Consumer Better Business Financial Statement Form

What is the Consumer Better Business Financial Statement

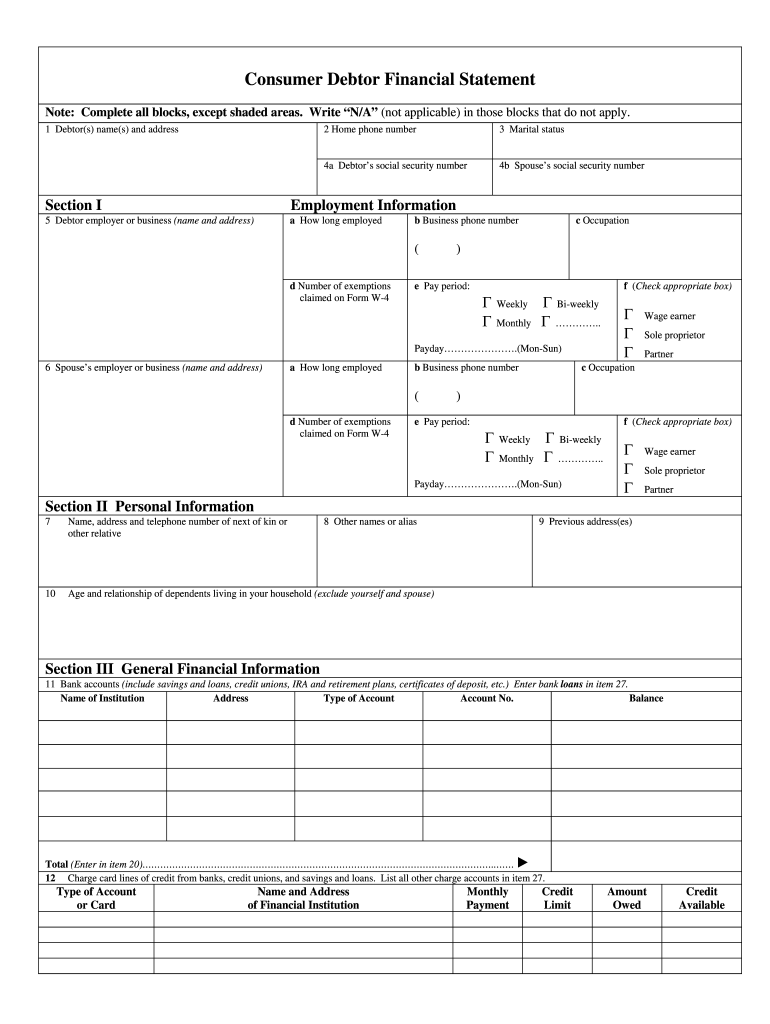

The Consumer Better Business Financial Statement is a critical document that provides a comprehensive overview of an individual's financial status. This statement typically includes details about income, expenses, assets, and liabilities. It is often used by lenders, creditors, and financial institutions to assess the creditworthiness of consumers. By presenting a clear picture of one’s financial health, this statement plays a vital role in various financial transactions, including loan applications and credit assessments.

How to use the Consumer Better Business Financial Statement

Utilizing the Consumer Better Business Financial Statement involves gathering accurate financial information and filling out the form correctly. Start by listing all sources of income, including wages, investments, and any other revenue streams. Next, detail your monthly expenses, which may include housing costs, utilities, and debt obligations. Once all information is compiled, ensure that it is presented clearly and concisely, as this will facilitate better understanding by lenders or financial institutions. This document can be submitted as part of a loan application or used for personal financial planning.

Steps to complete the Consumer Better Business Financial Statement

Completing the Consumer Better Business Financial Statement involves several key steps:

- Gather financial documents: Collect pay stubs, bank statements, and any other relevant financial records.

- List income sources: Clearly outline all income streams, including salaries, bonuses, and other earnings.

- Detail expenses: Itemize monthly expenses, ensuring to include fixed and variable costs.

- Calculate assets and liabilities: Provide an accurate account of all assets, such as property and savings, and liabilities, including loans and credit card debts.

- Review for accuracy: Double-check all entries for completeness and correctness to avoid discrepancies.

- Submit the statement: Once completed, the statement can be submitted to the relevant financial institution or retained for personal records.

Key elements of the Consumer Better Business Financial Statement

Several key elements are essential for a comprehensive Consumer Better Business Financial Statement. These include:

- Personal information: Name, address, and contact details.

- Income details: A breakdown of all income sources.

- Expense summary: An outline of monthly and annual expenses.

- Assets: A list of valuable possessions, including real estate and investments.

- Liabilities: All outstanding debts, including loans and credit obligations.

Legal use of the Consumer Better Business Financial Statement

The Consumer Better Business Financial Statement is legally recognized when it is accurately completed and submitted to financial institutions. It serves as a formal declaration of an individual's financial status and can be used in various legal contexts, such as loan applications and credit evaluations. Ensuring compliance with relevant regulations is crucial, as any inaccuracies may lead to legal repercussions or denial of credit. It is advisable to consult with a financial advisor or legal expert if there are uncertainties regarding its use.

Examples of using the Consumer Better Business Financial Statement

There are numerous scenarios in which the Consumer Better Business Financial Statement can be beneficial:

- Loan applications: Lenders often require this statement to assess an applicant's financial health.

- Credit evaluations: Creditors may use the statement to determine credit limits and terms.

- Personal financial planning: Individuals can utilize the statement to track their financial progress and plan for future goals.

Quick guide on how to complete consumer better business financial statement

Complete Consumer Better Business Financial Statement effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Consumer Better Business Financial Statement on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Consumer Better Business Financial Statement with ease

- Find Consumer Better Business Financial Statement and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Consumer Better Business Financial Statement and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer better business financial statement

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to debtor credit financial?

airSlate SignNow is a digital document management solution that empowers businesses to send and eSign documents efficiently. It plays a crucial role in debtor credit financial processes by simplifying agreements and contracts, ensuring faster turnaround times and improved accuracy.

-

How can airSlate SignNow benefit my debtor credit financial operations?

Using airSlate SignNow helps streamline your debtor credit financial operations by automating document workflows, reducing manual errors. This leads to quicker approvals and improved cash flow management, which is essential for effective financial planning.

-

What are the pricing options for airSlate SignNow for debtor credit financial needs?

airSlate SignNow offers various pricing plans designed to meet different business needs, including those specific to debtor credit financial activities. Each plan includes essential features that cater to small or large enterprises, ensuring you can find a cost-effective solution.

-

Does airSlate SignNow support integrations for debtor credit financial processes?

Yes, airSlate SignNow integrates seamlessly with numerous applications relevant to debtor credit financial processes. This allows for enhanced workflow efficiency, enabling you to connect with CRM systems, accounting software, and more to manage your financial documents effortlessly.

-

What features does airSlate SignNow offer for handling debtor credit financial documents?

airSlate SignNow provides robust features such as customizable templates, real-time tracking, and secure eSigning that specifically benefit debtor credit financial operations. These features help ensure compliance and simplify the management of financial agreements and contracts.

-

How secure is it to use airSlate SignNow for my debtor credit financial documents?

airSlate SignNow prioritizes security by employing advanced encryption and secure access controls to protect your debtor credit financial documents. You can trust that sensitive financial information is safeguarded throughout the signing process.

-

Can airSlate SignNow help reduce the time spent on debtor credit financial documentation?

Absolutely. By using airSlate SignNow, businesses can signNowly reduce the time spent on debtor credit financial documentation through automated workflows and efficient eSigning. This ensures that you can focus more on strategic financial decisions rather than getting bogged down by paperwork.

Get more for Consumer Better Business Financial Statement

- Hinduja hospital online registration form

- Ceta application form

- Nevada application for concealed firearm permit fillable form

- Dance guest pass neuqua valley high school nvhs ipsd form

- Listening inventory for education form

- London cardiac institute referral form

- Carbondale community high school schedule change request form

- Blank non compliance report form

Find out other Consumer Better Business Financial Statement

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile