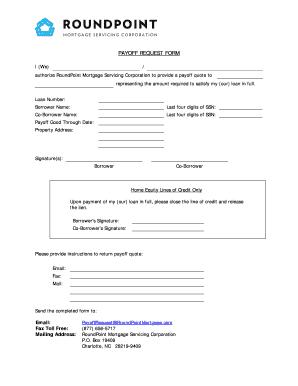

Roundpoint Mortgage Payoff Form

What is the Roundpoint Mortgage Payoff

The Roundpoint mortgage payoff refers to the process of settling the outstanding balance on a mortgage serviced by Roundpoint Mortgage Servicing Corporation. This process involves submitting a formal request to obtain a payoff statement, which outlines the total amount needed to fully pay off the mortgage. This statement is crucial for homeowners looking to refinance, sell their property, or simply eliminate their mortgage debt. Understanding the terms and conditions associated with the payoff is essential for ensuring a smooth transaction.

How to Obtain the Roundpoint Mortgage Payoff

To obtain the Roundpoint mortgage payoff, homeowners typically need to follow specific steps. First, they should gather relevant information, such as their account number and property details. Next, they can submit a Roundpoint payoff request through the company’s official channels, which may include online forms, phone calls, or written requests. It is important to ensure that all required information is accurate to avoid delays in processing. Homeowners should also inquire about any fees associated with the payoff request, as these can vary based on the terms of the mortgage.

Steps to Complete the Roundpoint Mortgage Payoff

Completing the Roundpoint mortgage payoff involves several key steps:

- Gather necessary documentation, including your mortgage account number and property address.

- Request a payoff statement from Roundpoint Mortgage Servicing Corporation, specifying the date for which the payoff amount is requested.

- Review the payoff statement carefully to understand the total amount due, including any applicable fees or interest.

- Make the payment using the method specified in the payoff statement, ensuring that you keep records of the transaction.

- Confirm with Roundpoint that the payment has been received and that the mortgage is officially paid off.

Legal Use of the Roundpoint Mortgage Payoff

The legal use of the Roundpoint mortgage payoff is governed by various regulations that ensure the process is valid and binding. When submitting a payoff request, it is essential to comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and documents can be legally recognized, provided they meet certain criteria. Homeowners should ensure that their requests are executed correctly to avoid any potential legal issues.

Required Documents for the Roundpoint Mortgage Payoff

When preparing to request a Roundpoint mortgage payoff, certain documents are typically required. Homeowners should have the following on hand:

- Mortgage account number

- Property address

- Identification documents, such as a driver’s license or Social Security number

- Any previous correspondence with Roundpoint regarding the mortgage

Having these documents ready can streamline the process and help ensure that the payoff request is processed efficiently.

Form Submission Methods for the Roundpoint Mortgage Payoff

Homeowners can submit their Roundpoint mortgage payoff requests through various methods. The most common submission methods include:

- Online submission via the Roundpoint website, where users can fill out a digital form.

- Phone requests, where homeowners can call customer service to initiate the process.

- Written requests sent via mail, which should include all necessary documentation and information.

Choosing the right method depends on personal preference and urgency, as online submissions may be processed faster than mailed requests.

Quick guide on how to complete roundpoint mortgage payoff

Effortlessly prepare Roundpoint Mortgage Payoff on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Roundpoint Mortgage Payoff on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and eSign Roundpoint Mortgage Payoff with ease

- Find Roundpoint Mortgage Payoff and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Roundpoint Mortgage Payoff to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the roundpoint mortgage payoff

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a roundpoint payoff request?

A roundpoint payoff request is a formal document issued to request the total amount needed to pay off a loan or mortgage. Using airSlate SignNow, you can easily create and send this request, ensuring that you have all the necessary information for your financial dealings.

-

How does airSlate SignNow facilitate roundpoint payoff requests?

airSlate SignNow provides an intuitive platform for creating and sending roundpoint payoff requests securely and efficiently. Our eSignature solution allows for quick approvals, ensuring that your requests are processed without unnecessary delays.

-

Are there any fees associated with making a roundpoint payoff request through airSlate SignNow?

airSlate SignNow offers competitive pricing plans that may include fees based on usage, but creating and sending a roundpoint payoff request is simple and cost-effective. You can choose a plan that best suits your needs and budget while enjoying the benefits of our features.

-

Can I track my roundpoint payoff request status in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your roundpoint payoff request in real-time. You can see when your request is sent, viewed, and signed, giving you peace of mind that your documents are progressing smoothly.

-

What features make airSlate SignNow suitable for handling roundpoint payoff requests?

airSlate SignNow comes equipped with features such as customizable templates, automatic reminders, and secure cloud storage, making it ideal for managing roundpoint payoff requests. These tools streamline the process and enhance efficiency, allowing you to focus on your business.

-

How can I integrate airSlate SignNow with other tools for my roundpoint payoff request needs?

airSlate SignNow seamlessly integrates with various CRM and document management systems, enhancing your ability to manage roundpoint payoff requests within your existing workflow. This integration simplifies data transfer and improves overall efficiency in handling documents.

-

Is airSlate SignNow suitable for businesses of all sizes when it comes to roundpoint payoff requests?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, making it an excellent choice for managing roundpoint payoff requests. Whether you're a small startup or a large enterprise, our solution scales to meet your specific requirements.

Get more for Roundpoint Mortgage Payoff

Find out other Roundpoint Mortgage Payoff

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure