Blank Notice to Owner Form Florida

What is the Blank Notice To Owner Form Florida

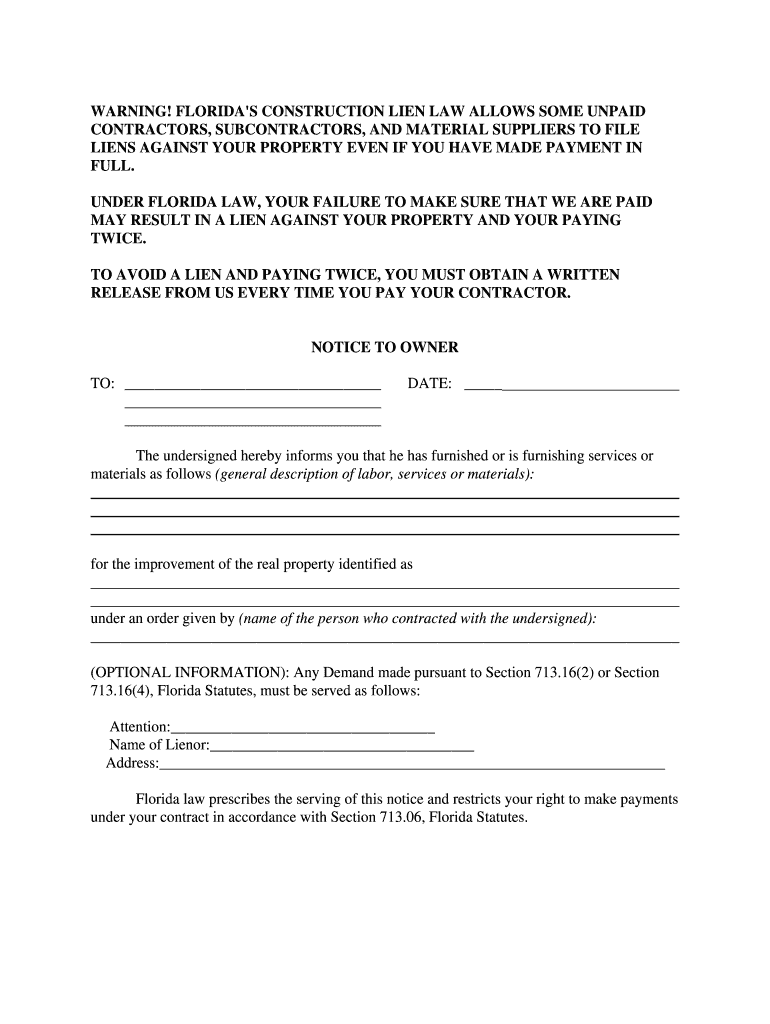

The Blank Notice To Owner Form Florida is a legal document used primarily in the construction industry. It serves as a formal notification to property owners that a contractor or subcontractor has provided services or materials to their property. This form is essential for ensuring that all parties involved are aware of the work being done and the potential for liens if payments are not made. It is particularly important in Florida, where specific laws govern the rights of contractors and property owners.

How to use the Blank Notice To Owner Form Florida

To effectively use the Blank Notice To Owner Form Florida, follow these steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the necessary details, including the name and address of the property owner, the contractor's information, and a description of the services or materials provided.

- Ensure that the form is signed and dated by the contractor or authorized representative.

- Deliver the completed form to the property owner via certified mail or in person, retaining proof of delivery.

Key elements of the Blank Notice To Owner Form Florida

Several key elements must be included in the Blank Notice To Owner Form Florida to ensure its validity:

- Property Owner Information: Full name and address of the property owner.

- Contractor Details: Name, address, and contact information of the contractor or subcontractor.

- Description of Work: A detailed account of the services or materials provided, including dates.

- Signature: The form must be signed by the contractor or an authorized representative.

Steps to complete the Blank Notice To Owner Form Florida

Completing the Blank Notice To Owner Form Florida involves several straightforward steps:

- Download or print the form from a legitimate source.

- Fill in the required fields accurately, ensuring all information is correct.

- Review the form for completeness and accuracy before signing.

- Make a copy of the completed form for your records.

- Send the form to the property owner, ensuring it is delivered in a manner that provides proof of receipt.

Legal use of the Blank Notice To Owner Form Florida

The legal use of the Blank Notice To Owner Form Florida is vital for protecting the rights of contractors and subcontractors. Under Florida law, this notice must be filed within a specific timeframe to preserve the right to file a lien. Failure to send this notice may result in losing the ability to claim payment for services rendered. It is crucial to adhere to all legal requirements associated with this form to ensure compliance and safeguard your interests.

State-specific rules for the Blank Notice To Owner Form Florida

Florida has specific rules governing the use of the Blank Notice To Owner Form. These include:

- The notice must be sent within a certain number of days after the first delivery of services or materials.

- It must be sent to the property owner directly, ensuring proper documentation of delivery.

- Failure to comply with these rules can result in the loss of lien rights, making it imperative for contractors to understand and follow these regulations.

Quick guide on how to complete owner form

Effortlessly Prepare Blank Notice To Owner Form Florida on Any Device

The management of documents online has become widely adopted by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct template and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Blank Notice To Owner Form Florida on any device through airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Method to Modify and Electronically Sign Blank Notice To Owner Form Florida Effortlessly

- Find Blank Notice To Owner Form Florida and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, the hassle of searching for forms, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Blank Notice To Owner Form Florida to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How do police address racial bias in 'call outs' (neighbors being more likely to call the police to report 'suspicious' activity of a minority in a segregated neighborhood)?

When I worked as a 9-1-1 operator there was a line of questioning developed to determine the priority of the call. These calls usually originated in a certain part of the city and the person calling usually reported a Black or Latino person acting "suspiciously." Well 9-1-1 operators wanted to catch the bad guys, too. So we would try to determine what the "suspicious" behavior was. Was the person looking into car windows? House windows? Were they walking down the street? They would report a Black or Latino male who was walking down the street or sitting in his car eating lunch. We erred on the safe side and would put out an information only call. Officers are aware of crime trends in the area and if an area has been experiencing a higher number of vehicle or house burglaries, then the information broadcast might be useful to the car that is patrolling that area. One night a woman called from the West side of the city, frantic because she heard a noise on the side of her house. There was a car nearby and we sent on a possible prowler at the location, no suspect description. We told her the police were on the way and to call back if she had a description. She called back. "I have a description!" "Yes Ma'am, is the suspect Black, White, Latino or Asian?" "They're two of them, and... and they are Black!" "What color shirt and pants are they wearing?" "They're both wearing dark clothing! Where are the police! Oh my God!!! They are on the side of my house looking around! Get the police out here now! Hello? Hello?" "Unit at ____ the P/R is on the line. She describes the suspects as two male Blacks wearing dark clothing on the side of the house right now." "Control, that's us. The P/R is describing us. We're two Black officers. We're wearing dark clothing, our uniform. Tell the P/R to open the door and come out and talk to us. The noise she's reporting is a tree branch." The operators had it easy, it's a tougher call for an officer. Err on the side of safety and treat people respectfully and hope that situation turns out okay for everyone. My motto, everyone gets to go home.

-

Why does the IRS not allow accountants to help business owners fill out tax forms? When the IRS isn't available to answer clarification questions, why can't I ask my accountant for clarification instead? What's the reasoning behind this IRS rule?

What! The IRS doesn’t allow CPAs to fill in tax returns for their clients? Where have I been? The IRS allows CPAs to help their clients in any respect necessary. The only thing is , if they materially contribute to the preparation of the return, the IRS wants the CPA to sign the return as a preparer. I get that, it makes sense. If I help you do a tax return, essentially I am a “shadow preparer” and the IRS wants me to sign on the return, to be sure I gave you proper and lawful advice.What I think you are relating is a common issue. A client comes in and asks a bunch of questions about how to complete a return. The CPA gives them all sorts of advice, but the client wants to do it themselves. Now the CPA is in an ethical quandary. The IRS demands that the CPA sign on the return, because they have materially participated in the preparation. The client is going to prepare the return, and so the CPA has lost control of what’s actually in the return, yet is going to have to sign it. Most CPAs simply won’t do that. They are going to demand to prepare the return, because their name ( and their professional status) is on the line. That’s what I do. If a client wants to ask me theoretical questions, fine, but if they are asking a bunch of questions about the preparation of their specific return, then I basically say that the IRS demands I sign the return, and there are so many moving parts in a tax return that I really have to prepare it, or charge them for reviewing it, which will probably cost as much or more.You can ( and should) ask your accountant for clarification on tax issues, that’s what we’re here for. But really, why are you so insistent on preparing your own return? It’s kind of like doing your own appendectomy. You probably could, but isn’t it better to have a professional fiddle with those things? I mean, is this really a special interest of yours, a hobby?In my experience, most clients who are convinced they should do their own returns are deluded by the myth that they can understand the tax law without spending hundreds of hours studying it, or they are afraid of paying for expert assistance. In either case, they are penny wise and pound foolish. If your time is only worth the minimum wage, if you are to keep up to date with the tax law, you have already spent time that’s way in excess of what a return professionally prepared will cost. Additionally, you’ve missed out having the return reviewed by someone who sees hundreds of returns, and knows when things stick out like sore audit flags. And, very importantly, you are flying solo without someone to back up and support the work they did.

-

If I am the owner of my business, do I need to fill out the column that asks for my annual income if employed in the visa forms for B2 visa application?

Well I thought that I shouldn't fill that and when I applied, I didn't. However an immigration attorney later told me that it was a mistake to not fill that up. I didn't agreed with him though.I don't have any arguments in favour or against it, but definitely it says if you are an employee so I strongly believe it should be skipped.But on other hand, how do Visa officer knows that how much you are earning ?Tough situation so maybe more consultants need to share their opinion.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

Is there any form filled out at the time Canadian gun owners purchased their guns (comparable to the US form 4473), or is it just a matter of presenting their P.A.L.?

Just show your valid PAL, and show the vendor no evidence of drunkenness, drug use, or violent intentions.EDIT: This simple transaction only applies to Non-Prohibited and Non-Restricted firearms, like deer rifles and most shotguns.

-

Why are teddy bears more strictly regulated than guns?

As someone who has been published in The Huffington Post, I can tell you that it is a hard left (very liberal) paper. What they are reporting here isn't news. They are, instead, advocating under the guise of news. For what it's worth, this isn't me claiming this. Allsides did a pretty good job of evaluating them: Huffington Post. I'm not saying that HuffPo is a terrible paper, run by terrible people. Instead, you should remember that what you've just read is a public service announcement.Teddy Bears are more carefully regulated? You're kidding, right? This doesn't even pass on first glance. I doubt anyone who understands gun control could argue that teddy bears are more regulated.Do they regulate how big of a teddy bear you can buy? Do they tell you that you can buy a black teddy bear, but not a silver one? Do you have to wait ten days to pick up a teddy bear you've already paid for? Can you be arrested because the laws about teddy bear configurations have changed, and you didn't know? No? No need to keep abreast of the TONS of teddy bear legislation? Surprising. Be careful crossing state lines with your Teddy Ruxpin. You have no idea how New Jersey will react. Or New York. Or California. Firearms are far more regulated than just about anything, probably up to and including pharmacology.And, I should point out, this is all to regulate a constitutionally protected right which is never supposed to be infringed.Teddy Bears are regulated only in their manufacture. You, as a citizen and consumer don't have to worry about anything. On the other hand, as a gun owner, you constantly have to be on guard. I don't disagree with the necessity of this, but I do laugh at the outrageous assertion that it is otherwise.So all that being said, let’s look at what the Illinois Counsel Against Gun Violence has to say: Ah. They listed maybe three dozen lines of laws regulating teddy bears and one law which hits guns. Well. That’s pretty damning.Except for one thing. The federal government, per our constitution, doesn’t regulate guns. Not that it really doesn’t, mind you. It just isn’t supposed to.So here’s the rub! Let’s look at all 50 states’ laws regarding teddy bears:ZERO.Let’s look at just California state laws regarding guns:Well… I would, but I’m not sure that Quora could handle it. In fact, it’s such a byzantine set of laws, they have an entire governmental department (the Bureau of Firearms) to regulate it. There are laws on the books regarding just about everything concerning firearms.To sum things up, teddy bears aren't more heavily regulated. Nothing of the sort. But maybe they should be. You have no constitutional right to a teddy bear.

Create this form in 5 minutes!

How to create an eSignature for the owner form

How to create an eSignature for the Owner Form in the online mode

How to create an eSignature for the Owner Form in Google Chrome

How to create an eSignature for putting it on the Owner Form in Gmail

How to make an eSignature for the Owner Form from your smart phone

How to generate an electronic signature for the Owner Form on iOS devices

How to create an electronic signature for the Owner Form on Android

People also ask

-

What is a Blank Notice To Owner Form Florida?

A Blank Notice To Owner Form Florida is a legal document used in Florida construction law that notifies property owners of a contractor's or subcontractor's intent to claim a lien on their property. This form is crucial for ensuring that all parties involved are aware of their rights and responsibilities regarding payments in construction projects.

-

How can I obtain a Blank Notice To Owner Form Florida using airSlate SignNow?

You can easily obtain a Blank Notice To Owner Form Florida through airSlate SignNow by accessing our template library. Simply search for the form, fill in the required details, and eSign it directly within our user-friendly platform, making the process seamless and efficient.

-

What features does airSlate SignNow offer for managing a Blank Notice To Owner Form Florida?

airSlate SignNow offers a variety of features for managing a Blank Notice To Owner Form Florida, including customizable templates, electronic signatures, and secure cloud storage. These tools enhance efficiency and ensure that your documents are easily accessible whenever needed.

-

Is airSlate SignNow cost-effective for using the Blank Notice To Owner Form Florida?

Yes, airSlate SignNow provides a cost-effective solution for managing the Blank Notice To Owner Form Florida. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you receive excellent value while simplifying your document management process.

-

Can I integrate airSlate SignNow with other software for the Blank Notice To Owner Form Florida?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Blank Notice To Owner Form Florida alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Blank Notice To Owner Form Florida?

Using airSlate SignNow for the Blank Notice To Owner Form Florida offers numerous benefits, including enhanced document security, easy collaboration with stakeholders, and the ability to track document status in real-time. This ensures that you stay informed about your legal documents throughout the process.

-

Is it easy to customize the Blank Notice To Owner Form Florida with airSlate SignNow?

Yes, airSlate SignNow makes it incredibly easy to customize the Blank Notice To Owner Form Florida to meet your specific needs. Our intuitive platform allows you to edit fields, add your branding, and insert any necessary clauses, ensuring that your document is tailored perfectly.

Get more for Blank Notice To Owner Form Florida

- Sample urgent care against medical advice form ucaoa

- Chm form

- Spousal accident disability form

- Program intake formspecial education complete all

- C ampamp a intake form 5818docx

- Joinpediatric orthopaedic society of north america posna form

- Regapp 0130 121117 auth rep form for appeals

- Cryotherapy insurance application rhodes risk form

Find out other Blank Notice To Owner Form Florida

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later