Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version Form

What is the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

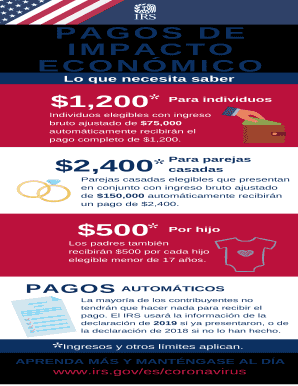

The Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version is an official document provided by the IRS that outlines the amounts of economic impact payments available to eligible individuals and families. This publication is specifically tailored for Spanish-speaking taxpayers, ensuring they have access to crucial financial information in their preferred language. It includes details on eligibility criteria, payment amounts based on filing status, and any relevant updates that may affect the payments.

How to use the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

To effectively use the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version, individuals should first review the eligibility criteria outlined within the document. Understanding the specific payment amounts based on filing status is essential for taxpayers to accurately assess their potential benefits. Additionally, this publication can serve as a reference when completing tax forms or when seeking assistance from tax professionals, ensuring that users are informed about their rights and available resources.

Steps to complete the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

Completing the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version involves several key steps:

- Review the eligibility requirements to confirm qualification for the economic impact payment.

- Identify the payment amount applicable to your filing status, whether single, married, or head of household.

- Gather necessary documentation, such as your Social Security number and tax return information.

- Fill out any required forms or sections as indicated in the publication.

- Submit your information to the IRS through the appropriate channels, whether online or by mail.

Legal use of the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

The legal use of the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version is crucial for ensuring compliance with IRS regulations. This publication serves as an authoritative source of information regarding economic impact payments, which are designed to provide financial relief during economic downturns. Users must ensure that they follow the guidelines and use the publication accurately to avoid any potential legal issues or misunderstandings regarding their payment eligibility and amounts.

Eligibility Criteria

Eligibility for the economic impact payments outlined in the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version is determined by several factors, including:

- Filing status (single, married filing jointly, head of household).

- Adjusted gross income (AGI) as reported on your tax return.

- Citizenship or residency status.

- Dependents claimed on your tax return.

It is essential for individuals to review these criteria carefully to determine their eligibility for the payments.

IRS Guidelines

The IRS provides specific guidelines regarding the economic impact payments that are detailed in the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version. These guidelines include information on how payments are calculated, the timeline for distribution, and any actions required by taxpayers to receive their payments. Adhering to these guidelines ensures that taxpayers can access the financial relief they are entitled to without delay.

Form Submission Methods

Taxpayers can submit their information related to the Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version through various methods:

- Online submission via the IRS website for electronic filing.

- Mailing a paper form directly to the IRS.

- In-person submission at designated IRS offices or authorized tax preparers.

Choosing the appropriate submission method is important for ensuring timely processing of economic impact payments.

Quick guide on how to complete publication 5412 k sp 5 2020 economic impact payment amounts spanish version

Complete Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version effortlessly on any device

Managing documents online has gained immense popularity among both organizations and individuals. It offers a superb environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version with minimal effort

- Obtain Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 5412 k sp 5 2020 economic impact payment amounts spanish version

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version?

Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version is a crucial document that outlines the specific amounts eligible individuals can expect from the Economic Impact Payment program. It provides detailed information in Spanish, ensuring that non-English speakers also understand their financial entitlements.

-

How can I access Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version?

You can easily access Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version through our website or directly from official IRS sources. Our airSlate SignNow platform also allows you to download and eSign related documents efficiently.

-

What features does airSlate SignNow offer for managing documents related to Publication 5412 K SP 5?

airSlate SignNow provides a range of features including eSigning, document sharing, and tracking for publications like Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version. These features enable you to manage your documentation process seamlessly and professionally.

-

Is there a cost associated with obtaining Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version?

Obtaining Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version itself is free from official sources. However, using airSlate SignNow's comprehensive document management solutions may involve subscription fees, which provide signNow value in saving time and resources.

-

Can airSlate SignNow assist in electronic filing of forms related to Publication 5412 K SP 5?

Yes, airSlate SignNow supports electronic filing for forms connected to Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version. This streamlines your process and ensures that your submissions are securely treated and processed in compliance with regulations.

-

What are the benefits of using airSlate SignNow for Publication 5412 K SP 5 related documents?

Using airSlate SignNow for handling documents related to Publication 5412 K SP 5 comes with many benefits, such as enhanced security, easy tracking of changes, and the ability to collaborate in real-time. These features improve overall efficiency and accuracy in completing essential paperwork.

-

Does airSlate SignNow integrate with other tools for managing Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of tools, allowing for improved management of documents like Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version. This enhances productivity and ensures a more cohesive workflow across your business operations.

Get more for Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

Find out other Publication 5412 K SP 5 Economic Impact Payment Amounts Spanish Version

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online