Usda Credit Score Waiver Form

What is the USDA Credit Score Waiver

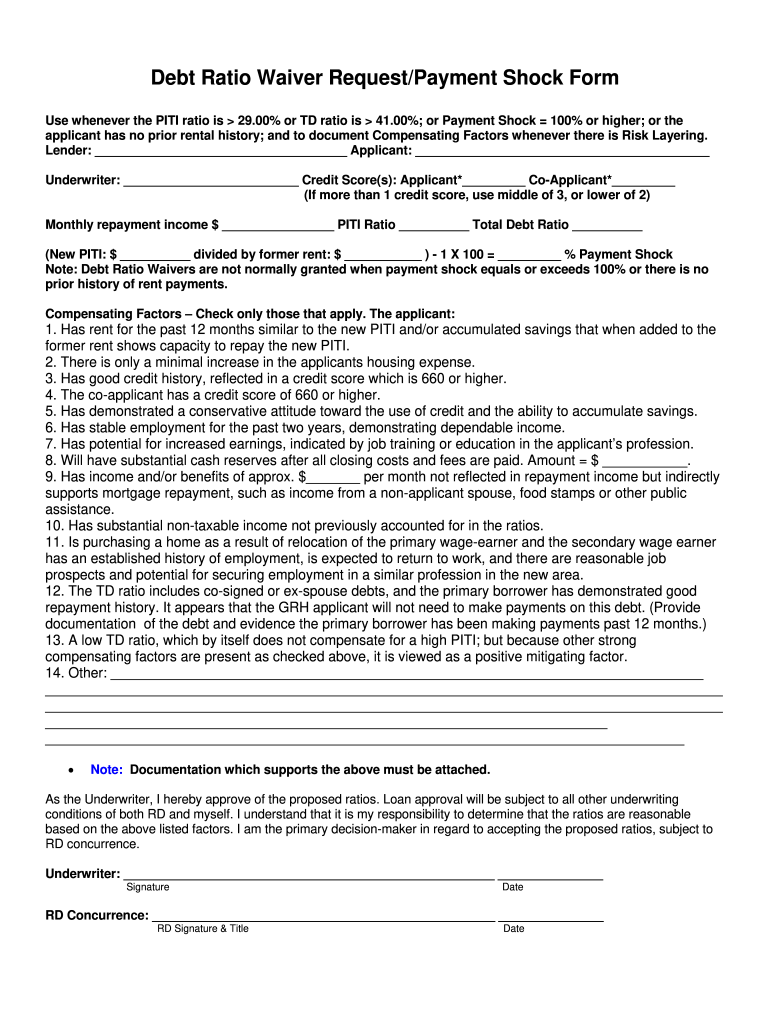

The USDA credit score waiver is a provision that allows borrowers to qualify for USDA loans even if their credit score falls below the typical threshold. This waiver is particularly beneficial for individuals who may have limited credit history or have faced financial challenges in the past. By utilizing this waiver, applicants can still access financing for rural development properties, which supports homeownership in less populated areas.

How to Use the USDA Credit Score Waiver

Using the USDA credit score waiver involves demonstrating that your financial situation justifies the exception to the standard credit score requirement. To effectively utilize this waiver, you should provide documentation that showcases your creditworthiness through alternative means, such as consistent payment history on rent or utilities. Lenders will assess your overall financial profile, including income stability and debt-to-income ratio, to determine eligibility for the waiver.

Steps to Complete the USDA Credit Score Waiver

Completing the USDA credit score waiver requires several key steps:

- Gather necessary financial documents, including proof of income and payment history.

- Consult with a USDA-approved lender to discuss your situation and the waiver process.

- Complete the USDA credit waiver form, ensuring all information is accurate and thorough.

- Submit the form along with your loan application and supporting documents to the lender.

Eligibility Criteria for the USDA Credit Score Waiver

To qualify for the USDA credit score waiver, applicants must meet specific eligibility criteria. These typically include:

- Demonstrating a reliable income source that meets USDA guidelines.

- Maintaining a low debt-to-income ratio, which indicates financial stability.

- Providing evidence of responsible credit behavior, such as timely payments on existing debts.

Key Elements of the USDA Credit Score Waiver

Understanding the key elements of the USDA credit score waiver can enhance your chances of approval. Important aspects include:

- The requirement for a thorough review of your financial history.

- The need for a USDA-approved lender to process the waiver request.

- Potential additional documentation that may be required to support your application.

Legal Use of the USDA Credit Score Waiver

The legal use of the USDA credit score waiver is governed by federal regulations that outline the conditions under which the waiver can be granted. It is essential to comply with these regulations to ensure that the waiver is recognized by lenders and meets the necessary legal standards. Utilizing a trustworthy platform for document submission can further enhance the legitimacy of your application.

Quick guide on how to complete usda credit score waiver

Prepare Usda Credit Score Waiver effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Usda Credit Score Waiver on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Usda Credit Score Waiver without difficulty

- Locate Usda Credit Score Waiver and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal authority as an original wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choosing. Modify and eSign Usda Credit Score Waiver and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usda credit score waiver

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is a USDA credit score waiver and how does it work?

A USDA credit score waiver allows applicants to bypass the usual credit score requirements for certain USDA loans. This waiver can be advantageous for those who may have limited credit history or lower credit scores. By qualifying for the waiver, applicants can access home financing solutions that would otherwise be unavailable.

-

How can airSlate SignNow help with the USDA credit score waiver process?

airSlate SignNow streamlines the documentation process for applying for a USDA credit score waiver. Our platform allows users to easily send, receive, and eSign the necessary documents, ensuring that your application is processed quickly and efficiently. This saves you time and reduces the hassle often associated with obtaining waivers.

-

What documents are required for a USDA credit score waiver application?

To apply for a USDA credit score waiver, you will typically need income verification, tax returns, and other relevant financial documentation. airSlate SignNow makes it easy to gather and organize these documents through its user-friendly interface. With our platform, you can ensure that you have all necessary paperwork ready for submission.

-

Are there any fees associated with using airSlate SignNow for the USDA credit score waiver?

AirSlate SignNow offers cost-effective solutions with flexible pricing plans which can fit various budgets. While there may be no direct fees associated with obtaining a USDA credit score waiver, using our platform can save you time and resources. It's a smart choice for those looking to manage their documentation costs effectively.

-

Can I integrate airSlate SignNow with other tools to facilitate the USDA credit score waiver process?

Yes, airSlate SignNow offers seamless integrations with various third-party applications to enhance your workflow. Whether you're using CRM systems or document management tools, our platform allows for efficient data exchange. These integrations can simplify the USDA credit score waiver application process and save you valuable time.

-

What benefits does using airSlate SignNow provide for my USDA credit score waiver application?

Using airSlate SignNow for your USDA credit score waiver application offers many benefits, including increased efficiency and reduced turnaround times. Our eSigning feature allows for quick approvals and document exchanges. Additionally, our secure platform ensures your sensitive information remains protected throughout the process.

-

Is airSlate SignNow secure for sending documents related to the USDA credit score waiver?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents and personal information related to the USDA credit score waiver. Our encryption protocols ensure that your data remains confidential and secure during transmission and storage, giving you peace of mind.

Get more for Usda Credit Score Waiver

- Vs 130 paternity form

- Dialysis orders sample form

- Civ 805 motion form

- Christmas parade permission slip valley preparatory school form

- Fmla certification of health care provider for family member39s serious form

- Accountant agreement template form

- Accounting consulting agreement template form

- Accounting agreement template form

Find out other Usda Credit Score Waiver

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement