Montana Partnership Tax 2018-2026

What is the Montana Partnership Tax

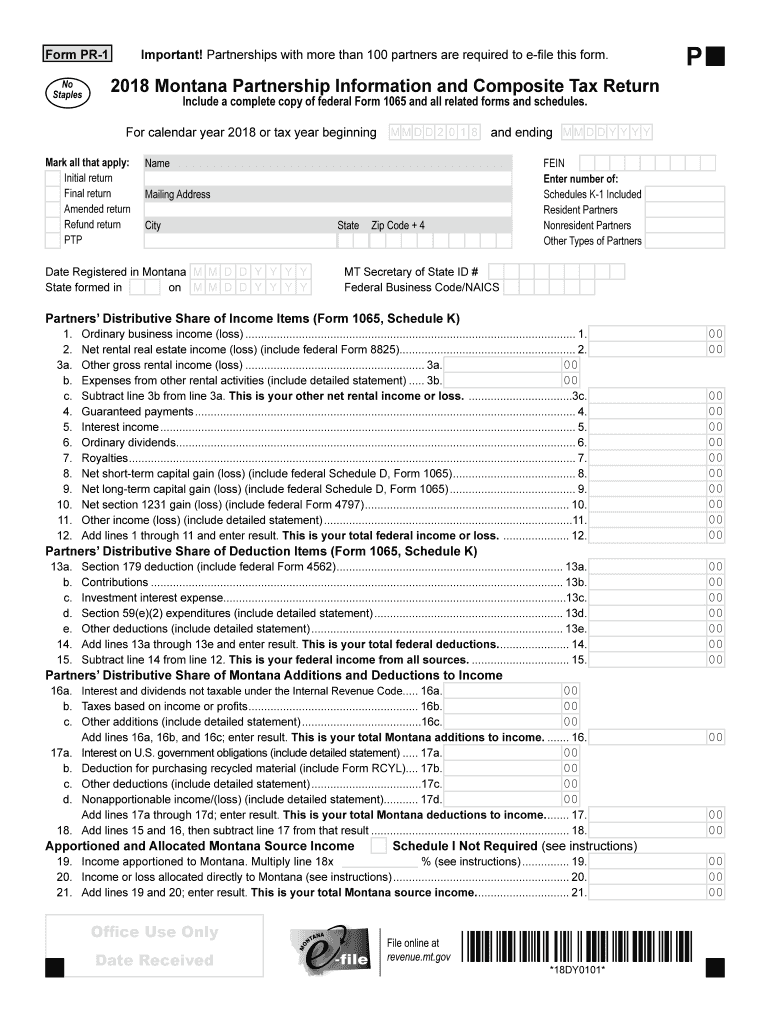

The Montana Partnership Tax is a tax imposed on partnerships operating within the state of Montana. This tax is based on the income generated by the partnership and is reported using the Montana Form PR-1. Partnerships are considered pass-through entities, meaning that the income is not taxed at the partnership level but is instead passed through to the individual partners, who report it on their personal tax returns. Understanding the specifics of the Montana Partnership Tax is crucial for ensuring compliance and accurate reporting.

Steps to complete the Montana Partnership Tax

Completing the Montana Partnership Tax involves several key steps. First, gather all necessary financial documents, including income statements and expense records for the partnership. Next, fill out the Montana Form PR-1, ensuring that all income and deductions are accurately reported. It is essential to include the names and Social Security numbers of all partners. After completing the form, review it for accuracy and compliance with state regulations. Finally, submit the form by the designated filing deadline to avoid penalties.

Required Documents

To successfully file the Montana Partnership Tax, certain documents are required. These include:

- Partnership financial statements, including profit and loss statements

- Individual partner information, such as names and Social Security numbers

- Records of any deductions the partnership intends to claim

- Previous year’s tax return, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Filing Deadlines / Important Dates

Filing deadlines for the Montana Partnership Tax are crucial to adhere to in order to avoid penalties. Typically, the Montana Form PR-1 is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by April 15. It is important to keep track of these dates and plan accordingly to ensure timely submission.

Penalties for Non-Compliance

Failure to comply with the Montana Partnership Tax requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal ramifications for the partnership. It is essential to understand these penalties and take proactive measures to ensure compliance, such as timely filing and accurate reporting of all income and deductions.

Legal use of the Montana Partnership Tax

The legal framework surrounding the Montana Partnership Tax is defined by state law, which outlines the obligations of partnerships in terms of tax reporting and payment. Partnerships must adhere to these laws to ensure that their tax filings are recognized as valid. Utilizing electronic filing methods, such as e-signing documents, can further enhance compliance and streamline the submission process.

Quick guide on how to complete montana partnership tax

Prepare Montana Partnership Tax seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the features required to create, alter, and eSign your documents swiftly without hurdles. Handle Montana Partnership Tax on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to alter and eSign Montana Partnership Tax effortlessly

- Find Montana Partnership Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Montana Partnership Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct montana partnership tax

Create this form in 5 minutes!

How to create an eSignature for the montana partnership tax

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is a Montana partnership return?

A Montana partnership return is a tax document that partnerships must file with the state of Montana to report their income, deductions, and credits. It is essential for ensuring compliance with state tax laws and helps in properly allocating income among partners.

-

How does airSlate SignNow simplify the filing of a Montana partnership return?

airSlate SignNow simplifies the filing of a Montana partnership return by enabling users to securely share and electronically sign necessary documents. The platform ensures that all partners can collaborate efficiently and submit their returns on time, minimizing the risk of errors.

-

What features does airSlate SignNow provide for handling Montana partnership returns?

AirSlate SignNow offers various features tailored for handling Montana partnership returns, including customizable templates and a robust document management system. These features streamline the preparation process and enhance the accuracy of submitted tax documents.

-

Is airSlate SignNow cost-effective for Montana partnership return filings?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file their Montana partnership return. With transparent pricing plans, users can manage their documentation needs without incurring hefty fees associated with traditional filing methods.

-

Can I integrate airSlate SignNow with accounting software for Montana partnership returns?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer when preparing Montana partnership returns. This integration helps streamline the filing process and ensures all financial data is up to date.

-

What are the benefits of eSigning my Montana partnership return with airSlate SignNow?

eSigning your Montana partnership return with airSlate SignNow provides a secure, quick, and legally binding way to finalize your documents. This reduces the need for physical paperwork and expedites the filing process, ensuring compliance and timely submissions.

-

Will airSlate SignNow provide support for filing Montana partnership returns?

Yes, airSlate SignNow offers customer support to assist users with any questions or challenges related to filing their Montana partnership return. Their knowledgeable team is ready to help ensure a smooth and efficient filing experience.

Get more for Montana Partnership Tax

- Swot templates editable form

- Efekta insurance claim form

- Two year permit application abusable volatile chemical avc dshs texas form

- Tax file number application or enquiry for individuals living outside australia form

- Copyright glencoe mcgraw hill answer key form

- Pbby form

- Reg 590 form

- Exclusive partnership agreement template form

Find out other Montana Partnership Tax

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease