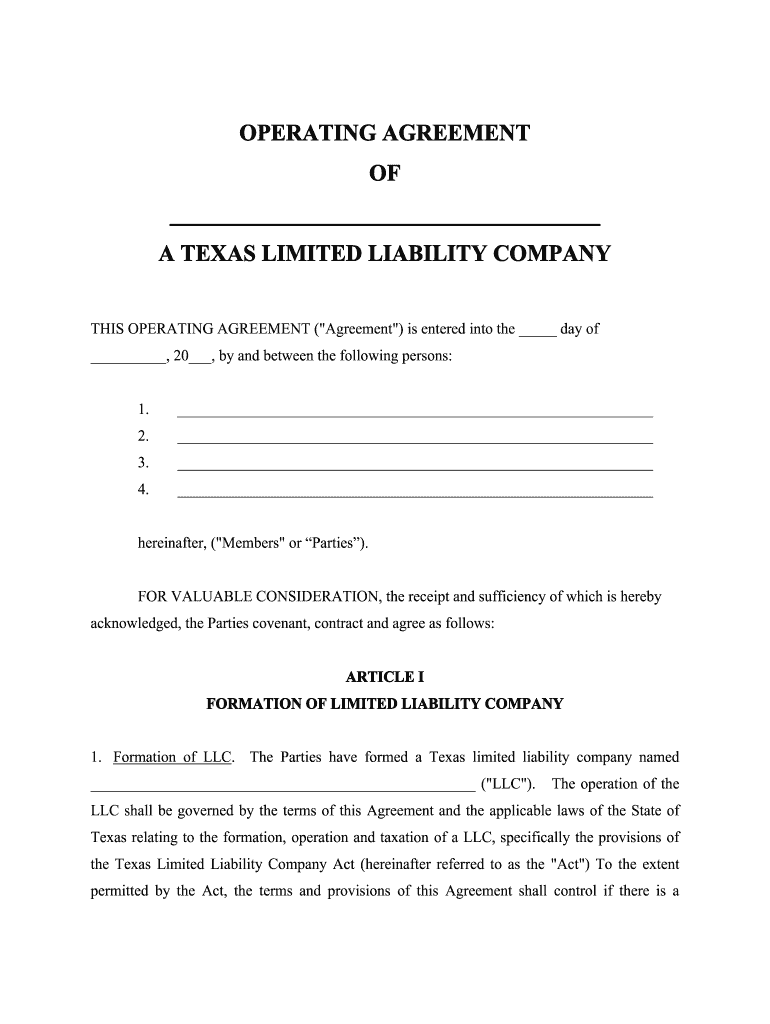

Llc Company Agreement Texas Form

What is the LLC Company Agreement in Texas

The LLC company agreement in Texas, often referred to as the operating agreement, is a crucial document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement serves as an internal guideline for the members of the LLC, detailing the rights and responsibilities of each member, how profits and losses will be distributed, and the procedures for making decisions. While Texas law does not mandate the creation of an operating agreement, having one is highly recommended to prevent misunderstandings and disputes among members.

Key Elements of the LLC Company Agreement in Texas

When drafting an LLC company agreement in Texas, it is essential to include several key elements to ensure clarity and legal compliance. These elements typically encompass:

- Member Information: Names and addresses of all members involved in the LLC.

- Management Structure: Details on whether the LLC will be member-managed or manager-managed.

- Capital Contributions: Information on the initial contributions made by each member and any future contributions required.

- Profit and Loss Distribution: Guidelines on how profits and losses will be allocated among members.

- Decision-Making Processes: Procedures for making important decisions, including voting rights and quorum requirements.

- Amendment Procedures: How the agreement can be modified in the future.

Steps to Complete the LLC Company Agreement in Texas

Completing the LLC company agreement in Texas involves several straightforward steps. Following this process can help ensure that all necessary information is included and that the document is legally sound:

- Gather Member Information: Collect the names and addresses of all LLC members.

- Define Management Structure: Decide whether the LLC will be managed by its members or by appointed managers.

- Outline Contributions: Specify the initial and future contributions of each member.

- Detail Profit and Loss Distribution: Clearly state how profits and losses will be shared.

- Establish Decision-Making Rules: Define how decisions will be made and the voting process.

- Review and Revise: Have all members review the agreement and make necessary revisions.

- Sign and Date: Ensure all members sign and date the agreement to validate it.

Legal Use of the LLC Company Agreement in Texas

The LLC company agreement in Texas holds significant legal weight, especially in disputes or when clarifying the rights of members. While not required by law, having a well-drafted agreement can protect members from personal liability and provide a clear framework for operations. It is advisable to consult with a legal professional to ensure that the agreement complies with Texas laws and adequately reflects the intentions of the members.

How to Obtain the LLC Company Agreement in Texas

Obtaining an LLC company agreement in Texas can be accomplished through several methods. Members can draft their own agreement using templates available online or seek assistance from legal professionals who specialize in business law. Many legal service providers offer customizable templates that can be tailored to meet the specific needs of the LLC. It is important to ensure that any template used complies with Texas regulations and includes all necessary elements for a comprehensive agreement.

Digital vs. Paper Version of the LLC Company Agreement

When it comes to the LLC company agreement, businesses have the option to maintain a digital or paper version. Digital agreements can be easily stored, shared, and signed electronically, providing convenience and efficiency. Utilizing electronic signature solutions can enhance the process, ensuring that all members can sign from anywhere. On the other hand, a paper version may be preferred for those who wish to have a physical copy for their records. Regardless of the format chosen, ensuring that the agreement is securely stored and accessible to all members is essential.

Quick guide on how to complete texas llc company agreement form

Effortlessly Prepare Llc Company Agreement Texas on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without disruptions. Handle Llc Company Agreement Texas on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Learn How to Edit and eSign Llc Company Agreement Texas with Ease

- Obtain Llc Company Agreement Texas and click Get Form to initiate the process.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which only takes moments and carries the same legal significance as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Llc Company Agreement Texas to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the texas llc company agreement form

How to generate an electronic signature for your Texas Llc Company Agreement Form in the online mode

How to generate an electronic signature for your Texas Llc Company Agreement Form in Chrome

How to make an eSignature for putting it on the Texas Llc Company Agreement Form in Gmail

How to generate an eSignature for the Texas Llc Company Agreement Form from your mobile device

How to generate an eSignature for the Texas Llc Company Agreement Form on iOS devices

How to create an eSignature for the Texas Llc Company Agreement Form on Android OS

People also ask

-

What is an LLC Company Agreement in Texas?

An LLC Company Agreement in Texas is a legal document that outlines the management structure and operational procedures of a limited liability company. It serves as a foundational agreement between members regarding their rights and responsibilities. Having a well-drafted LLC Company Agreement Texas is crucial for ensuring smooth operations and reducing potential disputes.

-

Why do I need an LLC Company Agreement in Texas?

An LLC Company Agreement in Texas is essential for defining the roles of members, profit-sharing, and decision-making processes within the company. It provides legal protection to members by establishing clear guidelines and can help prevent conflicts. Without this agreement, Texas law provides default rules that may not align with your business goals.

-

How do I create an LLC Company Agreement in Texas?

Creating an LLC Company Agreement in Texas involves drafting a document that includes essential information about your business structure and member responsibilities. You can use templates available online or consult a legal professional to ensure compliance with Texas laws. Using airSlate SignNow, you can easily eSign and store your LLC Company Agreement securely.

-

What are the benefits of having an LLC Company Agreement in Texas?

Having an LLC Company Agreement in Texas offers several benefits, including liability protection for members and clear guidelines on the management of the company. It also provides flexibility in structuring member roles and profit distribution, which can be tailored to meet specific needs. Overall, it helps safeguard your business interests.

-

Can I modify my LLC Company Agreement in Texas later?

Yes, you can modify your LLC Company Agreement in Texas as your business evolves. Amendments can be made to update member roles, change profit-sharing arrangements, or reflect any signNow changes in your business operations. It's advisable to document these changes and have all members eSign the updated agreement using airSlate SignNow.

-

How much does it cost to draft an LLC Company Agreement in Texas?

The cost to draft an LLC Company Agreement in Texas can vary signNowly based on whether you use a template, hire an attorney, or use an online service. Generally, you can expect to pay anywhere from $50 to several hundred dollars depending on the complexity and professional assistance needed. Utilizing airSlate SignNow can help streamline the signing process, potentially saving you time and money.

-

Does airSlate SignNow support eSigning for LLC Company Agreements in Texas?

Yes, airSlate SignNow fully supports eSigning for LLC Company Agreements in Texas. Our platform provides an easy-to-use interface that allows all members to securely eSign documents from anywhere. This feature ensures that your agreement is executed quickly and efficiently, aligning with your business needs.

Get more for Llc Company Agreement Texas

Find out other Llc Company Agreement Texas

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter