Fidelity Solo 401k Contribution Form 2013

What is the Fidelity Solo 401k Contribution Form

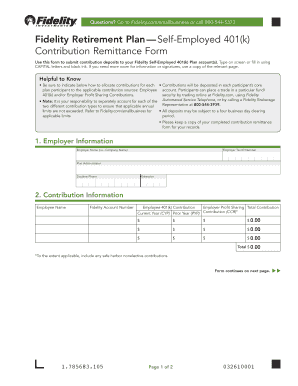

The Fidelity Solo 401k contribution remittance form is a crucial document for self-employed individuals who wish to contribute to their retirement savings through a Solo 401k plan. This form allows you to report your contributions to Fidelity, ensuring compliance with IRS regulations. It is specifically designed for sole proprietors, independent contractors, and business owners without employees, making it a tailored solution for those managing their own retirement plans.

How to use the Fidelity Solo 401k Contribution Form

Using the Fidelity Solo 401k contribution remittance form involves several straightforward steps. First, gather all necessary financial information, including your income and the amount you wish to contribute. Next, accurately fill out the form with your personal and business details. Ensure that you specify the contribution type, whether it is a salary deferral or a profit-sharing contribution. After completing the form, review it for accuracy before submission to avoid any potential issues.

Steps to complete the Fidelity Solo 401k Contribution Form

Completing the Fidelity Solo 401k contribution remittance form can be done efficiently by following these steps:

- Access the form through Fidelity's website or your account.

- Enter your personal information, including your name, address, and Social Security number.

- Provide your business details, such as the business name and type.

- Indicate the contribution amount and type, ensuring compliance with IRS limits.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Fidelity Solo 401k Contribution Form

The Fidelity Solo 401k contribution remittance form is legally binding when completed correctly. To ensure its validity, it must comply with IRS regulations regarding retirement contributions. This includes adhering to contribution limits and deadlines. Additionally, using a secure platform for electronic submission enhances the form's legal standing, as it provides an audit trail and ensures data integrity.

IRS Guidelines

The IRS provides specific guidelines for contributions to Solo 401k plans, which are essential to follow when completing the Fidelity Solo 401k contribution remittance form. Contributions can be made as employee deferrals or employer profit-sharing contributions, with maximum limits set annually. It is important to stay updated on these limits and ensure that your contributions do not exceed them to avoid penalties. Additionally, maintaining accurate records of your contributions is crucial for tax reporting purposes.

Filing Deadlines / Important Dates

Timely submission of the Fidelity Solo 401k contribution remittance form is vital for compliance. The IRS typically sets contribution deadlines for Solo 401k plans, usually aligned with the tax filing deadline for individuals. For example, contributions for the previous tax year can often be made until April 15 of the following year. It is essential to mark these dates on your calendar to ensure that you do not miss the opportunity to contribute and benefit from tax advantages.

Quick guide on how to complete fidelity solo 401k contribution form

Effortlessly prepare Fidelity Solo 401k Contribution Form on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Manage Fidelity Solo 401k Contribution Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Easily edit and eSign Fidelity Solo 401k Contribution Form with minimal effort

- Locate Fidelity Solo 401k Contribution Form and then click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign Fidelity Solo 401k Contribution Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity solo 401k contribution form

Create this form in 5 minutes!

How to create an eSignature for the fidelity solo 401k contribution form

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the fidelity self employed 401k contribution remittance form?

The fidelity self employed 401k contribution remittance form is a document used by self-employed individuals to report and remit their 401(k) contributions. This form ensures that contributions are accurately recorded by Fidelity, aiding in tax compliance and retirement planning. Utilizing the form helps streamline the contribution process and maintain organized financial records.

-

How do I complete the fidelity self employed 401k contribution remittance form?

To complete the fidelity self employed 401k contribution remittance form, gather your contribution details, personal information, and ensure you understand the contribution limits for your specific 401(k) plan. Follow the provided instructions carefully, filling in all necessary fields to avoid delays in processing. Once completed, you can submit it through the designated channels outlined by Fidelity.

-

What are the benefits of using the fidelity self employed 401k contribution remittance form?

Using the fidelity self employed 401k contribution remittance form simplifies your contribution process, ensuring accuracy and compliance with IRS regulations. It helps prevent errors that could lead to potential penalties, providing peace of mind as you invest in your retirement. Moreover, timely submissions of this form can enhance your retirement savings potential.

-

Is there a fee associated with submitting the fidelity self employed 401k contribution remittance form?

Typically, there are no direct fees for submitting the fidelity self employed 401k contribution remittance form itself. However, it's essential to review your Fidelity plan details, as there might be fees associated with the investment options within your 401(k). Always check the terms to understand any potential charges related to your contributions.

-

Can I edit my fidelity self employed 401k contribution remittance form after submission?

Once the fidelity self employed 401k contribution remittance form is submitted, changes are generally not allowed unless you contact Fidelity directly. If any errors are found, it's crucial to report them as quickly as possible to correct your contributions. Maintaining accurate records is essential for compliance and personal financial tracking.

-

How often should I submit the fidelity self employed 401k contribution remittance form?

The frequency of submitting the fidelity self employed 401k contribution remittance form depends on your contribution schedule. Many individuals submit it on a quarterly basis to align with their income flow, while others may do it annually. Ensure you stay informed about contribution limits and deadlines to stay compliant.

-

What integrations are available with the fidelity self employed 401k contribution remittance form?

The fidelity self employed 401k contribution remittance form can often be integrated with various accounting and payroll software solutions. These integrations help automate the contribution process, reducing the likelihood of errors. Be sure to check with Fidelity or your software provider for specific compatibility options that meet your needs.

Get more for Fidelity Solo 401k Contribution Form

Find out other Fidelity Solo 401k Contribution Form

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now