CTCAC Compliance Monitoring State Treasurer's Office 2020

What is the CTCAC Compliance Monitoring State Treasurer's Office

The CTCAC Compliance Monitoring State Treasurer's Office is a regulatory framework designed to ensure compliance with the California Tax Credit Allocation Committee (CTCAC) guidelines. This office oversees the monitoring of compliance for low-income housing tax credits, ensuring that properties meet the necessary standards and requirements. The primary goal is to promote affordable housing while safeguarding taxpayer interests. This form is essential for organizations and individuals involved in the allocation and management of these tax credits, providing a structured approach to compliance monitoring.

Steps to complete the CTCAC Compliance Monitoring State Treasurer's Office

Completing the CTCAC Compliance Monitoring State Treasurer's Office form involves several key steps. First, gather all necessary documentation related to the property and its compliance status. This may include financial records, tenant information, and property management details. Next, fill out the form accurately, ensuring all required fields are completed. It is crucial to review the form for any errors or omissions before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person, as specified by the State Treasurer's Office.

Legal use of the CTCAC Compliance Monitoring State Treasurer's Office

The legal use of the CTCAC Compliance Monitoring State Treasurer's Office form is governed by state and federal regulations regarding low-income housing tax credits. This form must be completed in accordance with the guidelines set forth by the CTCAC to ensure that all compliance measures are met. Failure to adhere to these regulations can result in penalties, including the loss of tax credits or legal action. Therefore, it is essential for users to understand the legal implications and ensure that all information provided is accurate and complete.

Key elements of the CTCAC Compliance Monitoring State Treasurer's Office

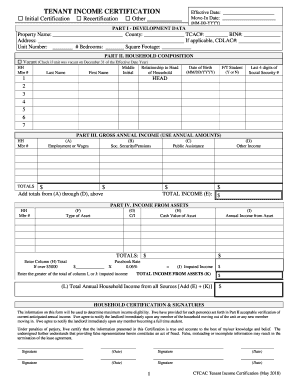

Key elements of the CTCAC Compliance Monitoring State Treasurer's Office form include detailed property information, compliance status, and tenant eligibility data. The form requires specific details about the property, such as its location, ownership, and the number of units. Additionally, it must outline the compliance measures taken, including income verification for tenants and adherence to affordability requirements. These elements are critical for demonstrating compliance with CTCAC regulations and for maintaining the integrity of the low-income housing tax credit program.

Eligibility Criteria

Eligibility for the CTCAC Compliance Monitoring State Treasurer's Office form typically includes properties that have received low-income housing tax credits. These properties must meet specific criteria set by the CTCAC, such as income limits for tenants and compliance with state housing regulations. Additionally, property owners must ensure that they maintain compliance throughout the duration of the tax credit period. Understanding these eligibility criteria is crucial for property managers and owners to ensure continued compliance and avoid penalties.

Form Submission Methods

The CTCAC Compliance Monitoring State Treasurer's Office form can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. When submitting by mail, it is important to ensure that the form is sent to the correct address and that it is postmarked by the required deadline. In-person submissions may be necessary for urgent matters or if additional documentation is required. Each submission method has its own guidelines, which should be followed carefully to ensure compliance.

Quick guide on how to complete ctcac compliance monitoring state treasurers office

Prepare CTCAC Compliance Monitoring State Treasurer's Office effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage CTCAC Compliance Monitoring State Treasurer's Office on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centric process today.

How to modify and eSign CTCAC Compliance Monitoring State Treasurer's Office without hassle

- Find CTCAC Compliance Monitoring State Treasurer's Office and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign CTCAC Compliance Monitoring State Treasurer's Office and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ctcac compliance monitoring state treasurers office

Create this form in 5 minutes!

How to create an eSignature for the ctcac compliance monitoring state treasurers office

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is CTCAC Compliance Monitoring at the State Treasurer's Office?

CTCAC Compliance Monitoring at the State Treasurer's Office involves the oversight of tax credit allocation, ensuring that developers comply with regulations. This process is crucial for maintaining transparency and accountability in the usage of state-supported funds. Understanding these compliance measures is essential for any organization seeking tax credit opportunities.

-

How can airSlate SignNow assist with CTCAC Compliance Monitoring for the State Treasurer's Office?

airSlate SignNow offers a streamlined solution to manage the documentation involved in CTCAC Compliance Monitoring at the State Treasurer's Office. Our platform enables users to easily send and eSign necessary documents, ensuring that all compliance paperwork is handled efficiently. This helps organizations stay organized and compliant with state regulations.

-

What are the pricing options for using airSlate SignNow for CTCAC Compliance Monitoring?

airSlate SignNow provides flexible pricing plans tailored for businesses focusing on CTCAC Compliance Monitoring and other document needs. Plans vary based on features and user requirements, ensuring an affordable solution that meets your compliance monitoring demands. Contact our sales team for personalized pricing that fits your organization's budget.

-

What features does airSlate SignNow offer for CTCAC Compliance Monitoring?

Our platform includes features like electronic signatures, document tracking, and secure storage that are invaluable for CTCAC Compliance Monitoring. Users can create templates, automate workflows, and easily access signed documents to maintain compliance with the State Treasurer's Office. This enhances productivity while ensuring adherence to necessary regulations.

-

What benefits does airSlate SignNow provide for managing CTCAC Compliance Monitoring?

By using airSlate SignNow for CTCAC Compliance Monitoring, organizations benefit from increased efficiency, reduced paperwork, and enhanced compliance accuracy. Our user-friendly interface simplifies the signing process, while real-time tracking ensures that all documents are handled appropriately. This leads to faster approvals and a smoother compliance experience.

-

Can airSlate SignNow integrate with other systems for CTCAC Compliance Monitoring?

Yes, airSlate SignNow integrates seamlessly with various popular applications and software for CTCAC Compliance Monitoring. This connectivity enhances your existing workflows and ensures that all compliance-related documents are easily accessible. By integrating with tools you already use, you can optimize your compliance processes even further.

-

Is airSlate SignNow suitable for small businesses handling CTCAC Compliance Monitoring?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses engaged in CTCAC Compliance Monitoring. Our cost-effective solution provides essential features without the complexity often associated with more extensive systems, making it an ideal choice for smaller organizations needing reliable compliance management.

Get more for CTCAC Compliance Monitoring State Treasurer's Office

Find out other CTCAC Compliance Monitoring State Treasurer's Office

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament