Sc 2645 2018-2026

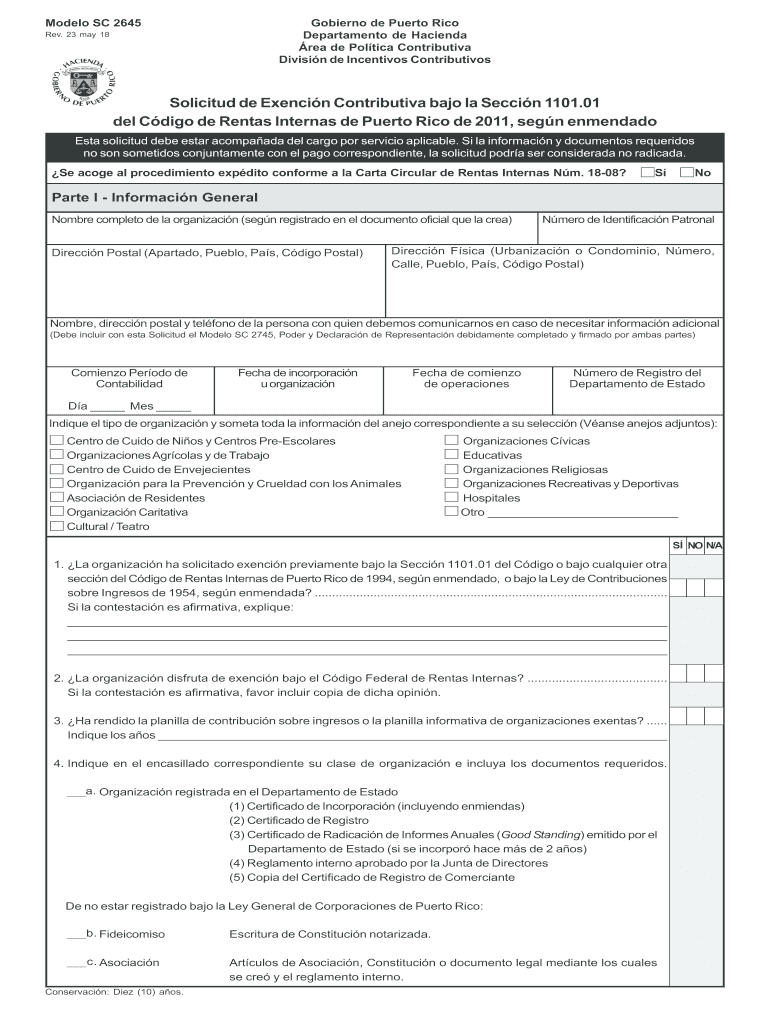

What is the SC 2645?

The SC 2645 is a specific form used in the United States, particularly for tax purposes, related to the exemption from certain contributions. This form is essential for individuals or entities looking to apply for tax relief under specific regulations. The SC 2645 is often referred to as the modelo SC 2645 and is recognized as a critical document within the tax filing process. Understanding its purpose and requirements is vital for ensuring compliance with tax laws.

How to Use the SC 2645

Using the SC 2645 involves several steps to ensure that the form is completed accurately. First, gather all necessary information, including personal identification details and financial data relevant to the exemption being requested. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Finally, submit the SC 2645 according to the guidelines provided by the relevant tax authority.

Steps to Complete the SC 2645

Completing the SC 2645 requires a systematic approach to ensure all information is accurately captured. Follow these steps:

- Gather required documents, including identification and financial records.

- Fill out the form, paying close attention to each section.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or via mail, as per the guidelines.

Legal Use of the SC 2645

The legal use of the SC 2645 hinges on its compliance with applicable tax regulations. The form must be completed in accordance with the laws governing tax exemptions. This includes providing accurate information and submitting the form within specified deadlines. Failure to comply with these legal requirements may result in penalties or denial of the exemption request.

Required Documents

When preparing to submit the SC 2645, certain documents are required to support the application. These documents may include:

- Proof of identity, such as a driver's license or Social Security number.

- Financial statements that demonstrate eligibility for the exemption.

- Any additional documentation requested by the tax authority.

Form Submission Methods

The SC 2645 can be submitted through various methods, allowing flexibility for users. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the form to the designated office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete sc 2645

Complete Sc 2645 seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle Sc 2645 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign Sc 2645 effortlessly

- Find Sc 2645 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Sc 2645 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 2645

Create this form in 5 minutes!

How to create an eSignature for the sc 2645

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the SC 2645 and how does it relate to airSlate SignNow?

The SC 2645 refers to a specific document format that can be seamlessly integrated with airSlate SignNow. This format allows users to easily manage and eSign their documents within the platform. By utilizing SC 2645, businesses can ensure compliance and efficiency in their document workflows.

-

What are the pricing options for using airSlate SignNow with SC 2645?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you're a small business or a large enterprise looking to use SC 2645, you can choose a plan that fits your budget. Additionally, a free trial is available, allowing you to explore the features related to SC 2645.

-

What features does airSlate SignNow provide for managing SC 2645 documents?

airSlate SignNow includes comprehensive features for managing SC 2645 documents, such as template creation, real-time collaboration, and automated workflows. These tools enhance productivity, making it easier for users to eSign and track their documents efficiently. Furthermore, integrating SC 2645 within the platform simplifies the approval process.

-

How does airSlate SignNow enhance security for SC 2645 documents?

airSlate SignNow prioritizes the security of your SC 2645 documents by utilizing advanced encryption protocols and secure cloud storage. Each document is protected during transmission and storage, ensuring that your sensitive information remains confidential. Compliance with industry regulations also enhances trust in handling SC 2645 files.

-

Can airSlate SignNow integrate with other software while using SC 2645?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, allowing users to streamline workflows with SC 2645 documents. Compatible with popular platforms like Salesforce, Google Drive, and Microsoft Office, these integrations help manage documents more effectively. This flexibility is crucial for businesses relying on SC 2645.

-

What benefits can businesses expect from using airSlate SignNow for SC 2645 eSigning?

Businesses can expect increased efficiency and reduced turnaround times when using airSlate SignNow for SC 2645 eSigning. The platform's user-friendly interface allows for quick document preparation and signature collection. Moreover, transitioning to electronic signatures for SC 2645 documents enhances compliance and reduces printing costs.

-

Is it easy to customize SC 2645 documents in airSlate SignNow?

Yes, customizing SC 2645 documents in airSlate SignNow is straightforward and user-friendly. The platform provides a variety of tools for editing and designing your documents as per your requirements. This customization capability allows businesses to maintain branding and specific formatting for SC 2645 files.

Get more for Sc 2645

- T6 form 646019714

- Www swf wc usace army milnavarroinformationdisclaimer and waiver of liability united states army

- Request for excused absence for educational reasons wake county form

- Form nz dl19 fill online printable fillable

- Joint account holder access letter form

- Woodbine georgia 31569 form

- Community involvement activity record form

- Im 1ssl pdf application for health coverage help paying form

Find out other Sc 2645

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement