Ca 540 Instructions 2018

What is the California 540 Form?

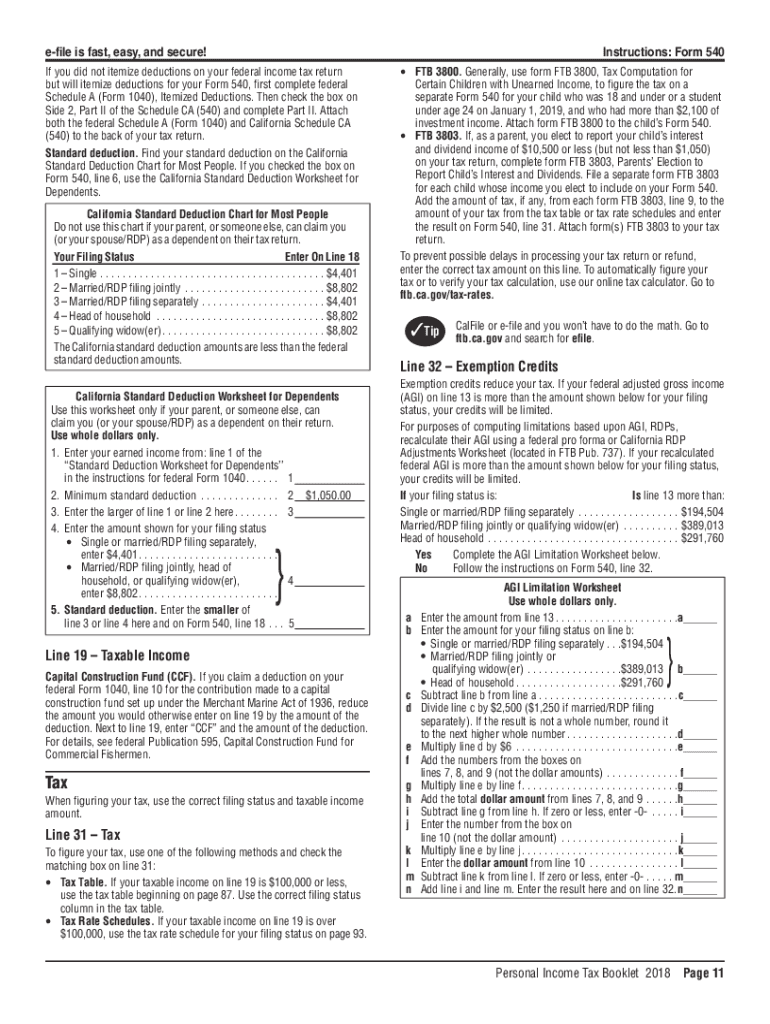

The California 540 form is the state's primary income tax return for residents. It is used by individuals to report their income, calculate their tax liability, and determine any refund or amount owed. This form is essential for those who have earned income in California and need to comply with state tax laws. The California 540 form is designed for full-year residents, while part-year residents may need to use the California 540NR form instead.

Steps to Complete the California 540 Form Instructions

Completing the California 540 form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Follow the instructions on the form closely, entering your income, deductions, and credits as applicable.

- Calculate your total tax liability using the provided tax tables or software tools.

- Review your completed form for accuracy before submission.

- Submit the form either electronically or via mail, ensuring you keep copies for your records.

Legal Use of the California 540 Form Instructions

The California 540 form instructions are legally binding documents that guide taxpayers in accurately reporting their income and tax obligations. It is important to follow these instructions carefully to ensure compliance with California tax law. Failure to adhere to the guidelines can result in penalties, interest on unpaid taxes, or even legal action. Utilizing a reliable platform for e-signatures can further enhance the legal validity of your submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the California 540 form. Typically, the form is due on April 15 of each year, aligning with federal tax deadlines. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents for the California 540 Form

To complete the California 540 form accurately, several documents are required:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Records of deductible expenses, including mortgage interest, property taxes, and medical expenses.

- Any relevant documentation for tax credits, such as education or childcare expenses.

Form Submission Methods

The California 540 form can be submitted through various methods:

- Online: Many taxpayers choose to file electronically through tax preparation software or the California Franchise Tax Board's website.

- Mail: Completed forms can be printed and mailed to the appropriate address based on the taxpayer's location.

- In-Person: Some individuals may opt to file in person at designated tax offices or during tax assistance events.

Who Issues the California 540 Form?

The California 540 form is issued by the California Franchise Tax Board (FTB), which is responsible for administering the state's income tax laws. The FTB provides the necessary forms, instructions, and resources to assist taxpayers in fulfilling their tax obligations. Taxpayers can access the form and its instructions directly from the FTB's official website or through authorized tax preparation services.

Quick guide on how to complete ca 540 instructions

Complete Ca 540 Instructions effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a reliable eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage Ca 540 Instructions on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and electronically sign Ca 540 Instructions effortlessly

- Locate Ca 540 Instructions and select Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize important sections of your documents or obscure private information with tools specifically designed for such tasks by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ca 540 Instructions to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca 540 instructions

Create this form in 5 minutes!

How to create an eSignature for the ca 540 instructions

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What are the California 540 form instructions?

The California 540 form instructions provide detailed guidance on how to correctly complete your state income tax return. These instructions outline required information, necessary forms, and step-by-step procedures, ensuring accurate filing. Utilizing comprehensive California 540 form instructions can help prevent common mistakes and streamline the filing process.

-

How can airSlate SignNow help with California 540 form instructions?

airSlate SignNow offers an easy-to-use platform to create, sign, and send your California 540 form digitally. By leveraging airSlate SignNow, you can integrate the California 540 form instructions directly into your document workflows. This feature promotes efficiency and ensures your filings are completed accurately.

-

Are there any costs associated with using airSlate SignNow for California 540 forms?

airSlate SignNow offers various pricing plans, allowing users to choose a solution that fits their budget while accessing California 540 form instructions. The costs depend on features and the number of users. With its cost-effective pricing, airSlate SignNow ensures that you get great value for assistance with your forms.

-

What benefits does airSlate SignNow provide for filing California 540 forms?

Using airSlate SignNow enhances your efficiency in completing California 540 form instructions by automating document signing and storage. The platform reduces the time spent on paperwork and minimizes the risk of errors during filing. Additionally, you can conveniently track the status of your signed documents.

-

Can I integrate airSlate SignNow with other software for California 540 form instructions?

Yes, airSlate SignNow supports various integrations that can enhance your workflow for California 540 form instructions. Whether you use accounting software or cloud storage solutions, airSlate SignNow allows for seamless integration. This interoperability helps you manage your documents more effectively.

-

What features does airSlate SignNow offer for managing tax forms like California 540?

airSlate SignNow provides features such as eSignature, document templates, and real-time collaboration, all of which are beneficial for managing tax forms like California 540. These features allow you to customize your documents per the California 540 form instructions while streamlining the signing process. This empowers teams to collaborate efficiently.

-

Is there customer support available for assistance with California 540 form instructions?

Yes, airSlate SignNow offers comprehensive customer support to assist you with California 540 form instructions. Their knowledgeable team is available to help resolve any queries related to document signing, integrations, and technical issues. Accessing reliable support can help ensure your tax forms are correctly completed.

Get more for Ca 540 Instructions

Find out other Ca 540 Instructions

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast