Publication 5419 Form

What is the Publication 5419

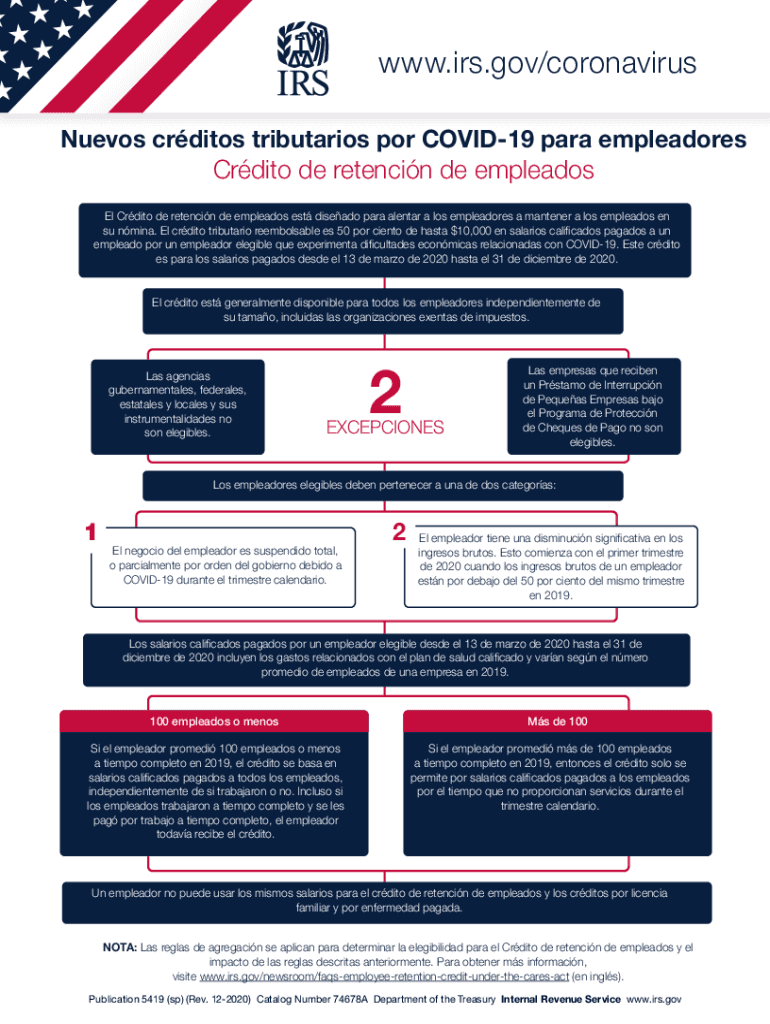

The Publication 5419, also known as the IRS 5419 form, is a document used primarily for tax purposes in the United States. This form provides essential guidelines and information regarding specific tax-related matters, helping taxpayers understand their obligations and rights. It is particularly relevant for individuals and businesses that need to report certain types of income or deductions. The publication serves as a resource for navigating the complexities of tax regulations, ensuring compliance with IRS standards.

How to use the Publication 5419

Using the Publication 5419 involves several steps to ensure accurate completion and compliance with IRS requirements. First, familiarize yourself with the content of the publication, as it contains vital information about the specific tax issues it addresses. Next, gather all necessary documents and data required to fill out the form accurately. This may include income statements, previous tax returns, and any relevant financial records. Once you have all the information, carefully follow the instructions provided in the publication to complete the form correctly.

Steps to complete the Publication 5419

Completing the Publication 5419 involves a systematic approach to ensure accuracy. Start by reviewing the publication to understand the requirements. Then, collect all necessary information, including personal identification details and financial data. Fill out the form step-by-step, ensuring that all fields are completed accurately. Pay close attention to any calculations required, as errors can lead to complications. After completing the form, review it thoroughly for any mistakes before submission. Finally, retain a copy of the completed form for your records.

Legal use of the Publication 5419

The legal use of the Publication 5419 is crucial for ensuring compliance with IRS regulations. When completed correctly, the form serves as a legally binding document that reflects your tax obligations. It is important to adhere to the guidelines outlined in the publication to avoid potential penalties or legal issues. Utilizing a reliable electronic signature platform can enhance the legal validity of the document, as it ensures compliance with eSignature laws and provides an audit trail for verification.

IRS Guidelines

The IRS guidelines associated with the Publication 5419 provide essential instructions for taxpayers. These guidelines outline the specific requirements for filling out the form, including eligibility criteria and necessary documentation. It is important to stay updated on any changes to these guidelines, as tax laws can evolve. By following the IRS guidelines closely, taxpayers can ensure that they meet all legal obligations and avoid potential issues with their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Publication 5419 are critical to ensure timely compliance with tax regulations. Typically, the IRS sets specific dates by which the form must be submitted, often coinciding with the annual tax filing season. It is essential to keep track of these important dates to avoid penalties for late submission. Mark your calendar with the relevant deadlines and ensure that you have ample time to complete and file the form accurately.

Required Documents

To complete the Publication 5419 accurately, certain documents are required. These may include personal identification information, income statements, and any relevant financial records that support the information reported on the form. Having all necessary documents ready before starting the completion process can streamline the experience and reduce the likelihood of errors. Ensure that all documents are current and reflect accurate information to comply with IRS standards.

Quick guide on how to complete publication 5419

Prepare Publication 5419 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Publication 5419 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Publication 5419 with ease

- Find Publication 5419 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Publication 5419 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 5419

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 5419 and how can airSlate SignNow help?

Form 5419 is a specific document used for certain legal or administrative purposes. airSlate SignNow simplifies the signing and management of Form 5419 by providing an intuitive platform that allows users to create, send, and eSign this form seamlessly.

-

How much does it cost to use airSlate SignNow for Form 5419?

The pricing for using airSlate SignNow varies depending on the plan you choose. Generally, airSlate SignNow offers competitive pricing that ensures you can efficiently manage Form 5419 without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 5419?

airSlate SignNow includes features like document templates, secure eSigning, and tracking for Form 5419. This makes it easier than ever to ensure that your documents are completed accurately and efficiently.

-

Is it easy to integrate airSlate SignNow with other software for Form 5419?

Yes, airSlate SignNow offers various integration options with other software applications. This allows you to streamline your process for handling Form 5419 and improves your overall workflow.

-

Can multiple users collaborate on Form 5419 in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Form 5419. This feature enhances teamwork and ensures that your document gets signed and processed quickly.

-

What are the security measures for Form 5419 in airSlate SignNow?

airSlate SignNow prioritizes the security of your data, including Form 5419. The platform uses encryption and complies with industry standards to keep your documents safe and secure.

-

Are there any mobile options for signing Form 5419 with airSlate SignNow?

Yes, airSlate SignNow offers mobile-friendly access for signing Form 5419. This flexibility allows you to manage documents on-the-go, ensuring that you can sign and send forms whenever necessary.

Get more for Publication 5419

Find out other Publication 5419

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself