Louisiana Short Sale Addendum to Purchase Agreement Form

What is the Louisiana Short Sale Addendum To Purchase Agreement

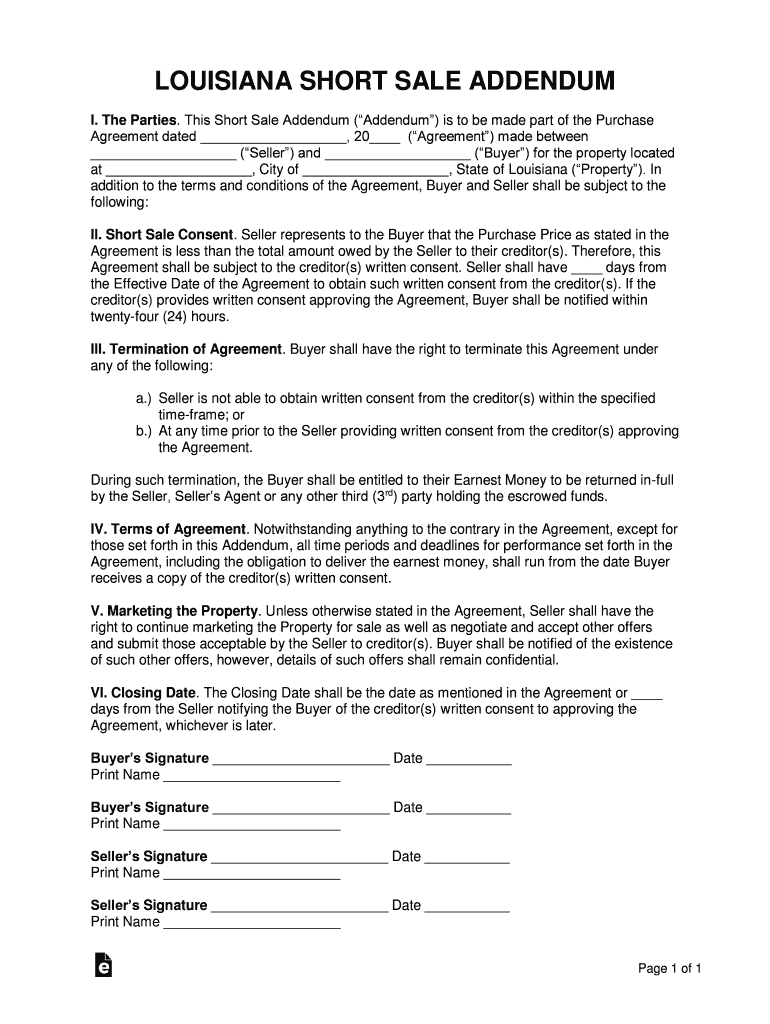

The Louisiana short sale addendum to purchase agreement is a legal document that outlines specific terms and conditions related to a short sale transaction. A short sale occurs when a property is sold for less than the amount owed on the mortgage, requiring lender approval. This addendum serves to protect both the buyer and seller by clarifying the responsibilities and expectations of each party, as well as the conditions under which the sale may proceed.

Key elements of the Louisiana Short Sale Addendum To Purchase Agreement

Several crucial elements are included in the Louisiana short sale addendum to purchase agreement. These typically encompass:

- Approval Contingency: This clause specifies that the sale is contingent upon the lender's approval of the short sale terms.

- Disclosure of Liens: The seller must disclose any existing liens on the property that may affect the sale.

- Timeframe for Approval: This section outlines the expected timeline for lender approval, which can vary significantly.

- Buyer's Rights: It details the rights of the buyer in the event the lender does not approve the short sale.

Steps to complete the Louisiana Short Sale Addendum To Purchase Agreement

Completing the Louisiana short sale addendum involves several key steps to ensure that all necessary information is accurately provided. The process typically includes:

- Gathering relevant financial documents, including mortgage statements and any correspondence with the lender.

- Filling out the addendum with accurate details regarding the property, seller, and buyer.

- Reviewing the addendum with legal counsel or a real estate professional to ensure compliance with state laws.

- Submitting the completed addendum to the lender for approval along with the purchase agreement.

Legal use of the Louisiana Short Sale Addendum To Purchase Agreement

The legal use of the Louisiana short sale addendum is governed by state and federal laws regarding real estate transactions. It is essential that both parties understand their rights and obligations as outlined in the addendum. This document must be signed by all parties involved to be considered legally binding. Additionally, compliance with local regulations and lender requirements is necessary for the addendum to be enforceable.

How to obtain the Louisiana Short Sale Addendum To Purchase Agreement

The Louisiana short sale addendum can typically be obtained through real estate professionals, such as agents or brokers, who are familiar with local forms and regulations. It may also be available through legal resources or real estate websites that provide templates for various real estate documents. Ensuring that the version used is up-to-date and compliant with current laws is crucial.

State-specific rules for the Louisiana Short Sale Addendum To Purchase Agreement

State-specific rules regarding the Louisiana short sale addendum may include unique disclosure requirements and timelines for lender responses. Louisiana law may dictate how the addendum should be structured and what information must be included. Familiarity with these regulations is important for both buyers and sellers to ensure that the transaction proceeds smoothly and legally.

Quick guide on how to complete louisiana short sale addendum to purchase agreement

Complete Louisiana Short Sale Addendum To Purchase Agreement effortlessly on any device

Digital document management is increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents promptly and without difficulties. Handle Louisiana Short Sale Addendum To Purchase Agreement on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The most efficient way to modify and eSign Louisiana Short Sale Addendum To Purchase Agreement effortlessly

- Find Louisiana Short Sale Addendum To Purchase Agreement and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to preserve your modifications.

- Select your preferred method to submit your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Louisiana Short Sale Addendum To Purchase Agreement and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana short sale addendum to purchase agreement

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is a short sale addendum?

A short sale addendum is a legal document used in real estate transactions to outline the specific terms and conditions for a short sale. This addendum typically addresses issues like lender approval and timelines. Understanding and using a short sale addendum can facilitate smoother transactions and minimize delays.

-

How do I create a short sale addendum using airSlate SignNow?

Creating a short sale addendum with airSlate SignNow is straightforward. You can use our customizable templates to draft your addendum quickly. After drafting, you can easily send it for electronic signatures, ensuring all parties are on the same page.

-

Is airSlate SignNow cost-effective for real estate professionals dealing with short sales?

Yes, airSlate SignNow offers a cost-effective solution for real estate professionals managing short sales. Our pricing plans are designed to accommodate various business sizes, ensuring you get maximum value. With seamless document management and eSigning capabilities, our platform is an investment in efficiency.

-

What features does airSlate SignNow offer for managing short sale documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and tracking capabilities for all documents, including short sale addendums. You can also integrate it with your existing CRM to streamline your workflow. These features help simplify the complexities of short sale transactions.

-

What are the benefits of using airSlate SignNow for short sale addendums?

Using airSlate SignNow for short sale addendums offers several benefits, including reduced paperwork, quicker turnaround times, and enhanced security for sensitive documents. Additionally, our platform enhances collaboration among parties involved in the transaction. This ultimately leads to a more efficient closing process.

-

Can I integrate airSlate SignNow with other tools for short sale management?

Absolutely! airSlate SignNow supports integrations with various popular tools and platforms, making it easier to manage short sale addendums alongside your other business processes. Whether it’s CRM software or project management tools, our integrations enhance your overall productivity.

-

What kind of support does airSlate SignNow provide for users dealing with short sales?

airSlate SignNow offers robust customer support to assist users with short sale addendums and any other inquiries. Our support team is available via chat, email, and phone to ensure you get the help you need promptly. We also provide extensive resources and guides for a better user experience.

Get more for Louisiana Short Sale Addendum To Purchase Agreement

- Behavioral learning for adaptive electronic warfare form

- Speech therapy session notes template form

- Fsis form 4735 4 fillable

- Connecticut sportsplex official youth waiver and release liability form

- Mr206 form

- At 167 memorandum of garnisheeattachmentenforcement of judgment judicial council forms

- Addendum for employment contract template form

- Administrative assistant employment contract template form

Find out other Louisiana Short Sale Addendum To Purchase Agreement

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document