Nys 100 Form 2013

What is the Nys 100 Form

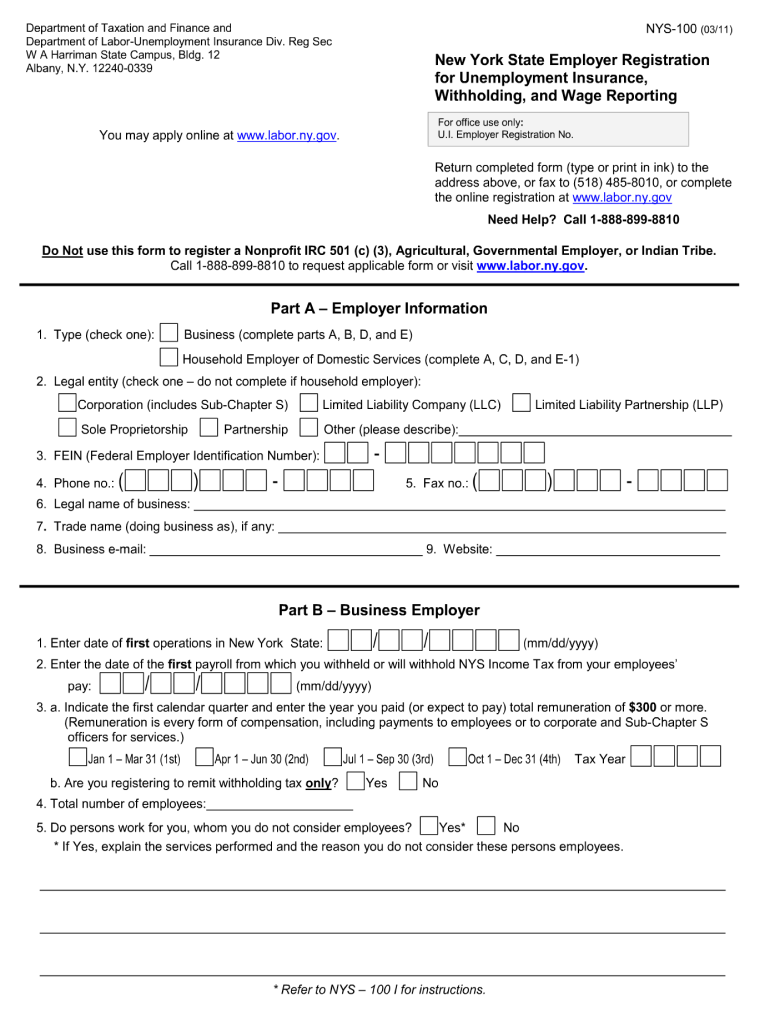

The Nys 100 Form is a crucial document used for filing personal income taxes in New York State. It serves as the primary tax return form for residents and is designed to report income, calculate tax liability, and claim any applicable credits or deductions. This form is essential for individuals who earn income within the state, ensuring compliance with state tax regulations.

How to use the Nys 100 Form

Using the Nys 100 Form involves several steps to ensure accurate reporting of your income and taxes owed. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the form by entering your personal information, income details, and deductions. It is important to follow the instructions provided with the form to avoid errors. Once completed, you can submit the form electronically or by mail, depending on your preference.

Steps to complete the Nys 100 Form

Completing the Nys 100 Form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy before submission.

Legal use of the Nys 100 Form

The Nys 100 Form is legally binding and must be completed truthfully and accurately. Filing this form is a legal requirement for residents earning income in New York State. Failure to file or providing false information can result in penalties, including fines and interest on unpaid taxes. It is advisable to retain copies of your submitted forms and supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Nys 100 Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to deadlines, as they can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Nys 100 Form can be submitted through various methods to accommodate different preferences. You can file electronically using approved tax software, which often provides a streamlined process and faster refunds. Alternatively, you can print the completed form and mail it to the appropriate state tax office. For those who prefer in-person assistance, some local tax offices may accept submissions directly, though this varies by location.

Quick guide on how to complete nys 100 2011 form

Complete Nys 100 Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Nys 100 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Nys 100 Form with ease

- Find Nys 100 Form and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text (SMS), invite link, or download to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Nys 100 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 100 2011 form

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the NYS 100 Form?

The NYS 100 Form is a required form for businesses operating in New York State to report their employee information and taxes. This form must be completed annually and is essential for complying with state tax regulations. With airSlate SignNow, you can easily eSign and manage your NYS 100 Form digitally, streamlining your workflow.

-

How does airSlate SignNow simplify the NYS 100 Form process?

airSlate SignNow provides a user-friendly platform that allows you to fill out and eSign the NYS 100 Form effortlessly. Our solution eliminates the need for paper forms, reducing errors and saving time. Plus, you can access your documents from any device, enhancing convenience and accessibility.

-

Is airSlate SignNow cost-effective for managing the NYS 100 Form?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective choice for managing the NYS 100 Form. Our plans are designed to fit various business sizes and budgets, allowing you to choose the best option for your needs without compromising on quality or features.

-

What features does airSlate SignNow provide for the NYS 100 Form?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and document tracking for the NYS 100 Form. These features help ensure that your forms are completed accurately and efficiently, while our secure platform keeps your information safe.

-

Can I integrate airSlate SignNow with other software for NYS 100 Form management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, such as CRM and accounting tools, to enhance your NYS 100 Form management. This integration helps streamline your processes and ensures that all necessary data is synchronized and easily accessible.

-

What benefits does airSlate SignNow offer for businesses completing the NYS 100 Form?

Using airSlate SignNow to complete the NYS 100 Form brings numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage all your documents in one place while ensuring that your forms comply with New York State regulations easily.

-

Is there customer support available for help with the NYS 100 Form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or challenges regarding the NYS 100 Form. Our support team is available to help you navigate the platform and ensure that you can complete your form accurately and effectively.

Get more for Nys 100 Form

- Grandparent visitation agreement form

- Child support worksheet arizona form

- Pneumococcal vaccine consent form

- Adoption paper form

- Mvap 22 relay manual form

- Aviva non financial endorsement form

- Office of juvenile justice community based services no ojj la form

- 35 fillable blank check templates pdf word form

Find out other Nys 100 Form

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast