Letter of Credit Application Form

What is the Letter of Credit Application Form

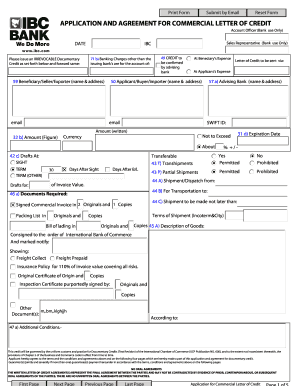

The letter of credit application form is a crucial document used in international trade. It allows a buyer to request a letter of credit from their bank, which guarantees payment to the seller upon fulfillment of specific conditions. This form serves as a formal request and outlines the necessary details for the bank to process the application. Understanding this form is essential for businesses engaged in import and export activities, as it facilitates secure transactions and builds trust between parties.

Steps to Complete the Letter of Credit Application Form

Filling out the letter of credit application form involves several key steps to ensure accuracy and compliance. Start by gathering all relevant information, such as the buyer's and seller's details, the amount of credit requested, and the terms of the transaction. Next, complete the form by entering the required information in the designated fields. It is important to double-check all entries for correctness, as errors can delay processing. Finally, submit the form to your bank through the preferred method, whether online or in person, and keep a copy for your records.

Key Elements of the Letter of Credit Application Form

The letter of credit application form contains several critical elements that must be accurately filled out. These include:

- Applicant Information: Details of the buyer, including name, address, and contact information.

- Beneficiary Information: Details of the seller or beneficiary of the letter of credit.

- Credit Amount: The total amount for which the letter of credit is requested.

- Terms and Conditions: Specific conditions that must be met for the payment to be released.

- Expiration Date: The date by which the letter of credit must be used.

Including all these elements accurately is essential for the successful processing of the application.

Legal Use of the Letter of Credit Application Form

The legal use of the letter of credit application form is governed by various regulations that ensure its validity. In the United States, the application must comply with the Uniform Commercial Code (UCC) and other relevant laws. Additionally, the form must be filled out correctly and signed by authorized individuals to be considered legally binding. Understanding these legal requirements helps protect both the buyer and seller in international transactions.

Who Issues the Letter of Credit Application Form

The letter of credit application form is typically issued by banks or financial institutions that provide trade finance services. Buyers seeking a letter of credit must approach their bank to obtain the form. The bank will guide the applicant through the process, ensuring that all necessary information is included and that the application meets legal and regulatory standards.

Form Submission Methods

Submitting the letter of credit application form can be done through various methods, depending on the bank's policies. Common submission methods include:

- Online Submission: Many banks offer online platforms where applicants can fill out and submit the form electronically.

- Mail Submission: Applicants can print the completed form and send it via postal mail to their bank.

- In-Person Submission: Applicants may also choose to visit their bank branch to submit the form directly.

Choosing the right submission method can streamline the application process and ensure timely processing.

Quick guide on how to complete letter of credit application form

Complete Letter Of Credit Application Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Letter Of Credit Application Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to alter and electronically sign Letter Of Credit Application Form without hassle

- Obtain Letter Of Credit Application Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Letter Of Credit Application Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of credit application form

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a letter of credit application form?

A letter of credit application form is a document used by applicants to request a letter of credit from a bank or financial institution. By completing this form, businesses can streamline the process of securing financing for imports and exports. With airSlate SignNow, you can easily fill out and eSign your letter of credit application form efficiently.

-

How can airSlate SignNow assist with the letter of credit application form?

airSlate SignNow provides an intuitive platform that simplifies the process of completing and signing your letter of credit application form. Our user-friendly interface allows for seamless collaboration and real-time updates, ensuring that all parties involved can efficiently manage their documentation. Using our solution can signNowly reduce the time it takes to process your application.

-

Is there a cost associated with using the letter of credit application form on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features and functionality you choose. We offer cost-effective plans tailored for businesses looking to streamline their document management process, including the use of the letter of credit application form. You can find detailed pricing information on our website to choose the package that best fits your needs.

-

What features are available for the letter of credit application form?

When using the letter of credit application form on airSlate SignNow, you can take advantage of features like eSignature, document tracking, and automated workflows. These features help ensure that your application is completed accurately and submitted on time. Additionally, you can customize the form to meet your specific requirements, enhancing the overall efficiency of the application process.

-

Are there any benefits to using airSlate SignNow for the letter of credit application form?

Using airSlate SignNow for your letter of credit application form offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. By leveraging our platform, businesses can easily track the application status and communicate with all involved parties. This enhanced efficiency ultimately leads to better financial management and smoother transactions.

-

Can I integrate airSlate SignNow with other software for my letter of credit application form?

Yes, airSlate SignNow offers integrations with various other software and platforms, allowing you to manage your letter of credit application form in a cohesive environment. Whether you need to connect with your CRM, accounting software, or other applications, our integration options make it easy to enhance your workflow. This level of connectivity streamlines the overall application process.

-

How secure is the letter of credit application form in airSlate SignNow?

Security is a top priority at airSlate SignNow. The letter of credit application form and all documents processed through our platform are protected with advanced encryption and comply with data protection regulations. Your sensitive information is safe, ensuring that your financial transactions and personal data remain confidential.

Get more for Letter Of Credit Application Form

- Carganet armas form

- Michigan quitclaim deed from individual to two individuals in joint tenancy 3352769 form

- Clifton nj opra request form

- Conducting criminal background checks guidance for michigan schools and their partners form

- Seacomm direct deposit request form

- Welcome to holland poem part 2 form

- Www mandg com dam prudirect debit form pru mandg com

- Naval reserve officers training form

Find out other Letter Of Credit Application Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word