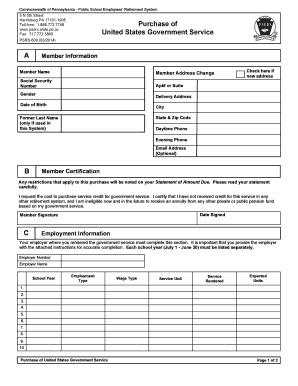

Purchase of United States Government Service PSERs Psers State Pa Form

Understanding the Purchase of United States Government Service PSERS

The Purchase of United States Government Service PSERS refers to a specific process for Pennsylvania educators to buy back service credit for time worked in other government positions. This process allows teachers to enhance their retirement benefits by adding eligible service years to their Pennsylvania State Employees' Retirement System (PSERS) account. Understanding the nuances of this purchase can help educators maximize their retirement savings and ensure they receive the benefits they deserve.

Steps to Complete the Purchase of United States Government Service PSERS

Completing the purchase of United States Government Service PSERS involves several key steps:

- Gather necessary documentation, including proof of previous employment and any relevant service records.

- Calculate the cost of the service purchase using the PSERS retirement calculator, which factors in your salary and years of service.

- Complete the required forms accurately, ensuring all information is correct to avoid processing delays.

- Submit the completed forms along with any required payment to PSERS for processing.

- Monitor the status of your application through the PSERS portal or by contacting their office for updates.

Key Elements of the Purchase of United States Government Service PSERS

Several key elements are crucial to understand when considering the purchase of service credit:

- Eligibility: Not all service time may qualify for purchase. It is essential to verify which periods of employment are eligible.

- Cost Calculation: The cost is determined based on your current salary and the number of years you wish to purchase.

- Payment Options: PSERS offers various payment methods, including lump-sum payments or installment plans.

- Impact on Retirement Benefits: Purchasing service credit can significantly enhance your retirement benefits, so understanding this impact is vital.

Legal Use of the Purchase of United States Government Service PSERS

The legal framework surrounding the purchase of service credit is governed by Pennsylvania state law and PSERS regulations. It is important to comply with all legal requirements to ensure that the purchase is valid and recognized by the retirement system. This includes adhering to deadlines for submitting forms and payments, as well as maintaining accurate records of your employment history.

Eligibility Criteria for the Purchase of United States Government Service PSERS

To be eligible for the purchase of service credit, you must meet specific criteria set by PSERS. Generally, you need to have been a member of PSERS and have prior government service that qualifies for purchase. Additionally, you must provide documentation proving your previous employment and the duration of that service. It is advisable to review PSERS guidelines or consult with a representative to confirm your eligibility before proceeding.

Form Submission Methods for the Purchase of United States Government Service PSERS

Submitting your application for the purchase of service credit can be done through several methods:

- Online: Many forms can be submitted electronically through the PSERS member portal, streamlining the process.

- Mail: You can send completed forms and documentation via postal service to the PSERS office.

- In-Person: For those who prefer face-to-face interaction, visiting a PSERS office may provide assistance and ensure that your forms are correctly submitted.

Quick guide on how to complete purchase of united states government service psers psers state pa

Complete Purchase Of United States Government Service PSERs Psers State Pa seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without holdups. Manage Purchase Of United States Government Service PSERs Psers State Pa on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Purchase Of United States Government Service PSERs Psers State Pa effortlessly

- Locate Purchase Of United States Government Service PSERs Psers State Pa and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Edit and eSign Purchase Of United States Government Service PSERs Psers State Pa and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the purchase of united states government service psers psers state pa

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the PSERS retirement calculator and how does it work?

The PSERS retirement calculator is a tool designed to help employees of the Pennsylvania Public School Employees' Retirement System estimate their retirement benefits. By inputting key data such as salary and years of service, users can obtain a clear projection of their retirement income. This offers valuable insights for better retirement planning.

-

How accurate is the PSERS retirement calculator?

The accuracy of the PSERS retirement calculator largely depends on the information provided by the user. By entering up-to-date salary and service year data, the calculator can provide a reliable estimate. However, for the most precise results, it is advisable to consult with a retirement planner.

-

Is there a cost associated with using the PSERS retirement calculator?

Using the PSERS retirement calculator is typically free for employees and retirees of the PSERS. This cost-effective solution allows users to gain critical insights into their retirement benefits without any financial burden. It's an accessible resource for all PSERS members seeking to plan their financial future.

-

What features make the PSERS retirement calculator user-friendly?

The PSERS retirement calculator is designed with user experience in mind, featuring an intuitive interface and step-by-step guidance. Users can easily navigate through the input fields, allowing for quick calculations. Additionally, results can be saved or printed, enhancing accessibility.

-

Can I integrate the PSERS retirement calculator with other financial planning tools?

While the PSERS retirement calculator is primarily a standalone tool, it can complement various financial planning software for a more comprehensive analysis. Using it alongside other financial calculators can provide a holistic view of your retirement strategy. It's recommended to check for specific integrations based on your planning software.

-

What are the benefits of using the PSERS retirement calculator for planning?

The key benefit of using the PSERS retirement calculator is the ability to visualize your potential retirement benefits, leading to informed decision-making. It helps you understand your financial readiness for retirement by projecting income based on your unique profile. This can empower you to make strategic adjustments to your savings and investments.

-

Who should use the PSERS retirement calculator?

The PSERS retirement calculator is ideal for current employees and retirees of the Pennsylvania Public School Employees' Retirement System. Anyone looking to understand their PSERS benefits, plan their retirement, or assess their financial fitness in relation to their future retirement goals will find this tool beneficial.

Get more for Purchase Of United States Government Service PSERs Psers State Pa

Find out other Purchase Of United States Government Service PSERs Psers State Pa

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document