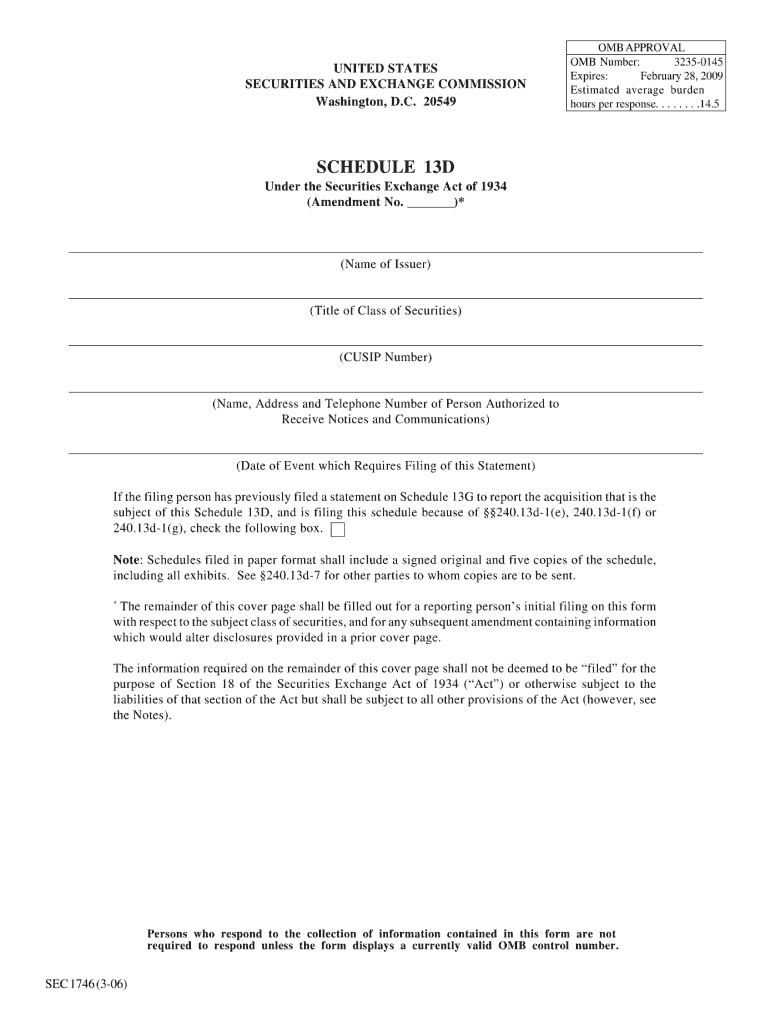

Schedule 13d Form

What is the Schedule 13D

The Schedule 13D is a filing required by the Securities and Exchange Commission (SEC) for any person or group that acquires more than five percent of a publicly traded company's stock. This form is essential for ensuring transparency in the ownership of significant stakes in companies and is used to disclose the identity of the investor, the purpose of the acquisition, and the source of funds used for the purchase. The Schedule 13D must be filed within ten days of the acquisition, providing timely information to the market and other shareholders.

How to use the Schedule 13D

Using the Schedule 13D involves several steps. First, determine if your ownership exceeds the five percent threshold, which triggers the filing requirement. Next, gather necessary information, including the identity of the investor, the number of shares acquired, and the purpose of the investment. Once this information is compiled, you can complete the form, ensuring all details are accurate and complete. After filling out the Schedule 13D, it must be submitted to the SEC electronically, which can be done through the EDGAR system. It is crucial to keep a copy of the filed form for your records.

Steps to complete the Schedule 13D

Completing the Schedule 13D requires careful attention to detail. Follow these steps:

- Identify the reporting person and any other parties involved.

- Provide information about the securities owned, including the number of shares and the percentage of total shares outstanding.

- Detail the purpose of the transaction, such as acquisition for investment or control.

- Disclose the source of funds used for the acquisition.

- Review the form for accuracy, ensuring compliance with SEC regulations.

- File the completed Schedule 13D electronically through the SEC's EDGAR system.

Legal use of the Schedule 13D

The legal use of the Schedule 13D is governed by SEC regulations, which mandate its filing when an individual or entity acquires a significant stake in a company. This form serves to protect investors by promoting transparency and preventing insider trading. Failure to file the Schedule 13D when required can result in penalties, including fines and restrictions on trading. It is important to understand the legal implications of the information disclosed in the form, as it can influence market perceptions and shareholder decisions.

Key elements of the Schedule 13D

Several key elements must be included in the Schedule 13D filing. These include:

- The identity of the reporting person and any affiliates.

- The number of shares owned and the percentage of total shares outstanding.

- The purpose of the acquisition, including any plans for the company.

- The source of funds used for the purchase.

- Any agreements or arrangements related to the securities.

Each of these elements plays a crucial role in providing a comprehensive view of the investor's intentions and the implications for the company and its shareholders.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 13D are critical to ensure compliance with SEC regulations. The form must be filed within ten days of acquiring more than five percent of a company's stock. Additionally, any material changes to the information provided in the Schedule 13D must be reported promptly, typically within two business days. Understanding these deadlines helps investors avoid penalties and maintain transparency in their investment activities.

Quick guide on how to complete schedule 13d

Effortlessly prepare Schedule 13d on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without hassle. Manage Schedule 13d on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Schedule 13d seamlessly

- Locate Schedule 13d and click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which requires only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements within a few clicks from any device you choose. Edit and eSign Schedule 13d to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 13d

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a schedule 13d and why is it important?

A schedule 13d is a filing with the SEC that provides information about anyone who acquires beneficial ownership of more than 5% of a company's equity securities. It’s important for transparency in the ownership structure of companies, ensuring that investors are informed about signNow shareholders. Understanding how to handle a schedule 13d is critical for compliance and can impact investment decisions.

-

How does airSlate SignNow support schedule 13d documentation?

airSlate SignNow streamlines the process of sending, signing, and managing schedule 13d documents electronically. With its user-friendly interface, you can create and share the necessary documents swiftly, ensuring adherence to filing deadlines. This efficiency helps maintain compliance with SEC regulations while saving your team time and resources.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit the needs of different businesses, whether you're a startup or a large enterprise. Each plan provides essential features for managing documents like schedule 13d filings effectively. Visit our pricing page to compare the plans and find the best fit for your organization's requirements.

-

What features make airSlate SignNow ideal for managing schedule 13d?

Key features of airSlate SignNow include electronic signatures, document tracking, and customizable templates, all of which enhance the handling of schedule 13d filings. Additionally, our robust security measures protect sensitive information, ensuring compliance while managing crucial documentation. These tools make it easier to prepare and submit filings efficiently.

-

Can I integrate airSlate SignNow with other tools for schedule 13d management?

Yes, airSlate SignNow seamlessly integrates with various applications, including CRM systems, cloud storage, and project management tools. This connectivity allows you to manage your schedule 13d documents alongside other essential business workflows. Integrating our platform can signNowly enhance your operational efficiency.

-

Is airSlate SignNow compliant with SEC regulations for schedule 13d?

Absolutely! airSlate SignNow adheres to all relevant SEC regulations, providing you with the confidence that your schedule 13d filings are handled correctly. Our tools ensure that all signatures and document transactions are legally binding and compliant, making it easier for you to focus on your business.

-

How can airSlate SignNow improve the turnaround time for filing schedule 13d?

By utilizing airSlate SignNow, businesses can signNowly reduce the turnaround time for schedule 13d filings through its efficient document automation and eSigning capabilities. This allows for quicker preparation and submission of required documents. Fast turnaround not only helps with compliance but also enhances overall business agility.

Get more for Schedule 13d

- Florida dmv military exemption form

- Strange weather raining frogs form

- Activity 1 1 2 simple machines practice problems answer key form

- Dept of homeland securtiy omb no 1660 0100 fema form 75 5a

- Pa department of public welfare application for benefits form dpw state pa

- Lpsc form d 7175

- Appendix j airspace storm water inspection report form dot ca

- Reconveyance deed 17211520 form

Find out other Schedule 13d

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy