Nys Form I 198p 2013

What is the Nys Form I 198p

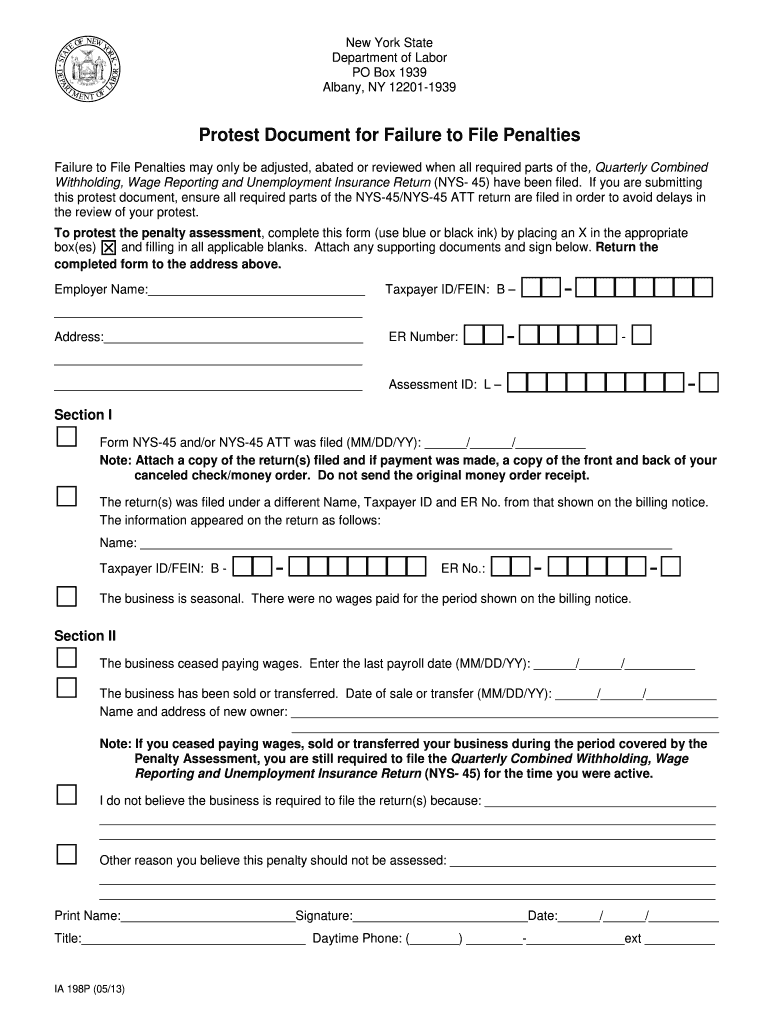

The Nys Form I 198p is a specific document used in New York State for tax purposes, particularly related to the reporting of income and withholding. This form is essential for individuals and businesses to accurately report their earnings and ensure compliance with state tax regulations. It serves as a declaration of income and is crucial for the calculation of taxes owed to the state.

How to use the Nys Form I 198p

Using the Nys Form I 198p involves filling out the required information accurately and submitting it to the appropriate tax authority. This form typically includes sections for personal identification, income details, and any applicable deductions or credits. It is important to follow the instructions provided with the form to ensure that all necessary information is included, which helps avoid delays in processing.

Steps to complete the Nys Form I 198p

Completing the Nys Form I 198p involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Include any deductions or credits you are eligible for, as outlined in the instructions.

- Review the completed form for accuracy before submission.

Legal use of the Nys Form I 198p

The Nys Form I 198p is legally binding when completed and submitted according to state guidelines. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed and dated to validate its contents, confirming that the information is correct to the best of the signer's knowledge.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Form I 198p are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines.

Key elements of the Nys Form I 198p

Key elements of the Nys Form I 198p include:

- Personal identification information

- Income reporting sections

- Deductions and credits applicable to the taxpayer

- Signature line for the taxpayer

- Instructions for submission

Who Issues the Form

The Nys Form I 198p is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. They provide resources and guidance for taxpayers on how to properly complete and submit the form.

Quick guide on how to complete nys form i 198p 2013

Effortlessly prepare Nys Form I 198p on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Nys Form I 198p on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Nys Form I 198p with ease

- Obtain Nys Form I 198p and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Leave behind the concerns of lost or mislaid files, the hassle of searching for forms, or errors that necessitate reprinting documents. airSlate SignNow manages all your document handling requirements in just a few clicks from your chosen device. Modify and electronically sign Nys Form I 198p and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys form i 198p 2013

Create this form in 5 minutes!

How to create an eSignature for the nys form i 198p 2013

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Nys Form I 198p?

Nys Form I 198p is a crucial tax document used by New York State residents when claiming specific deductions on their state income tax returns. This form is often necessary for individuals looking to identify eligible expenses and optimize their tax filings. It's important to ensure that all pertinent information is accurately provided on the Nys Form I 198p to avoid delays.

-

How can airSlate SignNow help with Nys Form I 198p?

airSlate SignNow offers a seamless platform for businesses to eSign and send Nys Form I 198p electronically, ensuring quick and secure document handling. With easy integration into existing workflows, you can streamline your tax filings process while reducing the need for physical paperwork. This efficiency saves time and resources, allowing you to focus on what matters most.

-

Is airSlate SignNow cost-effective for handling Nys Form I 198p?

Yes, airSlate SignNow provides a cost-effective solution for managing Nys Form I 198p, with competitive pricing plans tailored to fit various business needs. By using our platform, you can reduce printing and mailing costs while benefiting from intuitive features that simplify the signing process. This makes it an excellent investment for both small and large businesses.

-

What features does airSlate SignNow offer for managing Nys Form I 198p?

With airSlate SignNow, you have access to features like customizable templates for Nys Form I 198p, automated workflows, and real-time tracking of document status. Additionally, the platform ensures compliance with legal standards, making it easy to send, receive, and store your signed documents securely. All these tools work together to enhance your document management experience.

-

Can airSlate SignNow integrate with other software for Nys Form I 198p?

Absolutely! airSlate SignNow offers robust integrations with various applications, allowing you to manage Nys Form I 198p alongside your existing software solutions. Whether you're using CRM systems, accounting software, or project management tools, our platform can connect seamlessly to improve your overall workflow. This enables a more efficient process and reduces administrative burdens.

-

What are the benefits of using airSlate SignNow for Nys Form I 198p?

Utilizing airSlate SignNow for Nys Form I 198p brings numerous benefits, including increased efficiency, improved security, and enhanced compliance. The electronic signing process eliminates the hassles of manual paperwork, ensures faster turnaround times, and provides an audit trail for accountability. By adopting airSlate SignNow, businesses can transform their document handling processes.

-

Is there customer support available for Nys Form I 198p queries with airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist with any queries regarding Nys Form I 198p. Our knowledgeable team is available to help you navigate the platform and address any issues you may encounter during the document signing process. You can signNow our support team via chat, email, or phone for prompt assistance.

Get more for Nys Form I 198p

- Northern and downs paediatric case history form

- Mhsa volleyball roster amp line up cards form

- Dancing with the stars application form

- Duration recording form 35608859

- Remedial massage treatment plan form

- Schedule ptfc stfc form 1040me

- 6400 self inspection tool form

- 13 1 1 pay advice cover sheet form 2a docx

Find out other Nys Form I 198p

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later