Certificate of Automobile Insurance Final 2016-2026

What is the Certificate of Automobile Insurance Final?

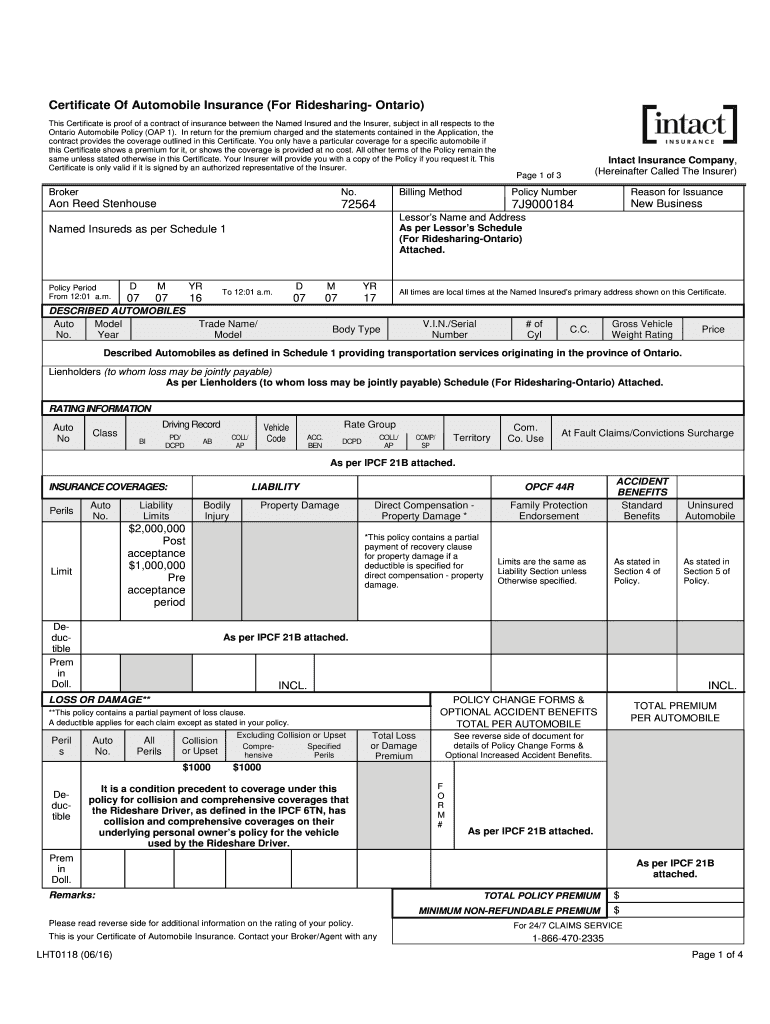

The Certificate of Automobile Insurance Final is a crucial document that serves as proof of insurance coverage for vehicles. This certificate outlines the details of the insurance policy, including the policyholder's name, vehicle information, coverage limits, and the effective dates of the policy. It is often required for various legal and administrative purposes, such as vehicle registration or when applying for loans related to the vehicle. Understanding this document is essential for ensuring compliance with state laws and regulations regarding automobile insurance.

How to Obtain the Certificate of Automobile Insurance Final

To obtain the Certificate of Automobile Insurance Final, policyholders typically need to contact their insurance provider. The process usually involves the following steps:

- Reach out to your insurance agent or customer service representative.

- Request the Certificate of Automobile Insurance Final and provide any necessary information, such as your policy number.

- Confirm the details that need to be included in the certificate, ensuring accuracy.

- Receive the certificate via email or physical mail, depending on your preference and the insurer's policies.

Key Elements of the Certificate of Automobile Insurance Final

The Certificate of Automobile Insurance Final contains several key elements that are vital for its validity:

- Policyholder Information: Name and address of the insured individual or entity.

- Vehicle Details: Make, model, and VIN (Vehicle Identification Number) of the insured vehicle.

- Coverage Limits: Details of the coverage provided, including liability limits and any additional coverages.

- Effective Dates: Start and end dates of the insurance policy.

- Insurer Information: Name and contact details of the insurance company providing the coverage.

Steps to Complete the Certificate of Automobile Insurance Final

Completing the Certificate of Automobile Insurance Final involves several important steps to ensure it is filled out correctly:

- Gather all necessary information, including your insurance policy details and vehicle specifications.

- Ensure that the certificate includes accurate and up-to-date information about your coverage.

- Review the document for any errors or omissions before submission.

- Submit the completed certificate to the relevant authority or organization that requires it.

Legal Use of the Certificate of Automobile Insurance Final

The Certificate of Automobile Insurance Final is legally recognized as proof of insurance in many jurisdictions. It is often required by state departments of motor vehicles (DMVs) for vehicle registration or renewal. Additionally, lenders may request this certificate when financing a vehicle. Ensuring that the certificate is accurate and up-to-date is essential to avoid legal complications and ensure compliance with state insurance regulations.

State-Specific Rules for the Certificate of Automobile Insurance Final

Each state in the U.S. may have specific rules governing the Certificate of Automobile Insurance Final. These rules can dictate the required information, the format of the certificate, and how it must be submitted. It is important for policyholders to be aware of their state's requirements to ensure that their certificate meets all legal standards. Checking with the local DMV or insurance regulatory body can provide clarity on these regulations.

Quick guide on how to complete certificate of automobile insurance final

Effortlessly Prepare Certificate Of Automobile Insurance Final on Any Device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without interruptions. Handle Certificate Of Automobile Insurance Final on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Certificate Of Automobile Insurance Final effortlessly

- Locate Certificate Of Automobile Insurance Final and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your adjustments.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Certificate Of Automobile Insurance Final to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of automobile insurance final

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What does limitation cancellation mean in the context of airSlate SignNow?

Limitation cancellation refers to the process of lifting restrictions on how long a signatory has to respond to a document within airSlate SignNow. This feature allows businesses to adapt to their workflow needs by ensuring that crucial documents can be signed without the constraints of time limitations.

-

How can airSlate SignNow assist with limitation cancellation in contract management?

airSlate SignNow provides tools that simplify limitation cancellation for contract management. By allowing users to adjust or cancel time limitations on document signing, businesses can avoid missed deadlines and ensure timely agreements are signNowed, enhancing operational efficiency.

-

Are there any additional costs associated with limitation cancellation features in airSlate SignNow?

No, limitation cancellation features are included in the standard pricing plans of airSlate SignNow. This means that all users can benefit from enhanced flexibility in document signing without incurring extra fees, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other tools for better limitation cancellation management?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing for better limitation cancellation management. These integrations can streamline processes and provide businesses with comprehensive solutions to handle their documentation efficiently.

-

How does limitation cancellation improve the user experience with airSlate SignNow?

Limitation cancellation improves user experience by providing flexibility in document signing timelines. This feature reduces the pressure on signatories, allowing them to review documents thoroughly and sign at their convenience, which ultimately leads to higher approval rates.

-

What types of documents can utilize the limitation cancellation feature in airSlate SignNow?

Various types of documents can utilize the limitation cancellation feature in airSlate SignNow, including contracts, agreements, and consent forms. By applying this feature, businesses can ensure that all essential documents remain actionable without the constraints of tight timelines.

-

Is limitation cancellation beneficial for startups using airSlate SignNow?

Absolutely! Limitation cancellation is especially beneficial for startups using airSlate SignNow as it provides greater flexibility in crucial document signing. This capability allows startups to focus on growth and development without the worry of stringent time constraints on their agreements.

Get more for Certificate Of Automobile Insurance Final

Find out other Certificate Of Automobile Insurance Final

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy