Publication 1 Form

What is the Publication 1?

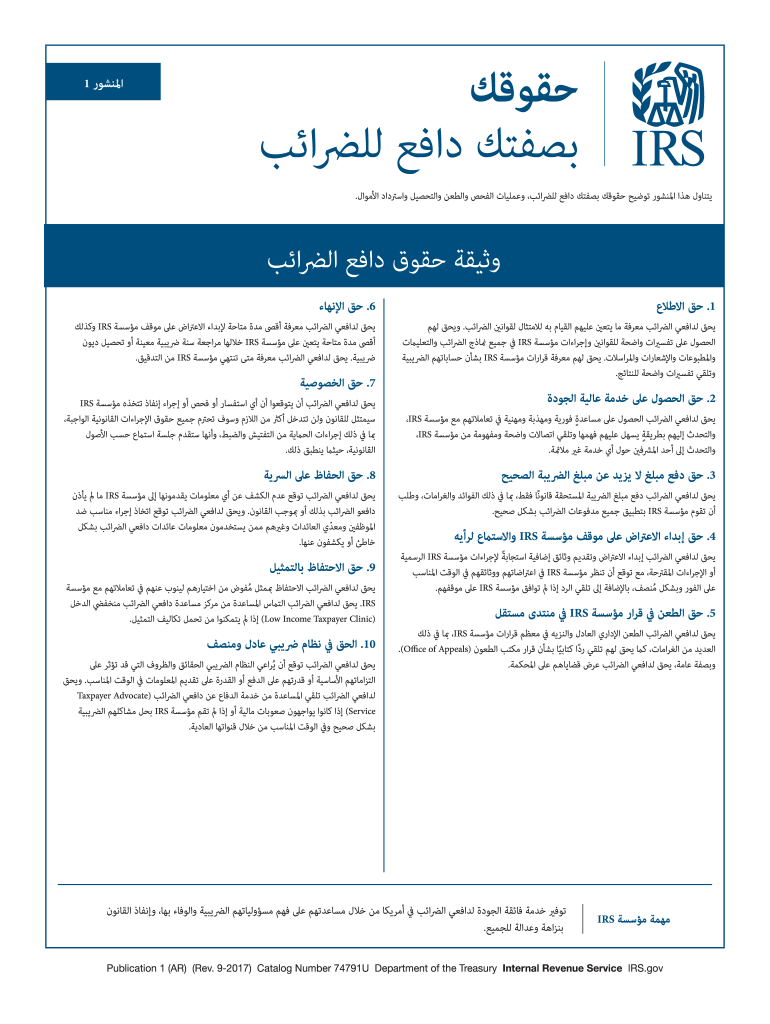

The Publication 1 is a document provided by the IRS that outlines essential information for taxpayers regarding their rights and responsibilities. It serves as a comprehensive guide to understanding tax obligations and the processes involved in filing taxes. This publication is particularly important for individuals seeking clarity on their taxpayer rights and the resources available to them. It covers various aspects of tax law, ensuring that taxpayers are informed and can navigate their tax situations effectively.

How to use the Publication 1

Utilizing the Publication 1 effectively involves understanding its contents and applying the information to your tax situation. Taxpayers can reference this publication to clarify their rights when dealing with the IRS, including the right to appeal decisions and the right to privacy. It is advisable to read through the publication thoroughly to grasp the various sections, which address topics such as taxpayer assistance, dispute resolution, and the importance of maintaining accurate records.

Steps to complete the Publication 1

Completing the Publication 1 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, such as income statements and previous tax returns. Next, carefully read through the publication to understand the requirements specific to your situation. Fill out the form by providing accurate information, ensuring that all entries are clear and complete. Finally, review the completed form for any errors before submission to avoid delays or complications.

Legal use of the Publication 1

The legal use of the Publication 1 is crucial for ensuring that taxpayers are aware of their rights and obligations under U.S. tax law. The publication is recognized as a legitimate resource that provides guidance on legal standards and compliance requirements. By understanding the legal implications outlined in the publication, taxpayers can better protect themselves and ensure adherence to IRS regulations, which can help avoid potential penalties or disputes.

Key elements of the Publication 1

Key elements of the Publication 1 include detailed explanations of taxpayer rights, the procedures for filing complaints, and the processes for resolving disputes with the IRS. It also emphasizes the importance of confidentiality and the protections afforded to taxpayers. Additionally, the publication outlines the various services available to assist taxpayers, including help lines and online resources, which can provide further support in navigating tax-related issues.

IRS Guidelines

IRS guidelines within the Publication 1 provide taxpayers with critical information on how to comply with tax laws and regulations. These guidelines cover a range of topics, including filing requirements, deadlines, and the necessary documentation for various tax situations. Understanding these guidelines is essential for ensuring that taxpayers fulfill their obligations and take advantage of any available benefits or deductions.

Filing Deadlines / Important Dates

Filing deadlines and important dates are crucial aspects covered in the Publication 1. Taxpayers need to be aware of key dates for filing their tax returns, making payments, and submitting any necessary documentation to the IRS. Missing these deadlines can result in penalties or interest charges, making it vital for individuals to stay informed about the timeline associated with their tax responsibilities.

Quick guide on how to complete publication 1

Complete Publication 1 easily on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed paperwork, as you can locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Publication 1 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Publication 1 with minimal effort

- Obtain Publication 1 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Publication 1 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 1

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is publication 1 in the context of airSlate SignNow?

Publication 1 refers to the comprehensive suite of features offered by airSlate SignNow that enables businesses to streamline their document workflows. This includes electronic signatures, secure document storage, and customizable templates to enhance productivity.

-

How does airSlate SignNow's pricing structure work for publication 1?

AirSlate SignNow offers flexible pricing plans for publication 1, catering to various business sizes and needs. You can choose from monthly or annual subscriptions, each providing access to core features along with additional functionalities at higher tiers.

-

What are the key features of publication 1?

The key features of publication 1 include electronic signatures, automated workflows, mobile access, and integrations with popular apps. These features are designed to facilitate easy document management and improve efficient collaboration among team members.

-

How can publication 1 benefit my business operations?

With publication 1, businesses can signNowly reduce the time spent on document processing and improve overall efficiency. The user-friendly interface allows for quick eSigning and document sharing, ultimately leading to faster turnaround times for important processes.

-

Does publication 1 integrate with other applications?

Yes, publication 1 supports various integrations, allowing seamless connectivity with popular tools such as Google Drive, Salesforce, and Microsoft Office. This enhances usability and enables users to manage documents within their favorite applications.

-

Is airSlate SignNow compliant with legal requirements for publication 1?

Absolutely! Publication 1 adheres to stringent security standards and legal regulations, ensuring that all electronic signatures are legally binding. This compliance guarantees that your documents are safe and trusted in any legal jurisdiction.

-

Can I try publication 1 before committing to a purchase?

Yes, airSlate SignNow offers a free trial of publication 1, allowing users to experience its features without any financial commitment. This trial period is an excellent opportunity to assess the platform's capabilities and see how it meets your business needs.

Get more for Publication 1

Find out other Publication 1

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed