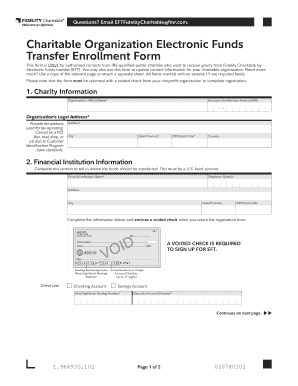

Charitable Organization Electronic Funds Transfer Enrollment Form

What is the charitable organization electronic funds transfer enrollment form

The charitable organization electronic funds transfer enrollment form is a crucial document that facilitates the automatic transfer of funds to charitable organizations. This form allows donors to authorize their bank to electronically transfer contributions directly to the charity of their choice. It streamlines the donation process, making it efficient and secure, while ensuring that funds reach the intended organization without delay.

How to use the charitable organization electronic funds transfer enrollment form

To use the charitable organization electronic funds transfer enrollment form, follow these steps:

- Download the form from the charity's official website or request a copy directly from the organization.

- Fill out the required fields, including your personal information, bank details, and the amount you wish to donate.

- Review the form for accuracy, ensuring that all information is correct to avoid any processing issues.

- Sign and date the form to authorize the electronic transfer.

- Submit the completed form to the charitable organization, either electronically or via mail, as specified by the charity.

Steps to complete the charitable organization electronic funds transfer enrollment form

Completing the charitable organization electronic funds transfer enrollment form involves several key steps:

- Gather necessary information, including your bank account number and routing number.

- Access the form and begin filling in your personal details, such as your name, address, and contact information.

- Provide the charity's name and any specific instructions regarding your donation.

- Indicate the frequency of the donation, whether it is a one-time gift or a recurring contribution.

- Sign the form to confirm your authorization for the electronic transfer.

- Submit the form according to the charity's guidelines.

Legal use of the charitable organization electronic funds transfer enrollment form

The legal use of the charitable organization electronic funds transfer enrollment form is governed by regulations that ensure the protection of both the donor and the charity. Electronic signatures on the form are recognized under the ESIGN Act and UETA, making them legally binding. It is essential that the form is filled out accurately and submitted in compliance with the charity's requirements to maintain its validity.

Key elements of the charitable organization electronic funds transfer enrollment form

Key elements of the charitable organization electronic funds transfer enrollment form include:

- Donor Information: Name, address, and contact details of the donor.

- Bank Information: Bank account number and routing number for the electronic transfer.

- Donation Amount: The specific amount to be donated.

- Frequency: Indication of whether the donation is a one-time payment or a recurring contribution.

- Signature: Donor's signature to authorize the transfer.

Form submission methods

The charitable organization electronic funds transfer enrollment form can typically be submitted through various methods:

- Online Submission: Many charities offer the option to submit the form electronically through their website.

- Mail: Donors can print the completed form and send it via postal mail to the charity's designated address.

- In-Person: Some organizations may allow donors to submit the form in person at their office or during fundraising events.

Quick guide on how to complete charitable organization electronic funds transfer enrollment form

Access Charitable Organization Electronic Funds Transfer Enrollment Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Charitable Organization Electronic Funds Transfer Enrollment Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Charitable Organization Electronic Funds Transfer Enrollment Form seamlessly

- Locate Charitable Organization Electronic Funds Transfer Enrollment Form and click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Charitable Organization Electronic Funds Transfer Enrollment Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charitable organization electronic funds transfer enrollment form

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is a charitable funds transfer?

A charitable funds transfer is the process of moving funds from one account to a charitable organization. This method ensures that donations are managed efficiently and securely, making it easier for businesses and individuals to support their favorite causes. With airSlate SignNow, you can streamline this process by electronically signing and managing your donation documents.

-

How does airSlate SignNow facilitate charitable funds transfers?

airSlate SignNow simplifies charitable funds transfers by enabling users to eSign necessary documents quickly and securely. Our platform ensures compliance and proper documentation, making the donation process straightforward. This helps organizations receive funds swiftly, allowing them to focus on their charitable missions.

-

What are the benefits of using airSlate SignNow for charitable funds transfers?

Using airSlate SignNow for charitable funds transfers offers numerous benefits, including enhanced security, reduced processing time, and improved accuracy in documentation. Our eSigning solution helps eliminate paperwork clutter, making it easier to manage and track donations. Additionally, organizations can reuse templates for common donation documents, further speeding up the process.

-

Are there any fees associated with charitable funds transfers using airSlate SignNow?

airSlate SignNow provides a cost-effective solution for charitable funds transfers, with transparent pricing plans to suit various organizational needs. Fees may vary depending on the services and features you choose, but we strive to keep our offerings affordable. Users can benefit from signNow savings compared to traditional methods, making it an ideal choice for charitable organizations.

-

Can I integrate airSlate SignNow with other tools for charitable funds transfers?

Absolutely! airSlate SignNow supports integration with a variety of platforms and tools, enhancing your ability to manage charitable funds transfers efficiently. By connecting with your existing financial systems or CRM software, you can automate document workflows and ensure that all donor and donation information is easily accessible.

-

Is it easy to track charitable funds transfers in airSlate SignNow?

Yes, airSlate SignNow offers features that facilitate easy tracking of charitable funds transfers. Users can view the status of documents, receive notifications upon completion, and access a comprehensive audit trail for every transaction. This transparency helps organizations maintain accountability and trust with their donors.

-

What types of charitable organizations can benefit from using airSlate SignNow?

Any charitable organization, whether a nonprofit foundation, community group, or crowdfunding campaign, can benefit from using airSlate SignNow for charitable funds transfers. Our platform is designed to cater to diverse needs and can help streamline the donation process regardless of the organization's size or mission. It's an invaluable tool for promoting transparency and efficiency in charitable giving.

Get more for Charitable Organization Electronic Funds Transfer Enrollment Form

Find out other Charitable Organization Electronic Funds Transfer Enrollment Form

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed