Mo Claiming Tax Credits 2014-2026

What is the Mo Claiming Tax Credits

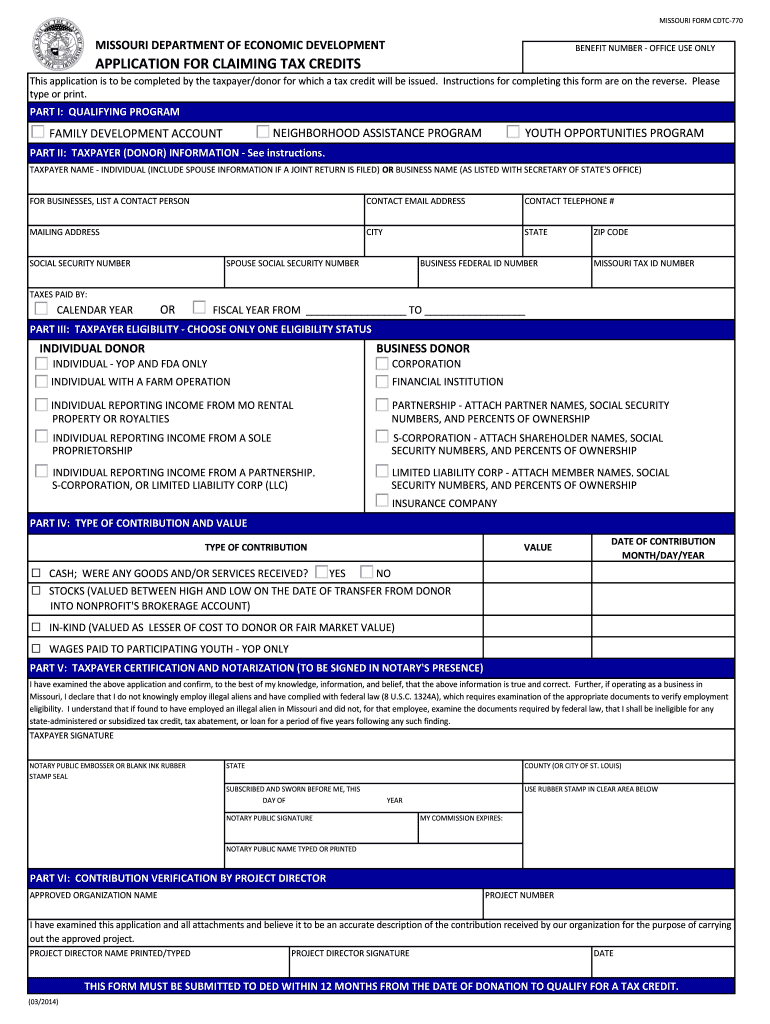

The Mo Claiming Tax Credits refers to various tax credit programs available in Missouri that allow eligible individuals and businesses to reduce their tax liabilities. These credits can be claimed for several purposes, including historic preservation, low-income housing, and property tax relief. Understanding the specific programs and their benefits is crucial for maximizing potential savings on your tax return.

Eligibility Criteria

To qualify for the Mo Claiming Tax Credits, applicants must meet specific eligibility requirements that vary by program. Generally, individuals must demonstrate a certain income level, residency status, or property ownership. For instance, the Missouri Property Tax Credit program is available to seniors and disabled individuals who meet income thresholds. It is essential to review the criteria for each credit type to ensure compliance.

Steps to complete the Mo Claiming Tax Credits

Completing the Mo Claiming Tax Credits application involves several key steps:

- Gather necessary documentation, such as income statements, property tax records, and identification.

- Obtain the correct application form, which may vary depending on the specific tax credit.

- Fill out the application accurately, ensuring all required fields are completed.

- Review the application for completeness and accuracy before submission.

- Submit the application via the designated method, whether online, by mail, or in person.

Required Documents

When applying for the Mo Claiming Tax Credits, applicants must provide various documents to support their claims. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Property tax statements or receipts.

- Identification documents, like a driver's license or Social Security card.

- Any additional documents specific to the tax credit being claimed.

Form Submission Methods (Online / Mail / In-Person)

Applicants can submit their Mo Claiming Tax Credits forms through various methods, depending on the specific program guidelines. Common submission methods include:

- Online: Many applications can be completed and submitted electronically through the Missouri Department of Revenue's website.

- Mail: Applicants may choose to print their completed forms and send them to the appropriate address via postal service.

- In-Person: Some individuals prefer to submit their applications directly at local tax offices or designated locations.

Key elements of the Mo Claiming Tax Credits

Understanding the key elements of the Mo Claiming Tax Credits is essential for successful application. Important aspects include:

- Credit Amount: Each tax credit has a specific value that can be claimed, which may vary based on eligibility and program type.

- Application Deadlines: Timely submission is crucial, as each program has its own deadlines for applications.

- Renewal Requirements: Some credits may require annual renewal or additional documentation to maintain eligibility.

Quick guide on how to complete mo claiming tax credits

Facilitate Mo Claiming Tax Credits on any gadget with ease

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Mo Claiming Tax Credits on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to alter and eSign Mo Claiming Tax Credits effortlessly

- Obtain Mo Claiming Tax Credits and click on Obtain Form to begin.

- Use the tools we provide to complete your document.

- Mark pertinent portions of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Signature tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Complete button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Mo Claiming Tax Credits and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo claiming tax credits

Create this form in 5 minutes!

How to create an eSignature for the mo claiming tax credits

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the nap grant application for claiming tax credits?

The nap grant application for claiming tax credits is a specific process that allows eligible businesses to access funds aimed at encouraging community development and social services. By understanding the application process, businesses can effectively utilize these grants to enhance their operations and potentially reduce their tax liabilities.

-

How can airSlate SignNow assist with my nap grant application for claiming tax credits?

airSlate SignNow simplifies the process of managing your nap grant application for claiming tax credits by providing a user-friendly platform for document preparation, signing, and storage. With its electronic signature capabilities, you can streamline your applications and improve the efficiency of communication with stakeholders.

-

What are the costs associated with using airSlate SignNow for grant applications?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Whether you are a small enterprise or a large organization handling multiple nap grant applications for claiming tax credits, you can find a cost-effective solution that fits your budget.

-

Can airSlate SignNow be integrated with other applications for my grant application process?

Yes, airSlate SignNow seamlessly integrates with many popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your documents and nap grant application for claiming tax credits more effectively, ensuring a smooth workflow across all tools you use.

-

What features does airSlate SignNow offer for completing nap grant applications?

airSlate SignNow provides a range of features designed to enhance the nap grant application for claiming tax credits, including customizable templates, bulk sending, and advanced security measures. These features help ensure that your applications are completed accurately and efficiently while maintaining confidentiality.

-

What benefits can I expect when using airSlate SignNow for my nap grant application?

Using airSlate SignNow for your nap grant application for claiming tax credits can save you time and reduce administrative burdens. The platform allows for quick document handling and ensures that all signatures are collected efficiently, which expedites the entire application process.

-

Is airSlate SignNow suitable for small businesses applying for grants?

Absolutely! airSlate SignNow is specifically designed to cater to businesses of any size, including small businesses seeking to manage their nap grant application for claiming tax credits. Its intuitive interface and flexible pricing make it a great choice for teams looking to optimize their grant application process on a budget.

Get more for Mo Claiming Tax Credits

Find out other Mo Claiming Tax Credits

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation