Connecticut Improvement Form

What is the Connecticut Improvement Form

The Connecticut capital improvement form is a document used to certify that certain improvements made to a property qualify for tax exemption. This form is essential for property owners who wish to benefit from tax savings associated with capital improvements. It outlines specific criteria and requirements that must be met to ensure compliance with state regulations.

How to use the Connecticut Improvement Form

To effectively use the Connecticut capital improvement form, property owners should first verify that their improvements are eligible for tax exemption. Once confirmed, the form must be filled out accurately with details regarding the property and the nature of the improvements. After completion, the form should be submitted to the appropriate local tax authority for review.

Steps to complete the Connecticut Improvement Form

Completing the Connecticut capital improvement form involves several key steps:

- Gather necessary information about the property and improvements.

- Fill out the form with accurate details, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form to the local tax authority by the specified deadline.

Legal use of the Connecticut Improvement Form

For the Connecticut capital improvement form to be legally valid, it must meet specific criteria outlined by state law. This includes proper completion, submission within deadlines, and adherence to all relevant regulations. The form serves as a legal declaration that the improvements made are eligible for tax benefits, making it crucial for compliance.

Key elements of the Connecticut Improvement Form

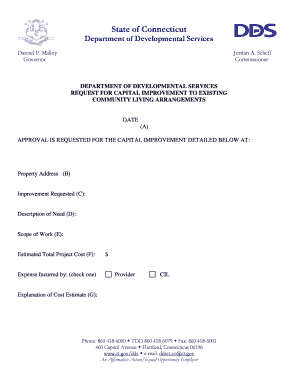

The Connecticut capital improvement form includes several key elements that must be addressed for it to be valid:

- Property identification details, including address and owner information.

- A description of the improvements made, specifying the type and cost.

- Signatures of the property owner or authorized representative.

- Any supporting documentation required to substantiate the claims made on the form.

Eligibility Criteria

To qualify for tax exemption under the Connecticut capital improvement form, certain eligibility criteria must be met. These typically include:

- The improvements must enhance the value of the property.

- They must be permanent in nature, such as structural changes or installations.

- The property must be used for qualified purposes as defined by state law.

Quick guide on how to complete connecticut improvement form

Effortlessly Prepare Connecticut Improvement Form on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the required format and securely keep it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents quickly without holdups. Handle Connecticut Improvement Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and electronically sign Connecticut Improvement Form with ease

- Find Connecticut Improvement Form and then click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require re-printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Alter and electronically sign Connecticut Improvement Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut improvement form

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Connecticut capital improvement form?

The Connecticut capital improvement form is a document used by businesses to request funding for signNow projects that enhance public infrastructure. It outlines the necessary details and specifications for proposed improvements, making it essential for effective project management in Connecticut.

-

How can airSlate SignNow assist with the Connecticut capital improvement form?

AirSlate SignNow streamlines the process of filling out and eSigning the Connecticut capital improvement form, allowing users to easily manage their documents online. With its user-friendly interface, businesses can quickly complete and submit their forms without any hassle.

-

Is airSlate SignNow cost-effective for submitting the Connecticut capital improvement form?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to handle the Connecticut capital improvement form efficiently. Our pricing plans are designed to suit varying needs, ensuring that you get excellent value without compromising on features.

-

What features does airSlate SignNow provide for the Connecticut capital improvement form?

AirSlate SignNow provides features such as secure eSigning, document templates, and real-time tracking for the Connecticut capital improvement form. These tools enhance efficiency and make it easier for businesses to manage and submit their forms.

-

Can I integrate airSlate SignNow with other applications while using the Connecticut capital improvement form?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, enabling users to connect their workflow with the Connecticut capital improvement form. This integration capability enhances productivity by allowing data to flow smoothly between platforms.

-

What are the benefits of using airSlate SignNow for the Connecticut capital improvement form?

Using airSlate SignNow for the Connecticut capital improvement form provides several benefits, including improved efficiency, reduced turnaround times, and enhanced accuracy in document handling. These advantages help businesses manage their projects more effectively.

-

Is there customer support available for users of the Connecticut capital improvement form with airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support for users dealing with the Connecticut capital improvement form. Our team is available to assist with any queries or technical support needed to ensure a smooth experience.

Get more for Connecticut Improvement Form

- Morgan dollar checklist 396031400 form

- Personal financial statement mcclure pools form

- Town of oyster bay code enforcement form

- Nicor gas sample bill form

- Dust control permit renewal form clark county nevada clarkcountynv

- Contractor employment agreement template form

- Zero hours employment contract template form

- Contractor subcontractor agreement template form

Find out other Connecticut Improvement Form

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed