Accredited Investor Form Leigh DOC Image Fonkoze

What is the investor form?

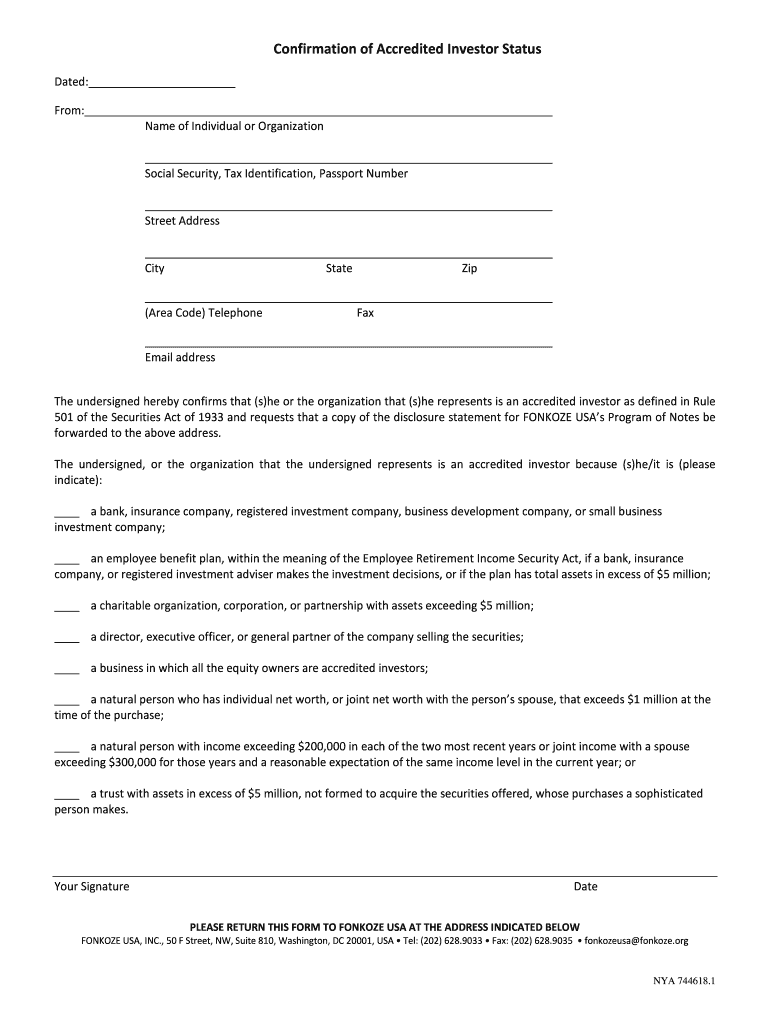

The investor form is a crucial document used to determine an individual's eligibility to invest in certain financial products, particularly those classified as private placements. This form typically collects personal information, financial status, and investment experience to assess whether the investor meets the criteria set forth by regulatory bodies. In the United States, the investor form is essential for compliance with securities regulations, ensuring that only qualified individuals participate in specific investment opportunities.

Steps to complete the investor form

Completing the investor form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including income, net worth, and investment experience. Next, carefully fill out each section of the form, providing truthful and complete answers. It is essential to review the form for any errors or omissions before submission. Finally, sign and date the form to validate your submission. This process ensures that the information provided is accurate and meets the requirements for investment eligibility.

Legal use of the investor form

The legal use of the investor form is governed by various regulations that protect both investors and issuers. In the U.S., compliance with the Securities Act of 1933 and other relevant laws is crucial. The form must be filled out accurately to avoid misrepresentation, which could lead to legal consequences for both the investor and the issuing company. Utilizing a reliable eSignature platform, like signNow, can enhance the legal standing of the completed form by ensuring it adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Eligibility criteria for the investor form

Eligibility criteria for the investor form typically include factors such as income level, net worth, and investment experience. For example, accredited investors must meet specific income thresholds, such as having an annual income exceeding $200,000 for the last two years or a net worth of over $1 million, excluding primary residence. Understanding these criteria is vital for individuals looking to participate in private investment opportunities, as they determine who can legally invest in certain offerings.

Required documents for the investor form

When completing the investor form, several documents may be required to verify the information provided. Commonly requested documents include tax returns, bank statements, and proof of assets to establish income and net worth. Additionally, personal identification, such as a driver's license or passport, may be necessary to confirm identity. Having these documents ready can streamline the completion process and ensure compliance with regulatory requirements.

Form submission methods

The investor form can typically be submitted through various methods, including online, by mail, or in-person. Online submission is often the most efficient method, allowing for quick processing and confirmation. When submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions may be required in certain situations, such as when additional verification is necessary. Understanding the available submission methods can help facilitate a smooth process.

Examples of using the investor form

Examples of using the investor form include scenarios where individuals seek to invest in private equity funds, hedge funds, or real estate syndications. In these situations, the form serves to confirm that the investor meets the necessary qualifications to participate in these investment opportunities. Additionally, financial advisors may utilize the investor form to assess their clients' suitability for specific investment strategies, ensuring that recommendations align with the clients' financial profiles and goals.

Quick guide on how to complete accredited investor form leighdoc image fonkoze

Prepare Accredited Investor Form Leigh DOC Image Fonkoze effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Accredited Investor Form Leigh DOC Image Fonkoze on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Accredited Investor Form Leigh DOC Image Fonkoze with no hassle

- Obtain Accredited Investor Form Leigh DOC Image Fonkoze and click on Get Form to begin.

- Use the tools available to fill out your form.

- Mark important sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Accredited Investor Form Leigh DOC Image Fonkoze to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accredited investor form leighdoc image fonkoze

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the investor form and how does it work?

The investor form is a digital document designed for capturing essential information from potential investors. With airSlate SignNow, you can easily create, send, and eSign investor forms, ensuring a smooth and efficient process for both parties. This solution allows for secure submission and storage of sensitive information.

-

What features does the investor form include?

The investor form includes features such as customizable fields, automated workflows, and real-time tracking of submissions. These tools help streamline the investment process and enhance communication with investors. Additionally, the form can be integrated with other platforms, providing a seamless experience.

-

How does airSlate SignNow ensure the security of the investor form?

airSlate SignNow takes data security seriously by employing advanced encryption and compliance measures to protect your investor form. User authentication and secure cloud storage ensure that your documents are safe from unauthorized access. This level of security helps build trust with your investors.

-

Is there a limit to how many investor forms I can create?

No, with airSlate SignNow, there is no limit to the number of investor forms you can create. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to scale your document management as needed. This flexibility makes it easier to manage multiple investment opportunities.

-

How much does it cost to use the investor form feature?

The cost of using the investor form feature depends on the specific plan you choose with airSlate SignNow. Various pricing tiers are available, designed to suit different business needs and budgets. You can start with a free trial to see how the investor form can streamline your processes.

-

Can the investor form be integrated with other tools?

Yes, the investor form can be easily integrated with various business applications, such as CRM systems and project management tools. These integrations enable seamless data flow and help you manage your investor relationships more effectively. This versatility makes it a powerful tool for your business.

-

What are the benefits of using the investor form with airSlate SignNow?

Using the investor form with airSlate SignNow offers several benefits, including increased efficiency, enhanced collaboration, and improved tracking of investor interactions. The ease of use encourages faster responses from potential investors, ultimately leading to quicker decisions. Additionally, you can manage all your documents in one place.

Get more for Accredited Investor Form Leigh DOC Image Fonkoze

Find out other Accredited Investor Form Leigh DOC Image Fonkoze

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple