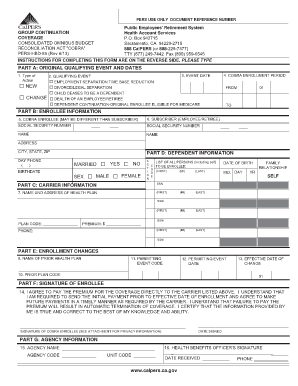

CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca 2019-2026

What is the reconciliation act?

The reconciliation act is a legislative process in the United States that allows for expedited consideration of certain tax, spending, and debt limit legislation. This process is primarily used to align federal budget policy with the priorities outlined in the annual budget resolution. By utilizing reconciliation, Congress can pass budget-related legislation with a simple majority in the Senate, avoiding the threat of a filibuster. This act is crucial for implementing significant changes in fiscal policy, including adjustments to entitlement programs and tax codes.

Key elements of the reconciliation act

Several key elements define the reconciliation act. First, it must adhere to the guidelines set forth in the Congressional Budget Act of 1974. This includes specific instructions that direct committees to achieve certain budgetary goals. Additionally, the reconciliation process is limited to provisions that directly affect federal spending or revenue. This means that extraneous policy changes are typically not permitted. The process also includes a time limit for debate in the Senate, which helps expedite the passage of the legislation.

Steps to complete the reconciliation act process

Completing the reconciliation act process involves several steps. Initially, Congress must adopt a budget resolution that includes reconciliation instructions. Following this, relevant committees draft legislation that aligns with the budgetary goals. Once the legislation is prepared, it is brought to the floor for debate and voting. If passed by both chambers of Congress, the bill is sent to the President for approval. This streamlined approach allows for significant legislative changes to be enacted efficiently.

Eligibility criteria for reconciliation

Eligibility for the reconciliation process is determined by the provisions outlined in the budget resolution. Only items that directly impact federal revenues or expenditures can be included. This means that any proposed changes must have a clear budgetary effect. Additionally, the reconciliation process is typically limited to specific timeframes established in the budget resolution, which can vary from year to year. Understanding these criteria is essential for lawmakers seeking to utilize this legislative tool effectively.

IRS guidelines related to the reconciliation act

The Internal Revenue Service (IRS) plays a role in the implementation of tax-related provisions of the reconciliation act. This includes issuing guidelines on how changes to tax laws will be applied. Taxpayers must be aware of these changes, as they can affect filing requirements, deductions, and credits. The IRS provides resources and updates to ensure compliance with the new regulations established through the reconciliation process, helping taxpayers navigate any adjustments in their obligations.

Penalties for non-compliance with reconciliation provisions

Failure to comply with the provisions established through the reconciliation act can result in various penalties. These may include financial penalties, interest on unpaid taxes, and potential legal consequences. It is crucial for individuals and businesses to understand their responsibilities under the new legislation to avoid these repercussions. Keeping informed about compliance requirements can help mitigate risks associated with non-compliance.

Quick guide on how to complete calpers group continuation coverage cobra calpers group continuation coverage cobra calpers ca

Complete CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca effortlessly on any device

Digital document management has become popular among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without issues. Manage CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca on any device with airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

The easiest way to modify and eSign CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca with ease

- Find CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your adjustments.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Edit and eSign CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calpers group continuation coverage cobra calpers group continuation coverage cobra calpers ca

Create this form in 5 minutes!

How to create an eSignature for the calpers group continuation coverage cobra calpers group continuation coverage cobra calpers ca

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the reconciliation act in the context of document signing?

The reconciliation act refers to the process of aligning financial transactions and agreements through electronic signatures. By using airSlate SignNow, businesses can ensure that documents are signed in compliance with the reconciliation act, making the management of financial records simpler and more secure.

-

How does airSlate SignNow help with compliance regarding the reconciliation act?

airSlate SignNow provides features that help businesses stay compliant with the reconciliation act by ensuring that all electronic signatures are legally binding. Our platform follows industry standards and regulations, ensuring that your documents meet the necessary compliance requirements.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to suit various business sizes and needs. Each plan includes features that support compliance with the reconciliation act, allowing you to choose an option that best fits your budget and document signing requirements.

-

What features does airSlate SignNow offer to support the reconciliation act?

Our platform includes features like template creation, automated reminders, and audit trails which are essential for compliance with the reconciliation act. These tools simplify the document signing process while ensuring that every step is tracked and accessible.

-

Can airSlate SignNow integrate with other software solutions for reconciliation act compliance?

Yes, airSlate SignNow easily integrates with popular business applications, enhancing your workflow and ensuring all documents comply with the reconciliation act. With seamless integrations, you can streamline your document management processes while maintaining compliance.

-

What are the benefits of using airSlate SignNow for documents related to the reconciliation act?

Using airSlate SignNow for your document management offers numerous benefits like increased accuracy and efficiency. By automating the signing process and ensuring compliance with the reconciliation act, your business can save time and reduce the risk of errors in financial documentation.

-

Is airSlate SignNow suitable for companies of all sizes regarding the reconciliation act?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, providing scalable solutions that comply with the reconciliation act. Whether you are a small startup or a large corporation, our platform can adjust to your specific document signing needs.

Get more for CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca

- Biting report kiddie academy form

- Cerere reziliere contract moldtelecom form

- Akc litter registration application american kennel club form

- Nab form pb 18

- Lulaway security jobs form

- Florida birth certificate application form pdf 73783294

- Form fda 2877

- Rental property partnership agreement template form

Find out other CalPERS Group Continuation Coverage COBRA CalPERS Group Continuation Coverage COBRA Calpers Ca

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form