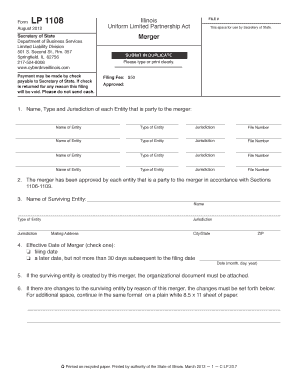

Form 1108

What is the Form 1108

The Form 1108 is a tax document used by businesses to claim certain deductions related to expenses incurred during the tax year. This form is essential for entities that wish to report their expenses accurately and ensure compliance with Internal Revenue Service (IRS) regulations. It provides a structured format for detailing various costs, helping taxpayers substantiate their claims and potentially reduce their overall tax liability.

How to use the Form 1108

To use the Form 1108 effectively, taxpayers should first gather all necessary financial documents related to their expenses. This includes receipts, invoices, and any other relevant records. Once these documents are organized, the form can be filled out, detailing each expense accurately. It is crucial to follow IRS guidelines when completing the form to avoid errors that could lead to delays or penalties.

Steps to complete the Form 1108

Completing the Form 1108 involves several key steps:

- Gather all relevant financial documentation.

- Download the Form 1108 from the IRS website or obtain a physical copy.

- Fill in your business information, including name, address, and tax identification number.

- List all applicable expenses in the designated sections, ensuring accuracy and completeness.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the appropriate deadline, ensuring you keep a copy for your records.

Legal use of the Form 1108

The legal use of the Form 1108 is governed by IRS regulations, which stipulate that all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties, including fines or audits. It is important for businesses to ensure that they are using the form in accordance with the law, maintaining proper documentation to support their claims.

Key elements of the Form 1108

Key elements of the Form 1108 include:

- Business Information: This section requires the taxpayer's name, address, and tax identification number.

- Expense Categories: The form includes specific categories for different types of expenses, such as operational costs, employee wages, and materials.

- Total Expenses: A summary section where total expenses must be calculated and reported.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1108 typically align with the general tax filing deadlines set by the IRS. Businesses should be aware of these dates to ensure timely submission. Generally, the deadline for filing is the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It is advisable to check for any updates or changes in deadlines annually.

Quick guide on how to complete form 1108

Manage Form 1108 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Access Form 1108 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The easiest way to modify and electronically sign Form 1108 seamlessly

- Locate Form 1108 and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this function.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, either by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate issues with lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Form 1108 and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1108

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1108 and its purpose?

Form 1108 is a crucial document used by businesses to request an extension of time for filing a tax return. It ensures that you won't incur late fees while providing you extra time to prepare your submissions accurately.

-

How can airSlate SignNow help with Form 1108?

AirSlate SignNow streamlines the process of completing and submitting Form 1108 by providing an intuitive eSignature platform. This allows users to fill out the form electronically, ensuring efficient processing and timely submissions.

-

Is there a cost associated with using airSlate SignNow for Form 1108?

Yes, while airSlate SignNow offers a range of pricing plans, using it to manage Form 1108 can be a cost-effective option compared to traditional paper filing. Users benefit from minimized errors and faster processing times with an affordable subscription.

-

What features does airSlate SignNow offer for Form 1108?

AirSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking, all of which are beneficial when managing Form 1108. These features enhance workflow efficiency and document security.

-

Can I integrate airSlate SignNow with other applications for Form 1108?

Absolutely! AirSlate SignNow supports integrations with popular applications, making it easy to incorporate Form 1108 into your existing workflow. This ensures seamless document management and improves productivity.

-

What are the benefits of using airSlate SignNow for handling Form 1108?

Using airSlate SignNow for Form 1108 offers numerous benefits, including quicker processing times, enhanced security, and reduced paperwork. These advantages help businesses stay organized and compliant with tax regulations.

-

How secure is airSlate SignNow for submitting Form 1108?

AirSlate SignNow implements top-tier security measures to protect your documents, including Form 1108. With features like encryption and secure cloud storage, your sensitive information remains safe from unauthorized access.

Get more for Form 1108

- Emergency contact information bsunshineb bpreschoolb sunshine preschool

- Nfpa hydrant flow test form

- Orthodontic contract template form

- 101 funny teacher awards form

- Worksheet for rating residents form

- Neft mandate form 444159548

- Safety standards certificate and inspection stickers order form

- Missouri affidavit form

Find out other Form 1108

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple