the US and that your income from that business that comes from US sources should be taxable in the U.S. You should not assume that as a nonresident alien you have carte blanche to create a US LLC, operate a business under its auspices, and then at tax time argue that the income should not be taxable in the US because the LLC is a disregarded entity. The IRS will look at all of the facts and circumstances surrounding your business, including your choice of a US-based entity as the face of your business, and while that decision alone won't be dispositive, it will certainly be considered.

-

How is a single member LLC have limited liability while still using their social security number, rather than obtaining a federal ID number? Is it necessary to even apply for a federal ID number?

My understanding of the limited liability aspect of a single member LLC is built into, and is indeed probably the main purpose of, the LLC incorporation. This effectively separates and shelters an individual’s personal holdings (such as their house, savings, etc.) from the assets owned by the LLC in the event that the business is sued.The use of the individual’s SSN vs. the federal EIN for a single member LLC is more concerned with how taxes are reported and paid. The EIN is required, for example, if the LLC has employees or has certain tax obligations (excise taxes come to mind).A more extensive and official reply can be found here: Single Member Limited Liability Companies

Create this form in 5 minutes!

How to create an eSignature for the georgia single member limited liability company llc operating agreement

How to make an eSignature for your Georgia Single Member Limited Liability Company Llc Operating Agreement online

How to create an eSignature for the Georgia Single Member Limited Liability Company Llc Operating Agreement in Chrome

How to make an eSignature for putting it on the Georgia Single Member Limited Liability Company Llc Operating Agreement in Gmail

How to create an eSignature for the Georgia Single Member Limited Liability Company Llc Operating Agreement from your mobile device

How to create an electronic signature for the Georgia Single Member Limited Liability Company Llc Operating Agreement on iOS

How to generate an electronic signature for the Georgia Single Member Limited Liability Company Llc Operating Agreement on Android

People also ask

-

What is a Single Member LLC Operating Agreement in Georgia?

A Single Member LLC Operating Agreement in Georgia is a legal document that outlines the management structure and operational guidelines of a single-member limited liability company. This agreement is crucial for defining the business's framework, protecting the owner's personal assets, and ensuring compliance with state laws.

-

Why do I need a Single Member LLC Operating Agreement in Georgia?

Having a Single Member LLC Operating Agreement in Georgia is essential as it provides clarity on how your business operates. It helps to establish credibility with banks and investors and protects your personal assets by separating them from your business liabilities.

-

How can airSlate SignNow help me create a Single Member LLC Operating Agreement in Georgia?

airSlate SignNow offers an easy-to-use platform that allows you to create, customize, and eSign your Single Member LLC Operating Agreement in Georgia efficiently. With our templates and user-friendly interface, you can ensure that your agreement meets all legal requirements specific to Georgia.

-

Is there a cost associated with using airSlate SignNow for my Single Member LLC Operating Agreement in Georgia?

Yes, airSlate SignNow provides a cost-effective solution for creating your Single Member LLC Operating Agreement in Georgia. We offer various pricing plans that cater to different business needs, ensuring you get the best value for your investment.

-

Can I customize my Single Member LLC Operating Agreement in Georgia using airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your Single Member LLC Operating Agreement in Georgia. You can add specific clauses, adjust the terms, and personalize the document to fit your business model.

-

What features does airSlate SignNow offer for eSigning my Single Member LLC Operating Agreement in Georgia?

airSlate SignNow provides a range of features for eSigning your Single Member LLC Operating Agreement in Georgia, including secure cloud storage, real-time tracking, and customizable signing workflows. These features ensure a smooth and efficient signing process.

-

Does airSlate SignNow integrate with other business tools for managing my Single Member LLC Operating Agreement in Georgia?

Yes, airSlate SignNow seamlessly integrates with various business applications, helping you manage your Single Member LLC Operating Agreement in Georgia alongside your other operational tools. This integration enhances productivity and streamlines your business processes.

Get more for Single Member Llc Operating Agreement Georgia

- Pa state fire academy local level course application haccedu hacc form

- Sunday school information sheet

- The herbert irving comprehensive cancer center at columbia form

- Ohs pre appointment form for traveling residentsdocx

- Assumed name certificate form

- Equipment checkout form 412533993

- Summit ampamp poster faircardiovascular research center form

- Radiology on kiawah island duke radiology form

Find out other Single Member Llc Operating Agreement Georgia

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy