Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version Form

What is the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

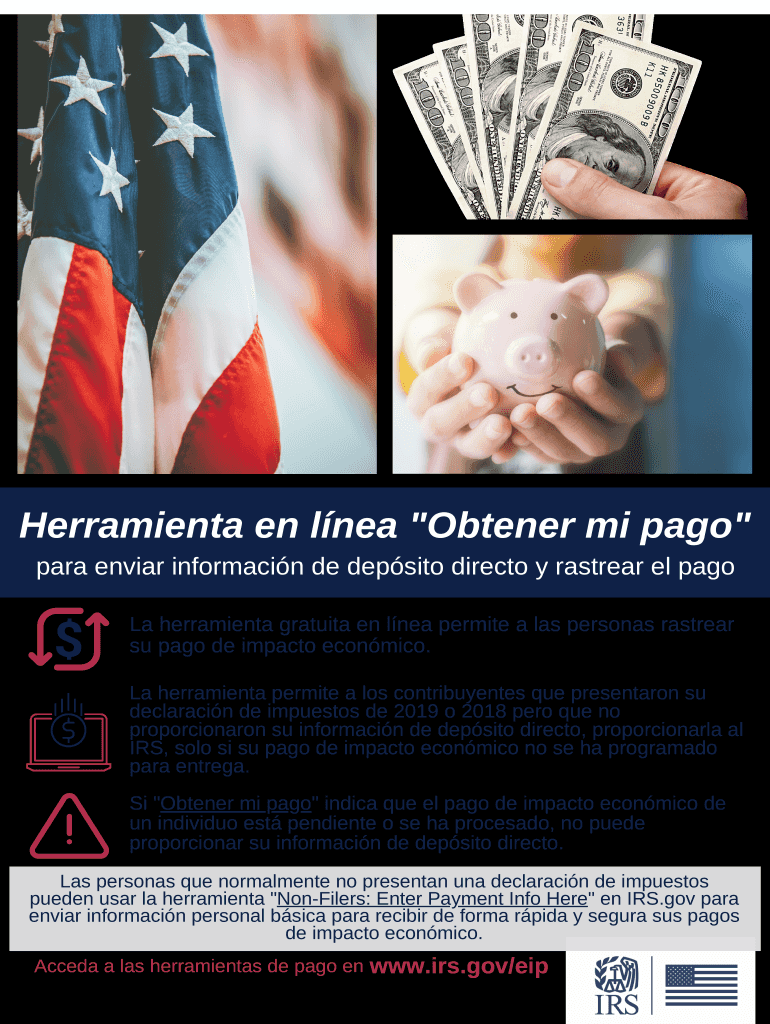

The Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is a resource provided by the IRS designed to assist Spanish-speaking individuals in accessing their payment information. This tool allows users to check the status of their payments, including Economic Impact Payments and other related financial assistance. It is essential for users to understand the tool's purpose, as it streamlines the process of obtaining crucial financial information in a language that is accessible and easy to understand.

How to use the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

Using the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is straightforward. Users need to visit the designated IRS website where the tool is hosted. Once there, they will be prompted to enter specific personal information, such as their Social Security number, date of birth, and mailing address. This information is necessary to verify the user's identity and ensure they receive accurate payment status updates. The tool guides users through each step, making it user-friendly for those who may not be familiar with online processes.

Steps to complete the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

Completing the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version involves several key steps:

- Access the IRS website where the tool is available.

- Select the Spanish language option to ensure comprehension.

- Enter your Social Security number accurately.

- Provide your date of birth as requested.

- Input your mailing address, ensuring it matches IRS records.

- Submit the information to receive your payment status.

Following these steps carefully will help ensure that users can successfully check their payment status without complications.

Legal use of the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

The Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is legally recognized for verifying payment statuses. It complies with IRS regulations, ensuring that the information provided through the tool is secure and confidential. Users should be aware that the data they enter is protected under privacy laws, and the tool is designed to facilitate access to essential financial information without compromising personal data. Understanding the legal implications of using this tool can provide users with peace of mind while navigating their payment inquiries.

Eligibility Criteria

To utilize the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version, users must meet specific eligibility criteria. Primarily, they must be individuals who have filed a tax return with the IRS and are seeking information regarding their Economic Impact Payments. Additionally, users should have a valid Social Security number and be able to provide accurate personal details to verify their identity. Understanding these criteria is crucial for ensuring that users can effectively access the information they need.

Required Documents

When using the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version, users need to have certain documents on hand to facilitate the process. The primary document required is a valid Social Security card or number, as this is essential for identity verification. Additionally, users should have their most recent tax return available, as it may contain relevant information needed for the tool. Having these documents prepared can streamline the process and reduce any potential delays in obtaining payment status information.

Quick guide on how to complete publication 5412 c sp 4 2020 get my payment online tool spanish version

Effortlessly Prepare Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to access the appropriate form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without complications. Manage Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version with Ease

- Find Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 5412 c sp 4 2020 get my payment online tool spanish version

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version?

The Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is an online solution designed to help Spanish-speaking individuals access payment information conveniently. This tool streamlines the process of obtaining payment details, making it user-friendly and efficient for those preferring Spanish.

-

How can I access the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version?

You can access the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version through the airSlate SignNow platform. Simply visit our website, navigate to the tool, and follow the prompts to easily retrieve your payment information in Spanish.

-

Is the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version free to use?

Yes, the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is designed to be user-friendly and accessible without any fees. You can utilize this tool at no cost, making it an excellent resource for Spanish-speaking individuals seeking payment assistance.

-

What features does the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version offer?

The Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version provides several features, including real-time payment tracking, secure access to payment information, and the ability to view historical data. The tool is designed for simplicity and efficiency, making it perfect for users who prefer navigating in Spanish.

-

What are the benefits of using the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version?

Using the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version offers numerous benefits, such as quick access to payment details and user-friendly navigation for Spanish speakers. Additionally, the tool reduces the complexity of finding payment information, allowing users to focus on their financial needs.

-

Can the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version be integrated with other software?

Yes, the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version is designed to seamlessly integrate with various business tools and software. This allows users to enhance their existing workflows by incorporating payment information retrieval directly into their systems.

-

Who can benefit from the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version?

Anyone who speaks Spanish and requires assistance with payment information can benefit from the Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version. This tool is especially useful for individuals looking for streamlined access to their payment data in their preferred language.

Get more for Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

Find out other Publication 5412 C SP 4 Get My Payment Online Tool Spanish Version

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later