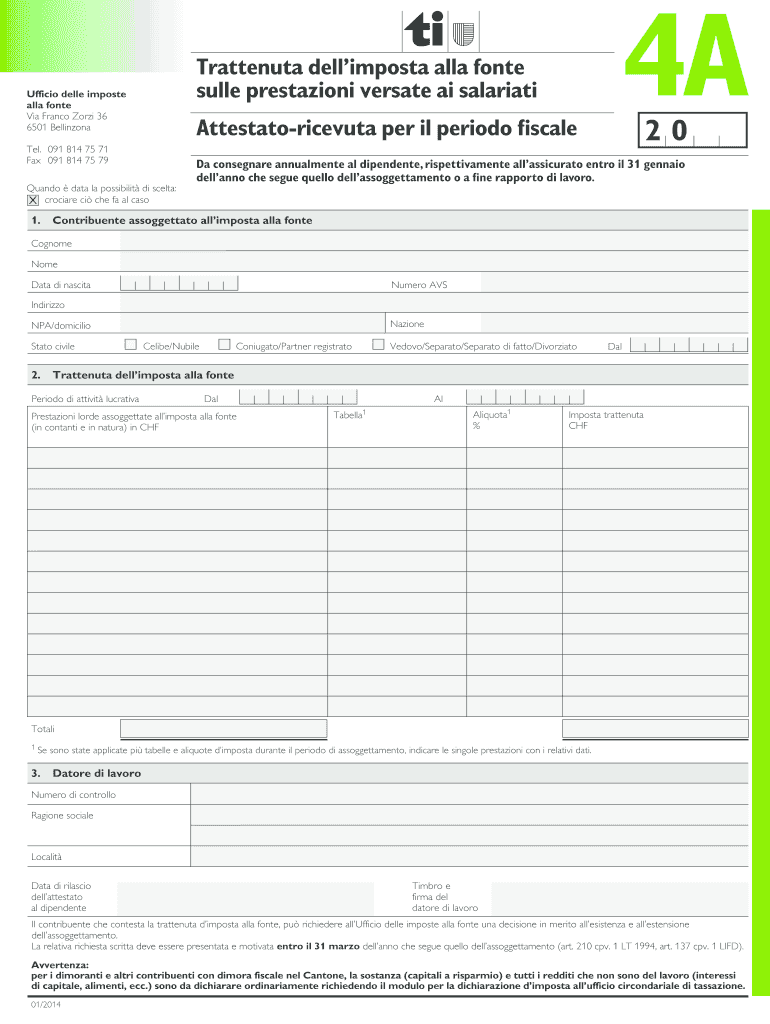

Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate AI Salariati 2014

What is the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati?

The trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati refers to the withholding tax applied to payments made to employees. This tax is deducted directly from an employee's salary before they receive their paycheck. The purpose of this withholding is to ensure that employees meet their tax obligations throughout the year, rather than paying a lump sum at tax time. The amount withheld is based on various factors, including the employee's income level, filing status, and the number of allowances claimed on their W-4 form.

How to complete the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati

Completing the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati involves several key steps. First, employers must accurately determine the amount to withhold based on the employee's earnings and tax information. This includes reviewing the employee's W-4 form to understand their filing status and allowances. Next, employers calculate the withholding amount using the IRS withholding tables or an appropriate payroll software. Finally, the withheld amount must be reported and submitted to the IRS along with the employer's payroll tax obligations.

Key elements of the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati

Several key elements define the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. These include:

- Withholding Rates: The rates are determined by the IRS and can vary based on income levels and filing status.

- Employee Information: Accurate employee data, including their W-4 details, is essential for proper withholding.

- Reporting Requirements: Employers must report withheld amounts to the IRS and state tax authorities regularly.

- Compliance: Adhering to federal and state tax regulations is crucial to avoid penalties.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines related to the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. Key dates include:

- Quarterly Tax Payments: Employers are required to remit withheld taxes on a quarterly basis.

- Annual Reporting: Form W-2 must be provided to employees by January 31 of the following year, summarizing total wages and taxes withheld.

- Tax Filing: Employers must file their annual employment tax returns by April 15.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. These guidelines outline the responsibilities of employers, including how to calculate withholding amounts, how to report them, and the importance of maintaining accurate records. Employers should regularly consult the IRS website for updates on tax rates and regulations to ensure compliance.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati can result in significant penalties. Employers may face fines for late payments, incorrect withholding amounts, or failure to file required forms. Additionally, employees may be held responsible for underpayment of taxes, leading to potential audits and further financial implications. It is crucial for employers to stay informed and adhere to all tax obligations to avoid these consequences.

Quick guide on how to complete trattenuta dellimposta alla fonte sulle prestazioni versate ai salariati

Effortlessly Prepare Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without any delays. Handle Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

How to Alter and Electronically Sign Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati Without Breaking a Sweat

- Obtain Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati and click on Get Form to begin.

- Take advantage of the tools provided to complete your form.

- Mark pertinent sections of your documents or conceal sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all information carefully and click on the Done button to retain your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct trattenuta dellimposta alla fonte sulle prestazioni versate ai salariati

Create this form in 5 minutes!

How to create an eSignature for the trattenuta dellimposta alla fonte sulle prestazioni versate ai salariati

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati?

La trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati è un processo fiscale attraverso il quale le aziende detraendo una percentuale dalle retribuzioni dei lavoratori. Questo importo viene poi versato direttamente all'agenzia delle entrate. Comprendere come funziona questo sistema è essenziale per una corretta gestione delle buste paga.

-

How does airSlate SignNow simplify the process of handling trattenuta dell'imposta alla fonte?

airSlate SignNow semplifica la gestione della trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati offrendo strumenti di automazione che migliorano l'efficienza. La piattaforma consente di inviare e firmare documenti in modo rapido, assicurando che tutte le deduzioni fiscali siano gestite correttamente. Inoltre, il tracking e la gestione documentale diventano più semplici, riducendo il rischio di errori.

-

What features does airSlate SignNow offer for managing payroll and taxes?

Le funzionalità di airSlate SignNow per la gestione delle buste paga includono l'automazione dei documenti, il monitoraggio delle firme e l'integrazione con software di contabilità. Attraverso questi strumenti, è possibile assicurarsi che la trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati avvenga correttamente e senza intoppi. Questo aumenta l'affidabilità del processo e riduce il carico di lavoro amministrativo.

-

Is there a cost associated with using airSlate SignNow for payroll purposes?

Sì, airSlate SignNow adotta una struttura di prezzo competitiva per le aziende. I costi variano in base alle funzionalità necessarie e al numero di utenti, ma l'investimento si ripaga grazie all'efficienza guadagnata nella gestione della trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. Contattaci per un preventivo personalizzato.

-

Can airSlate SignNow integrate with existing accounting software?

Sì, airSlate SignNow si integra facilmente con vari software di contabilità e gestione aziendale. Queste integrazioni consentono di automatizzare la raccolta e la conservazione delle informazioni relative alla trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. Utilizzando queste integrazioni, il processo diventa più fluido e senza interruzioni.

-

What benefits can I expect from using airSlate SignNow?

Utilizzare airSlate SignNow offre vantaggi come una riduzione dei tempi di gestione burocratica e una maggiore precisione nei calcoli delle buste paga. Grazie al supporto per la trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati, le aziende possono evitare sanzioni fiscali. Inoltre, la facilità d'uso della piattaforma consente a ogni membro del team di gestire i documenti senza difficoltà.

-

How can I ensure compliance with tax regulations when using airSlate SignNow?

airSlate SignNow offre strumenti e guide per assicurare la conformità con le normative fiscali, incluse quelle relative alla trattenuta dell'imposta alla fonte sulle prestazioni versate ai salariati. La piattaforma è progettata per mantenere gli aggiornamenti normativi, garantendo che le aziende rimangano nei parametri legali. Inoltre, il supporto clienti è disponibile per rispondere a qualsiasi domanda in merito.

Get more for Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati

- Bni application form 394948380

- Mitgliedsbescheinigung krankenkasse form

- Donato rodriguez form

- Annual review of sharps form

- Cinnamon roll order form mtcctopeka

- Tennessen warning form

- Sunday school registration form cormorant lutheran church cormorantlutheran

- City offers rebates for projects that improve water efficiency form

Find out other Trattenuta Dell'imposta Alla Fonte Sulle Prestazioni Versate Ai Salariati

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online