Wg020 Tax Download Form

What is the Wg020 Tax Download

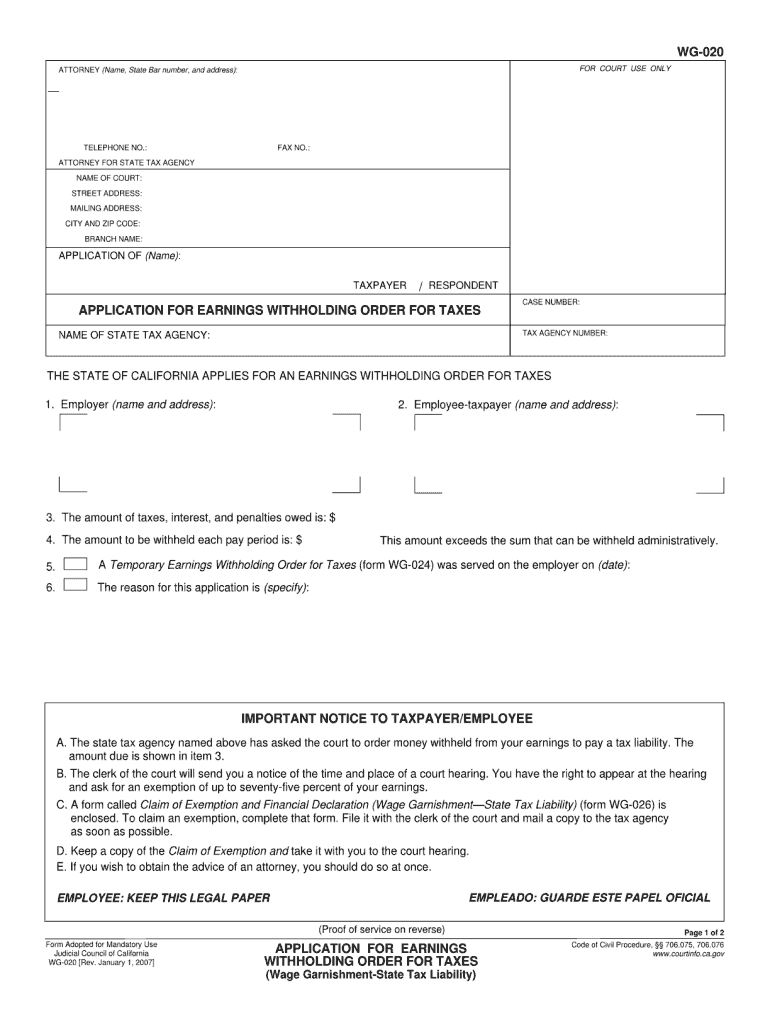

The Wg020 Tax Download is a specific form used in California for reporting withholding taxes. This form is essential for employers to report the state income tax withheld from employees' wages. It ensures compliance with California tax regulations and helps maintain accurate records for both employers and employees. Understanding this form is crucial for proper tax filing and financial management.

Steps to complete the Wg020 Tax Download

Completing the Wg020 Tax Download involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee details and the amounts withheld. Next, download the form from a reliable source. Fill in the required fields, ensuring all data is accurate. After completing the form, review it for any errors. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Wg020 Tax Download

The Wg020 Tax Download holds legal significance as it is used to report withholding taxes to the state of California. To be considered legally valid, the form must be completed accurately and submitted within the designated time frame. Compliance with state regulations is essential to avoid penalties or legal issues. Utilizing a trusted electronic signature platform can enhance the legal standing of the submitted form.

Required Documents

To complete the Wg020 Tax Download, certain documents are required. Employers should have access to employee payroll records, including names, Social Security numbers, and the amounts withheld for state income tax. Additionally, any previous tax filings may be necessary for reference. Ensuring all documentation is accurate and readily available will facilitate a smoother completion process.

Filing Deadlines / Important Dates

Filing deadlines for the Wg020 Tax Download are crucial for compliance. Employers must be aware of the specific dates for submitting the form to avoid penalties. Typically, the form is due quarterly, with specific deadlines for each quarter. Keeping track of these dates and planning ahead can help ensure timely submission and adherence to California tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Wg020 Tax Download can be submitted through various methods, providing flexibility for employers. Options include online submission through the California tax authority's website, mailing a physical copy to the designated address, or delivering it in person. Each method has its own set of guidelines, and employers should choose the one that best suits their needs while ensuring compliance with submission requirements.

Quick guide on how to complete wg020 tax download

Finalize Wg020 Tax Download effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Wg020 Tax Download on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Wg020 Tax Download without hassle

- Locate Wg020 Tax Download and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive content with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional physical signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Wg020 Tax Download and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wg020 tax download

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is wg020 in relation to airSlate SignNow?

wg020 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature streamlines the signing process, making it more efficient for businesses of all sizes. Understanding wg020 can help you leverage the platform's full potential to achieve seamless document workflows.

-

How much does airSlate SignNow's wg020 feature cost?

The wg020 feature is included as part of airSlate SignNow's competitive pricing plans. Depending on the level of service you choose, you can enjoy access to this powerful feature at various price points. We offer flexible plans to ensure that businesses can select a solution that fits their budget while maximizing value.

-

What are the key features of wg020 in airSlate SignNow?

Key features of wg020 include customizable templates, advanced security measures, and seamless workflow integration. These functionalities allow users to create, send, and manage documents with ease. By utilizing wg020, businesses can enhance their operational efficiency and improve document turnaround times.

-

How does wg020 benefit my business?

wg020 benefits businesses by enabling faster document processing and reducing the time spent on manual tasks. With eSigning capabilities at the core, it boosts productivity and enhances customer satisfaction. By streamlining document workflows, wg020 helps you focus more on growth and less on administrative hurdles.

-

Can wg020 be integrated with other apps?

Yes, wg020 in airSlate SignNow supports various integrations with popular applications and tools. This capability allows for seamless collaboration across different platforms, enhancing your business processes. You can connect wg020 with CRMs, project management tools, and more to create a comprehensive workflow.

-

Is wg020 secure for handling sensitive documents?

Absolutely, wg020 prioritizes security in document handling. The feature includes industry-standard encryption and compliance measures to ensure that your sensitive information is protected. You can trust wg020 to keep your documents secure while facilitating efficient eSigning.

-

What types of documents can I manage using wg020?

wg020 enables you to manage a diverse range of documents, including contracts, agreements, and invoices. Whether you are sending or signing documents, this feature supports various file formats to accommodate your needs. Leveraging wg020 enhances your document management capabilities across different industries.

Get more for Wg020 Tax Download

- 4 h member enrollment form ashtabula county home the ashtabula osu

- Cv italiano form

- Cap aviaion operationjal risk management worksheet form

- Bounce house waiver form

- Tennessee consolidated net worth election form

- Reg 1000 application for clean air vehicle decals dmv ca form

- Standard form commercial pamps forms for real estate

- Leonard consulting form

Find out other Wg020 Tax Download

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple