Llc Operating Agreement Idaho Form

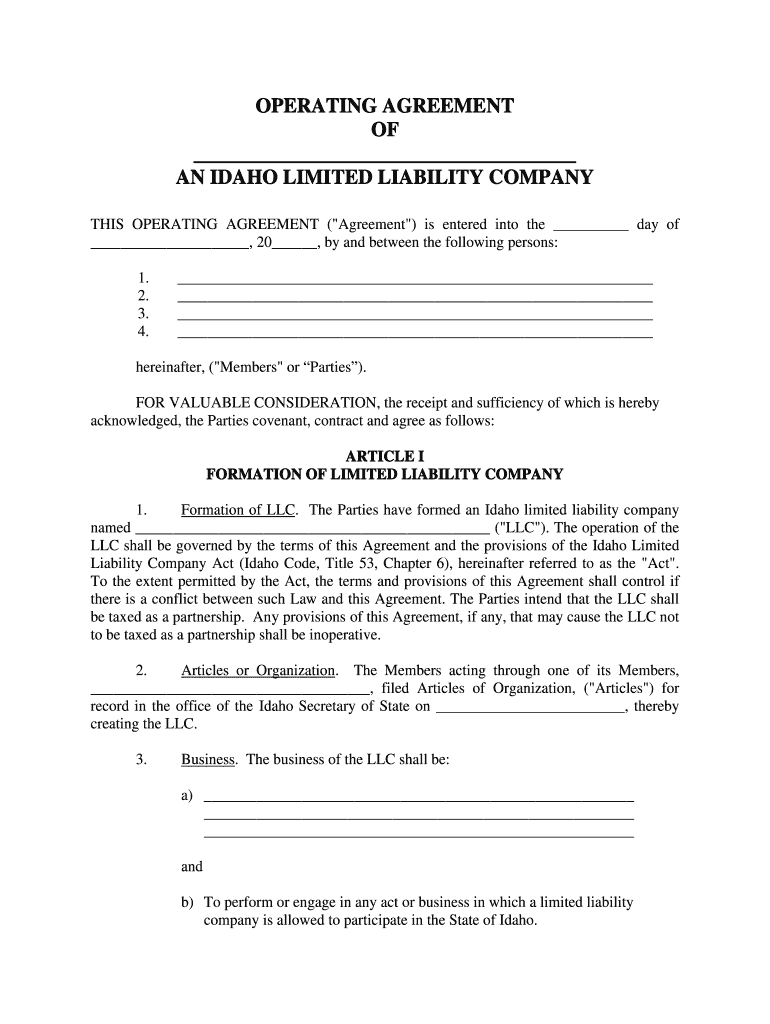

What is the Idaho LLC Operating Agreement?

The Idaho LLC operating agreement is a crucial legal document that outlines the management structure and operational guidelines of a limited liability company (LLC) in Idaho. This agreement serves as an internal document for the members of the LLC, detailing the rights, responsibilities, and obligations of each member. It helps to clarify how the business will be run, how profits and losses will be distributed, and how decisions will be made. While not required by law in Idaho, having an operating agreement is highly recommended as it provides legal protection and helps prevent disputes among members.

Key Elements of the Idaho LLC Operating Agreement

An effective Idaho LLC operating agreement typically includes several key elements:

- Business Name and Address: The official name and primary location of the LLC.

- Members' Information: Names and addresses of all members involved in the LLC.

- Management Structure: Outline of whether the LLC will be member-managed or manager-managed.

- Capital Contributions: Details on the initial contributions made by each member and any future contributions required.

- Profit and Loss Distribution: Explanation of how profits and losses will be allocated among members.

- Voting Rights: Description of how voting will occur and the voting power of each member.

- Amendment Procedures: Guidelines for how the operating agreement can be amended in the future.

Steps to Complete the Idaho LLC Operating Agreement

Completing an Idaho LLC operating agreement involves several steps to ensure that all necessary information is included and accurately represented:

- Gather Member Information: Collect the names, addresses, and contributions of all LLC members.

- Define Management Structure: Decide whether the LLC will be managed by its members or by appointed managers.

- Outline Financial Arrangements: Specify how profits and losses will be shared and any capital contributions required.

- Draft the Agreement: Use a template or create a custom document that includes all key elements.

- Review and Revise: Have all members review the agreement and suggest any necessary changes.

- Sign the Agreement: Ensure all members sign the document to make it legally binding.

Legal Use of the Idaho LLC Operating Agreement

The Idaho LLC operating agreement is legally binding among the members of the LLC. It is important to ensure that the agreement complies with Idaho state laws and regulations. While the state does not require an operating agreement, having one can provide legal protections, clarify member roles, and serve as a reference in case of disputes. Courts often refer to the operating agreement when resolving conflicts, making it essential for the document to be clear and comprehensive.

How to Use the Idaho LLC Operating Agreement

The Idaho LLC operating agreement should be used as a reference document for the internal operations of the LLC. Members can refer to it when making decisions, resolving disputes, or when changes in management or ownership occur. It can also be useful when seeking financing or entering into contracts, as it demonstrates the structure and governance of the LLC. Regularly reviewing and updating the agreement ensures that it remains relevant and reflective of the current operations and agreements among members.

Obtaining the Idaho LLC Operating Agreement

To obtain an Idaho LLC operating agreement, you can either draft one from scratch or use a template. Many legal websites and resources offer customizable templates that can be tailored to your specific needs. It is advisable to consult with a legal professional to ensure that the agreement meets all legal requirements and adequately protects the interests of all members. Once drafted, ensure that all members review and sign the agreement to formalize it.

Quick guide on how to complete idaho limited liability company llc operating agreement

Effortlessly Prepare Llc Operating Agreement Idaho on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Llc Operating Agreement Idaho on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Llc Operating Agreement Idaho with Ease

- Locate Llc Operating Agreement Idaho and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial parts of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Llc Operating Agreement Idaho and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How is a Delaware limited liability company (LLC) without members and without an operating agreement dissolved?

A2ASection 18–801 of the Delaware Code states, among other provisions, that a limited liability company without members may be dissolved.The state-provided Certificate of Cancellation is to be signed by an “authorized person” before it is filed. Under the circumstances described in this question, the logical authorized person would be the authorized person who formed the LLC.

-

How can a foreigner (a non-citizen living outside the U.S.) form a limited liability company (LLC) in the United States?

Yes, anyone in the world can create an LLC in the United States. You never need the visit the United States to do so, it can be done by fax in many states, by mail in the rest, and by lawyer in all of them.Merely holding an ownership interest in an LLC (a passive member) is unlikely the violate the terms of any visa, despite generating self-employment income; but you'll want to consult an immigration attorney. Being an active member while present in the United States can, as you would require work authorization.The tax implications of owning an LLC depends upon the nature of the income. Unless the only income is from passive investments and/or personal services performed outside of the United States; it would otherwise likely give rise to income effectively connected to a trade or business in the United States, and thus be taxable even for a non-resident alien.

-

How can I get help to modify an operating agreement for a newly formed LLC without hiring a lawyer?

Legally, you can't. A person cannot cannot offer legal services without an active law license, and such issues are far too complex for unintelligent forms based sites (not run by actual attorneys, just legally classified "form assistants") like Legal Zoom, etc; they can only act as a "filing service" to file base docs, and that is only q% of the overall process, if that; it does not suffice, and they mislead people.The other parts of legal entities are very complex and subtle and become exponentially more so with more members. The exception is a CPA, who can do very limited company formation work, but who generally don't really know what they're doing with formation, other than the tax specific aspects, and are never used for ongoing matters or as the lead people for company exit stages. The best option is always a corporate attorney (senior if possible) with a strong enjoyment of the tax law area of the work, or a combo team (e.g corporate lawyer and tax lawyer in the same firm, or a bit quite as common but still good, a corporate attorney and a CPA (some firms actually offer this in house).Normally however you get what you pay for, and if you invest in a good business attorney up front you will never have to even ask such a question because all contingencies would have been handled during setup. If you did that yourself, it's likely things weren't done correctly at the corporate governance level and half the decisions are null and void anyway, falling back to state law defaults (which are intended for large and/or public companies), leaving many unintended consequences. You may need a commercial litigation attorney/firn at this stage depending on size.

-

Up to how many members can a limited liability company (LLC) have in California?

There is no limit on the number of members that a limited liability company (LLC) may have as far as California law is concerned.However, the LLC’s Articles of Organization or Operating Agreement may, but is not required to, place a limit on the number of members the LLC may have.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How does a Limited Liability Company (LLC) protect the business owner(s) from personal liability when the LLCs have to sign a 'personal guarantee' from vendors that holds these owners personally liable?

Let’s see. You have a new company. The company has NO credit history. The company wants to purchase things from another business. That business wants to make sure that they get paid. Thus the personal guarantee. They are protecting themselves from your limited liability by having it expanded to you personally just to prevent what you are inferring.Now someone slips and falls in you place of business. They can get the business but not your personal assets.So the LLC still does limit liability - providing you have not “pierced the corporate veil” thru operating your llc in a non business like manner.

-

If a person wants to form a small business and their Certified Public accountant (CPA) advised them to form a Limited Liability Company (LLC), can they do this online? And would they need business liability insurance?

I think you should do what your CPA advises.In terms of HOW to form a LLC, you have options. Almost all states allow folks to form a LLC online either by using their web-based form or by downloading a PDF with instructions.There are many companies (including my own) that will form a LLC for you. So, you have two options: Do it yourself, or hire an Internet company to do it for you.There are pros and cons to each approach, and there are many variations of the companies that will do it for you.The advantage of doing it yourself is mostly the cost. You’re not paying anyone to do it for you.The negative, is that you will have to learn what to do and that can sometimes take a bit of work. Furthermore, the state (no matter where you file) won’t provide an Operating Agreement (which is critical for multi-member LLC’s) and they won’t help you with other aspects of forming a company. You tell them that Mickey Mouse is an owner, they will put Mickey Mouse down as an owner.Finally, there are some things that are just impossible doing it yourself (i.e. forming an Anonymous LLC), because by definition you need a third-party to be your organizer and registered agent.Conversely, hiring someone to form your LLC for you will provide some level of peace-of-mind and simplicity. They will provide some template documents, and they can provide additional services that may be important to your business (i.e. Registered Agent services).With that said, when you hire the “cheapest” company to help you, they are often not adding much value to the process, other than already knowing what to do. The absolute best company to hire would be your local business attorney or law firm, but they will also be the most expensive. The next best would be law firms who provide these services online (like my company, see Form a Limited Liability Company (LLC) | Law 4 Small Business, P.C. (L4SB)). After that will be your typical unlicensed legal provider, such as legalzoom and the others. Last on the list are individuals who are doing formations online, because they can make a quick buck.Factors that you should consider, when thinking about hiring a company to help you form a LLC are:Their online reputation, not the thousands of reviews listed on their website, but the actual google reviews.Do they provide attorney-client privilege and confidentiality?Can you actually speak to someone knowledgeable that will give you sound advice or has the ability to consult with your CPA?Can they help you with other aspects of their business?As it relates to business liability insurance, depending on the type of business you have, you may need to consider:General liability insuranceWorkers (or Workmans) CompensationKeyman / Key-life (if you have more than one owner, or the business needs money if you were to die or become incapacitated)Professional liability insurance (if you’re providing some sort of skilled service)Special insurance / riders, depending on what it is you doI strongly recommend you consult with at least TWO local business insurance agents (with good reputations) to see what they say.Good luck to you. Larry.

-

How do I form a LLC owned by a foreign limited company? Do I have to provide the foreign company documents when forming the LLC?

You form the LLC, and make the limited company a member of the LLC. The process for forming the LLC does not change regardless of whether its owners are foreign or domestic.No, you do not need to provide foreign company documents when forming the LLC. However, unless the person you will designate as the responsible person/organization of the LLC has a US Tax ID, you will need to apply for the Tax ID using the paper application (Form SS-4) rather than the online application. This adds a little complexity and a lot more time to the process.

Create this form in 5 minutes!

How to create an eSignature for the idaho limited liability company llc operating agreement

How to create an electronic signature for your Idaho Limited Liability Company Llc Operating Agreement in the online mode

How to make an electronic signature for the Idaho Limited Liability Company Llc Operating Agreement in Chrome

How to make an electronic signature for signing the Idaho Limited Liability Company Llc Operating Agreement in Gmail

How to create an eSignature for the Idaho Limited Liability Company Llc Operating Agreement straight from your smartphone

How to create an electronic signature for the Idaho Limited Liability Company Llc Operating Agreement on iOS devices

How to generate an electronic signature for the Idaho Limited Liability Company Llc Operating Agreement on Android OS

People also ask

-

What is an Idaho LLC operating agreement?

An Idaho LLC operating agreement is a legal document that outlines the ownership and operational procedures of your limited liability company in Idaho. It is essential for defining roles, responsibilities, and the management structure of the LLC, ensuring that all members are on the same page.

-

Why do I need an Idaho LLC operating agreement?

Having an Idaho LLC operating agreement is crucial as it helps prevent disputes among members by clearly defining each member’s rights and responsibilities. It also enhances your LLC’s credibility and can be vital for opening a business bank account or securing funding.

-

How much does it cost to create an Idaho LLC operating agreement?

The cost to create an Idaho LLC operating agreement can vary depending on whether you draft it yourself or use a professional service. Using airSlate SignNow, you can access templated agreements at a low cost, making it a cost-effective solution for your Idaho LLC's needs.

-

Can I edit my Idaho LLC operating agreement later?

Yes, an Idaho LLC operating agreement can be amended as your business evolves. It's important to revisit and update the agreement whenever there are signNow changes, such as a new member joining or a change in management structure to ensure it accurately reflects your LLC's operations.

-

What features does airSlate SignNow offer for creating an Idaho LLC operating agreement?

airSlate SignNow offers a user-friendly platform to create, edit, and electronically sign your Idaho LLC operating agreement securely. With its simple interface, you can customize templates, add fields for signatures, and manage document workflows with ease.

-

Is an Idaho LLC operating agreement required by law?

While Idaho law does not require LLCs to have an operating agreement, it is highly recommended to protect the interests of the members. Creating an Idaho LLC operating agreement with airSlate SignNow can help clarify roles and reduce potential conflicts in your business.

-

Can I integrate airSlate SignNow with other tools for managing my Idaho LLC operating agreement?

Yes, airSlate SignNow integrates seamlessly with various business tools to enhance your document management. These integrations allow you to streamline workflows and maintain organized records of your Idaho LLC operating agreement alongside other business documents.

Get more for Llc Operating Agreement Idaho

- Child abuse registry form manitoba ringette association

- Important information and funeral planning guide

- Essentail goaltending form

- Cibc pre authorized debit form pdf

- Certificate of automobile insurance final form

- Exhibition2016 space contract canadian music week form

- Medication reconciliation form

- Wfg canada form

Find out other Llc Operating Agreement Idaho

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease