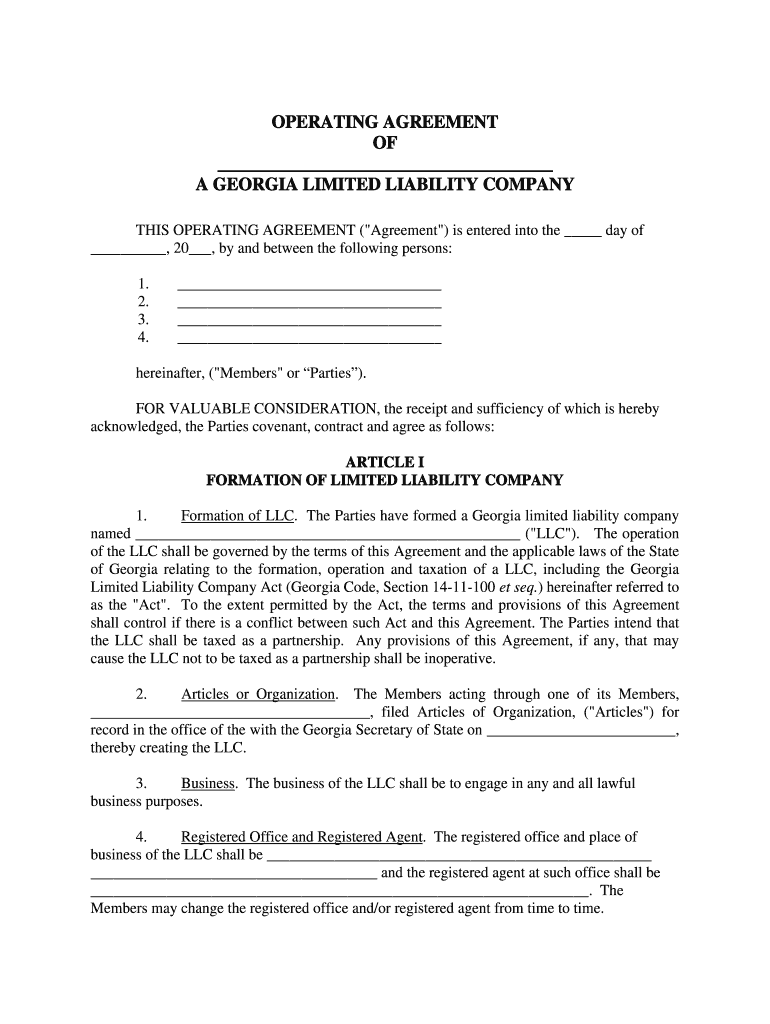

Georgia Limited Liability Company LLC Operating Agreement Form

What is the Georgia Limited Liability Company LLC Operating Agreement

The Georgia Limited Liability Company (LLC) operating agreement is a crucial legal document that outlines the management structure and operational guidelines of an LLC in Georgia. This agreement serves as an internal document that governs the relationships between members and the LLC itself. It typically includes provisions regarding the distribution of profits, responsibilities of members, and procedures for adding or removing members. While Georgia law does not mandate an operating agreement for LLCs, having one is highly recommended to establish clear expectations and protect the interests of the members.

Key elements of the Georgia Limited Liability Company LLC Operating Agreement

When drafting an operating agreement for an LLC in Georgia, certain key elements should be included to ensure clarity and compliance. These elements typically consist of:

- Member Information: Names and addresses of all members.

- Management Structure: Details on whether the LLC will be member-managed or manager-managed.

- Profit Distribution: Guidelines on how profits and losses will be allocated among members.

- Voting Rights: Procedures for decision-making and voting among members.

- Amendment Procedures: Steps to modify the agreement if necessary.

Including these elements helps to prevent disputes and ensures that all members are on the same page regarding the operation of the LLC.

Steps to complete the Georgia Limited Liability Company LLC Operating Agreement

Completing an operating agreement for an LLC in Georgia involves several straightforward steps. Here is a guide to help you through the process:

- Gather Member Information: Collect the names and addresses of all LLC members.

- Decide on Management Structure: Determine whether the LLC will be managed by its members or by appointed managers.

- Draft the Agreement: Use a template or create a custom agreement that includes all necessary provisions.

- Review and Revise: Ensure all members review the document and suggest changes as needed.

- Sign the Agreement: All members should sign the final version to make it effective.

Following these steps can help ensure that the operating agreement is comprehensive and tailored to the needs of the LLC.

Legal use of the Georgia Limited Liability Company LLC Operating Agreement

The operating agreement for an LLC in Georgia is legally binding among the members, provided it is properly executed. It serves as a reference point in case of disputes or misunderstandings regarding the management and operation of the LLC. Courts often look to the operating agreement to resolve conflicts, making it essential to ensure that it accurately reflects the intentions of the members. Additionally, having a well-drafted operating agreement can enhance the credibility of the LLC in the eyes of banks and investors.

How to obtain the Georgia Limited Liability Company LLC Operating Agreement

Obtaining a Georgia LLC operating agreement can be done in several ways. Many online resources offer templates that can be customized to fit the specific needs of your LLC. Additionally, legal professionals can provide tailored agreements that comply with Georgia law. It is important to ensure that any template used includes all necessary provisions and is reviewed by all members before signing. This approach helps to ensure that the document meets the unique requirements of your LLC.

State-specific rules for the Georgia Limited Liability Company LLC Operating Agreement

Georgia has specific guidelines regarding LLC operating agreements that members should be aware of. While the state does not require an operating agreement, it is advisable to have one to outline the internal workings of the LLC. The agreement should comply with Georgia's business laws and should not contradict the Georgia Limited Liability Company Act. Furthermore, if the LLC has multiple members, it is essential to clearly define the roles and responsibilities of each member to avoid potential conflicts.

Quick guide on how to complete georgia limited liability company llc operating agreement

Complete Georgia Limited Liability Company LLC Operating Agreement effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Georgia Limited Liability Company LLC Operating Agreement on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Georgia Limited Liability Company LLC Operating Agreement with ease

- Obtain Georgia Limited Liability Company LLC Operating Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Georgia Limited Liability Company LLC Operating Agreement to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How is a Delaware limited liability company (LLC) without members and without an operating agreement dissolved?

A2ASection 18–801 of the Delaware Code states, among other provisions, that a limited liability company without members may be dissolved.The state-provided Certificate of Cancellation is to be signed by an “authorized person” before it is filed. Under the circumstances described in this question, the logical authorized person would be the authorized person who formed the LLC.

-

How can a foreigner (a non-citizen living outside the U.S.) form a limited liability company (LLC) in the United States?

Yes, anyone in the world can create an LLC in the United States. You never need the visit the United States to do so, it can be done by fax in many states, by mail in the rest, and by lawyer in all of them.Merely holding an ownership interest in an LLC (a passive member) is unlikely the violate the terms of any visa, despite generating self-employment income; but you'll want to consult an immigration attorney. Being an active member while present in the United States can, as you would require work authorization.The tax implications of owning an LLC depends upon the nature of the income. Unless the only income is from passive investments and/or personal services performed outside of the United States; it would otherwise likely give rise to income effectively connected to a trade or business in the United States, and thus be taxable even for a non-resident alien.

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

Up to how many members can a limited liability company (LLC) have in California?

There is no limit on the number of members that a limited liability company (LLC) may have as far as California law is concerned.However, the LLC’s Articles of Organization or Operating Agreement may, but is not required to, place a limit on the number of members the LLC may have.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How does a Limited Liability Company (LLC) protect the business owner(s) from personal liability when the LLCs have to sign a 'personal guarantee' from vendors that holds these owners personally liable?

Let’s see. You have a new company. The company has NO credit history. The company wants to purchase things from another business. That business wants to make sure that they get paid. Thus the personal guarantee. They are protecting themselves from your limited liability by having it expanded to you personally just to prevent what you are inferring.Now someone slips and falls in you place of business. They can get the business but not your personal assets.So the LLC still does limit liability - providing you have not “pierced the corporate veil” thru operating your llc in a non business like manner.

-

If a person wants to form a small business and their Certified Public accountant (CPA) advised them to form a Limited Liability Company (LLC), can they do this online? And would they need business liability insurance?

I think you should do what your CPA advises.In terms of HOW to form a LLC, you have options. Almost all states allow folks to form a LLC online either by using their web-based form or by downloading a PDF with instructions.There are many companies (including my own) that will form a LLC for you. So, you have two options: Do it yourself, or hire an Internet company to do it for you.There are pros and cons to each approach, and there are many variations of the companies that will do it for you.The advantage of doing it yourself is mostly the cost. You’re not paying anyone to do it for you.The negative, is that you will have to learn what to do and that can sometimes take a bit of work. Furthermore, the state (no matter where you file) won’t provide an Operating Agreement (which is critical for multi-member LLC’s) and they won’t help you with other aspects of forming a company. You tell them that Mickey Mouse is an owner, they will put Mickey Mouse down as an owner.Finally, there are some things that are just impossible doing it yourself (i.e. forming an Anonymous LLC), because by definition you need a third-party to be your organizer and registered agent.Conversely, hiring someone to form your LLC for you will provide some level of peace-of-mind and simplicity. They will provide some template documents, and they can provide additional services that may be important to your business (i.e. Registered Agent services).With that said, when you hire the “cheapest” company to help you, they are often not adding much value to the process, other than already knowing what to do. The absolute best company to hire would be your local business attorney or law firm, but they will also be the most expensive. The next best would be law firms who provide these services online (like my company, see Form a Limited Liability Company (LLC) | Law 4 Small Business, P.C. (L4SB)). After that will be your typical unlicensed legal provider, such as legalzoom and the others. Last on the list are individuals who are doing formations online, because they can make a quick buck.Factors that you should consider, when thinking about hiring a company to help you form a LLC are:Their online reputation, not the thousands of reviews listed on their website, but the actual google reviews.Do they provide attorney-client privilege and confidentiality?Can you actually speak to someone knowledgeable that will give you sound advice or has the ability to consult with your CPA?Can they help you with other aspects of their business?As it relates to business liability insurance, depending on the type of business you have, you may need to consider:General liability insuranceWorkers (or Workmans) CompensationKeyman / Key-life (if you have more than one owner, or the business needs money if you were to die or become incapacitated)Professional liability insurance (if you’re providing some sort of skilled service)Special insurance / riders, depending on what it is you doI strongly recommend you consult with at least TWO local business insurance agents (with good reputations) to see what they say.Good luck to you. Larry.

-

How do I form a LLC owned by a foreign limited company? Do I have to provide the foreign company documents when forming the LLC?

You form the LLC, and make the limited company a member of the LLC. The process for forming the LLC does not change regardless of whether its owners are foreign or domestic.No, you do not need to provide foreign company documents when forming the LLC. However, unless the person you will designate as the responsible person/organization of the LLC has a US Tax ID, you will need to apply for the Tax ID using the paper application (Form SS-4) rather than the online application. This adds a little complexity and a lot more time to the process.

Create this form in 5 minutes!

How to create an eSignature for the georgia limited liability company llc operating agreement

How to generate an eSignature for the Georgia Limited Liability Company Llc Operating Agreement online

How to generate an electronic signature for your Georgia Limited Liability Company Llc Operating Agreement in Chrome

How to generate an eSignature for putting it on the Georgia Limited Liability Company Llc Operating Agreement in Gmail

How to make an eSignature for the Georgia Limited Liability Company Llc Operating Agreement from your smart phone

How to create an electronic signature for the Georgia Limited Liability Company Llc Operating Agreement on iOS

How to make an eSignature for the Georgia Limited Liability Company Llc Operating Agreement on Android OS

People also ask

-

What is an LLC operating agreement in Georgia?

An LLC operating agreement in Georgia is a crucial document that outlines the management structure and operating procedures of your limited liability company. This agreement helps protect your limited liability status and provides clarity on roles and responsibilities among members. Having a well-structured LLC operating agreement prevents future disputes and ensures compliance with Georgia state laws.

-

Why is having an LLC operating agreement important in Georgia?

An LLC operating agreement is important in Georgia because it serves as the foundational document for your business’s operations. It outlines the ownership structure, responsibilities, and decision-making processes, essential for preventing misunderstandings. Without it, your LLC may be governed by default state rules that may not align with your intentions.

-

How do I create an LLC operating agreement in Georgia?

To create an LLC operating agreement in Georgia, you first need to gather information about your LLC's structure and the roles of each member. Using airSlate SignNow, you can easily draft a customizable agreement, ensuring all essential elements are included. This streamlined electronic process is efficient and ensures that your document meets legal requirements.

-

What features does airSlate SignNow offer for LLC operating agreements?

airSlate SignNow offers a variety of features for crafting LLC operating agreements, including customizable templates, document collaboration tools, and eSignature capabilities. The platform allows multiple members to review and sign the agreement seamlessly. Additionally, it provides secure storage for your documents, ensuring parts of your LLC operating agreement in Georgia are always accessible.

-

What are the benefits of using airSlate SignNow for an LLC operating agreement in Georgia?

Using airSlate SignNow for your LLC operating agreement in Georgia offers numerous benefits, including saving time and reducing paperwork. The platform enables quick revisions and facilitates easy collaboration among members. Ultimately, it streamlines the entire process of creating and signing your LLC operating agreement.

-

Are there any costs associated with creating an LLC operating agreement in Georgia using airSlate SignNow?

Yes, there are costs associated with creating an LLC operating agreement in Georgia using airSlate SignNow, which vary based on the pricing plan you choose. However, the platform is known for its cost-effective solutions that enhance document management efficiency. The investment in airSlate SignNow can pay off by simplifying the process of drafting and securing your LLC operating agreement.

-

Can I integrate airSlate SignNow with other tools for my LLC in Georgia?

Absolutely! airSlate SignNow can be integrated with various business tools and applications, enhancing your document management workflow related to your LLC operating agreement in Georgia. These integrations provide added functionalities, like automatic updates and notifications, streamlining your overall business operations.

Get more for Georgia Limited Liability Company LLC Operating Agreement

Find out other Georgia Limited Liability Company LLC Operating Agreement

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed