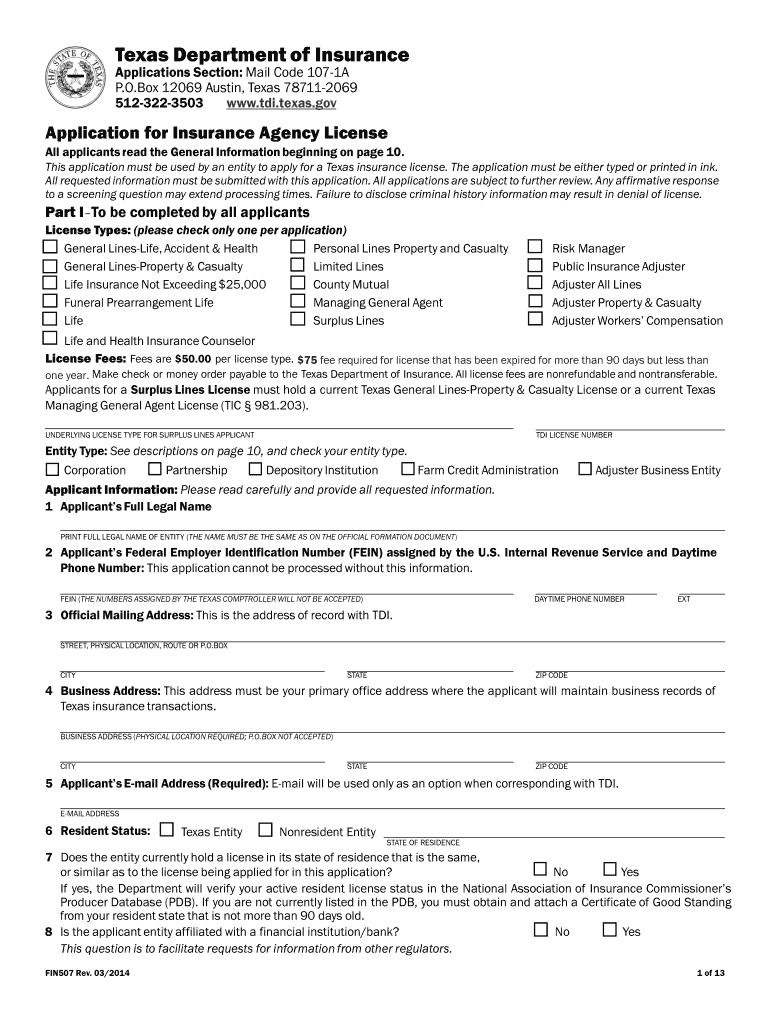

Fin 507 Form 2021

What is the Fin 507 Form

The Fin 507 Form is a specific document used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is primarily utilized by individuals and businesses to disclose income, expenses, and other financial details that are essential for tax compliance. Understanding the purpose of the Fin 507 Form is crucial for ensuring that all required information is accurately reported, thereby avoiding potential penalties or issues with the IRS.

How to use the Fin 507 Form

Using the Fin 507 Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Fin 507 Form

Completing the Fin 507 Form requires a systematic approach to ensure all information is provided correctly. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Carefully read the instructions provided with the form to understand each section.

- Fill in personal information, including your name, address, and Social Security number.

- Report income and expenses accurately, ensuring all figures are correct.

- Review the completed form for any mistakes or omissions.

- Sign and date the form before submission.

Legal use of the Fin 507 Form

The Fin 507 Form must be used in compliance with IRS regulations to ensure its legal validity. This includes adhering to guidelines regarding the reporting of income and expenses. Failure to use the form correctly can result in penalties, including fines or audits by the IRS. It is essential to keep a copy of the completed form and any supporting documents for your records, as these may be required in the event of an audit or inquiry.

Form Submission Methods

The Fin 507 Form can be submitted through various methods, providing flexibility for users. The primary submission methods include:

- Online Submission: Many users opt to submit the form electronically through the IRS e-file system, which is often faster and more secure.

- Mail: Users can also print the completed form and send it via postal mail to the appropriate IRS address, as specified in the form instructions.

- In-Person: In some cases, individuals may choose to deliver the form in person at their local IRS office, although this method is less common.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Fin 507 Form to avoid penalties. Typically, the form must be submitted by April 15 of the tax year following the income being reported. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, individuals who request an extension may have until October 15 to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete fin 507 2012 form

Effortlessly Prepare Fin 507 Form on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents rapidly without delays. Manage Fin 507 Form on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

Simplifying the Process of Editing and eSigning Fin 507 Form

- Find Fin 507 Form and click on Get Form to initiate.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Fin 507 Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 507 2012 form

Create this form in 5 minutes!

How to create an eSignature for the fin 507 2012 form

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Fin 507 Form and why is it important?

The Fin 507 Form is a crucial document used for reporting specific financial information. It plays a key role in ensuring compliance with regulatory requirements. Understanding the Fin 507 Form is vital for businesses to maintain transparency and meet their legal obligations.

-

How can airSlate SignNow help me in completing the Fin 507 Form?

airSlate SignNow simplifies the process of completing the Fin 507 Form by providing an intuitive eSigning platform. Our solution allows you to fill out the form digitally, ensuring accuracy and efficiency. You can easily gather signatures and send the document securely to relevant parties without the hassle of printing.

-

Is there a cost associated with using airSlate SignNow for the Fin 507 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. We provide a cost-effective solution that includes features for completing the Fin 507 Form and other documents. You can choose from monthly or annual subscriptions that fit your budget.

-

What are the key features of airSlate SignNow for the Fin 507 Form?

Key features of airSlate SignNow include customizable templates, real-time document tracking, and advanced security measures. These features ensure that your Fin 507 Form is handled efficiently and securely. Additionally, you can integrate our platform with other tools to streamline your workflow.

-

Can airSlate SignNow integrate with other software for filing the Fin 507 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easier to file the Fin 507 Form. You can connect with tools like CRM systems and document management platforms to enhance your workflows and automate processes.

-

What benefits does airSlate SignNow provide for businesses dealing with the Fin 507 Form?

Using airSlate SignNow for the Fin 507 Form provides numerous benefits, including increased efficiency and reduced administrative burden. The platform allows for faster turnaround times, enabling quicker compliance with financial reporting requirements. Additionally, electronic signatures ensure legal validity without the need for physical documents.

-

How secure is airSlate SignNow when handling the Fin 507 Form?

airSlate SignNow prioritizes the security of your documents, including the Fin 507 Form. Our platform employs advanced encryption and authentication measures to protect sensitive data. You can trust that your information is safe while using our easy-to-navigate eSigning solution.

Get more for Fin 507 Form

- Ppib consent forms

- A long walk to water two voice poem form

- Bank of america loan modification application pdf form

- Form 6 4

- New york last will and testament template form

- Application to reduce traffic infractions form

- Latent evidence submission form dcjs use only dcjs case

- Ny 005 bargain and sale deed with covenant against grantors acts individual or corporation single sheet nybtu 8002 form

Find out other Fin 507 Form

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF